The EUR/USD currency pair on Thursday, quite unexpectedly for many, continued its upward movement, which began after a rebound from the 1.0780 level. As a result, the pair managed to grow to the level of 1.0924, which was the upper limit of volatility on Thursday. The price also managed to overcome the moving average, which is the first signal for a possible trend change in the instrument. Of course, the trend can change its direction, it can do it right now, although both linear regression channels are directed downwards. Sooner or later, any trend ends, so why not now? Because the fundamental, geopolitical, and macroeconomic backgrounds still do not support the European currency. What happened on Thursday?

ECB Vice-Chairman Luis de Guindos made a statement that goes against all the statements of Christine Lagarde over the past six months. Either a split is brewing in the ECB, or de Guindos and Lagarde have not agreed, or Lagarde simply has not had time to voice the new rhetoric of the ECB yet. However, based on what de Guindos suddenly declares that the key rate may be raised as early as July? The military conflict in Ukraine is over and now nothing threatens the European economy? Has the energy crisis receded? Have oil and gas prices declined? Is the sanctions war with Russia no longer being waged? Has the European currency received the "reserve" status? Is the food crisis no longer threatening Europeans? Did GDP show a sharp increase in the first quarter? Has inflation started to slow down? The answers to all of the above questions are obvious. The most interesting thing is that traders could have the impression of a slowdown in inflation according to yesterday's report. The value of 7.5% was predicted, but in reality, the indicator was 7.4% in March. However, we remind you that this was the second assessment of the indicator for March. The first recorded an acceleration in the consumer price index from 5.9% to 7.5%. That is, by the end of March, inflation in the EU increased from 5.9% to 7.4% y/y.

How to interpret the words of Luis de Guindos and his colleagues from the Bank of Latvia?

De Guindos' speech was not voluminous. At least the part of it that ended up in the media. The vice-chairman of the ECB said that the APP program could end as early as July, therefore, an increase in the key rate may also occur in July. He also noted that inflation in the European Union is close to its peak and may begin to slow down in the second half of the year. Almost the same rhetoric was voiced by the head of the Bank of Latvia Martins Kazaks. Now let's analyze all the phrases that provoked the growth of the euro yesterday.

"The APP program may end in July." Given that the Bank of England and the Fed have already completed economic stimulus programs, the ECB is lagging far behind on this issue. Inflation is rising, in particular, due to the increasing money supply. And the money supply is growing because the ECB continues to print money under the APP program and pour it into the economy. Therefore, the rejection of the APP is not a tightening of monetary policy. This is only a rejection of further weakening.

"An increase in the key rate may also occur in July." There are no grounds for such a decision. GDP in the fourth quarter showed an increase of only 0.4%. This is very little. Any tightening of monetary policy will slow down economic growth, so GDP may fall into negative territory. It is necessary to fight inflation, but the ECB does not currently have tools that could reduce inflation without harming the economy. Otherwise, these tools would have been used long ago.

"Inflation in the European Union is close to its peak and will begin to slow down." Christine Lagarde spoke about this in the second half of 2021. But since then, inflation has increased by more than 2 times. If the conflict in Ukraine does not end in the coming months, there is every reason to assume that inflation will remain high for a long time. In the States, for example, Fed officials say in plain text that it makes no sense to expect inflation to fall to the target value of 2% earlier than 2024. Does the ECB have any other inflation? Or will a decrease from 7.4% to 7.2% be considered a victory?

Even if we are wrong in our conclusions and the rate is raised in July, it will be raised to 0, since now it is completely negative. The Fed will bring its rate up to 1.5% by then.

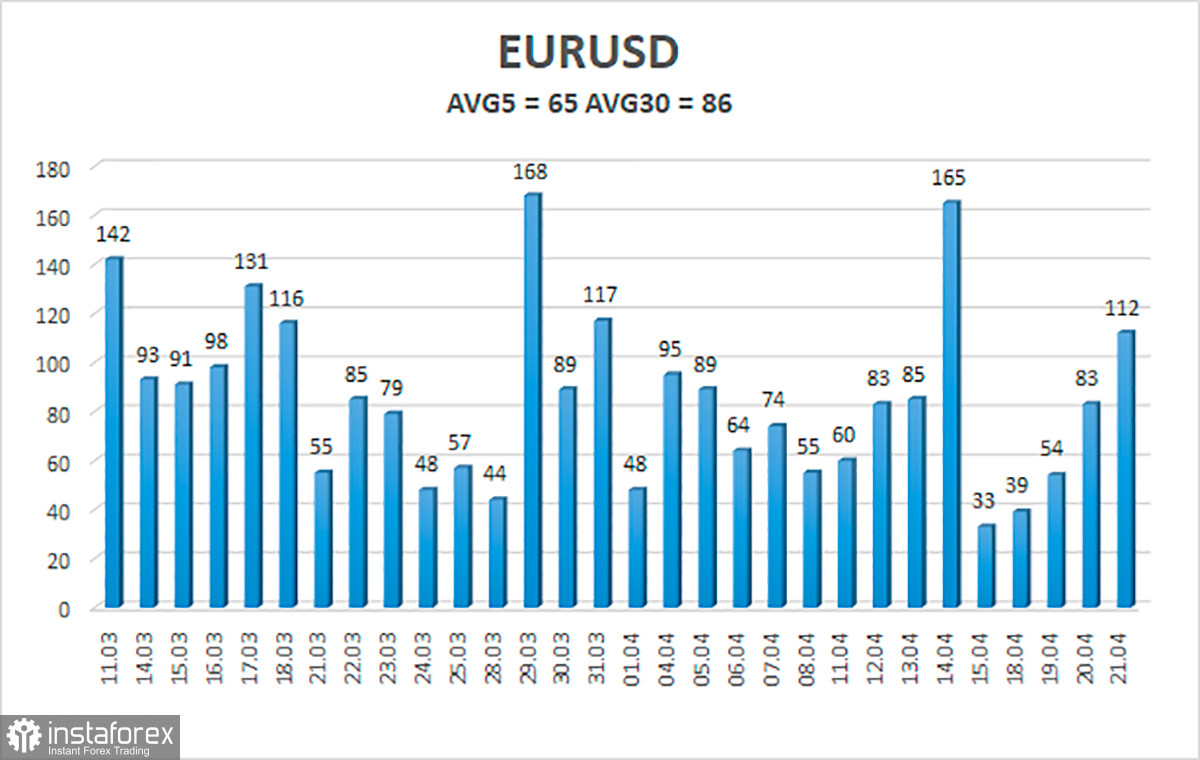

The average volatility of the euro/dollar currency pair over the last 5 trading days as of April 22 is 65 points and is characterized as "high". Thus, we expect the pair to move today between the levels of 1.0773 and 1.0904. The reversal of the Heiken Ashi indicator downwards signals a new round of downward movement.

Nearest support levels:

S1 – 1.0742

S2 – 1.0620

S3 – 1.0498

Nearest resistance levels:

R1 – 1.0864

R2 – 1.0986

R3 – 1.1108

Trading recommendations:

The EUR/USD pair has consolidated above the moving average line, but the growth may be short-lived. Thus, now it is necessary to open new short positions with targets of 1.0773 and 1.0772 if the pair returns to the area below the moving average. New long positions should be opened with targets of 1.0904 and 1.0986 if the price bounces off the moving average.

Explanations of the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română