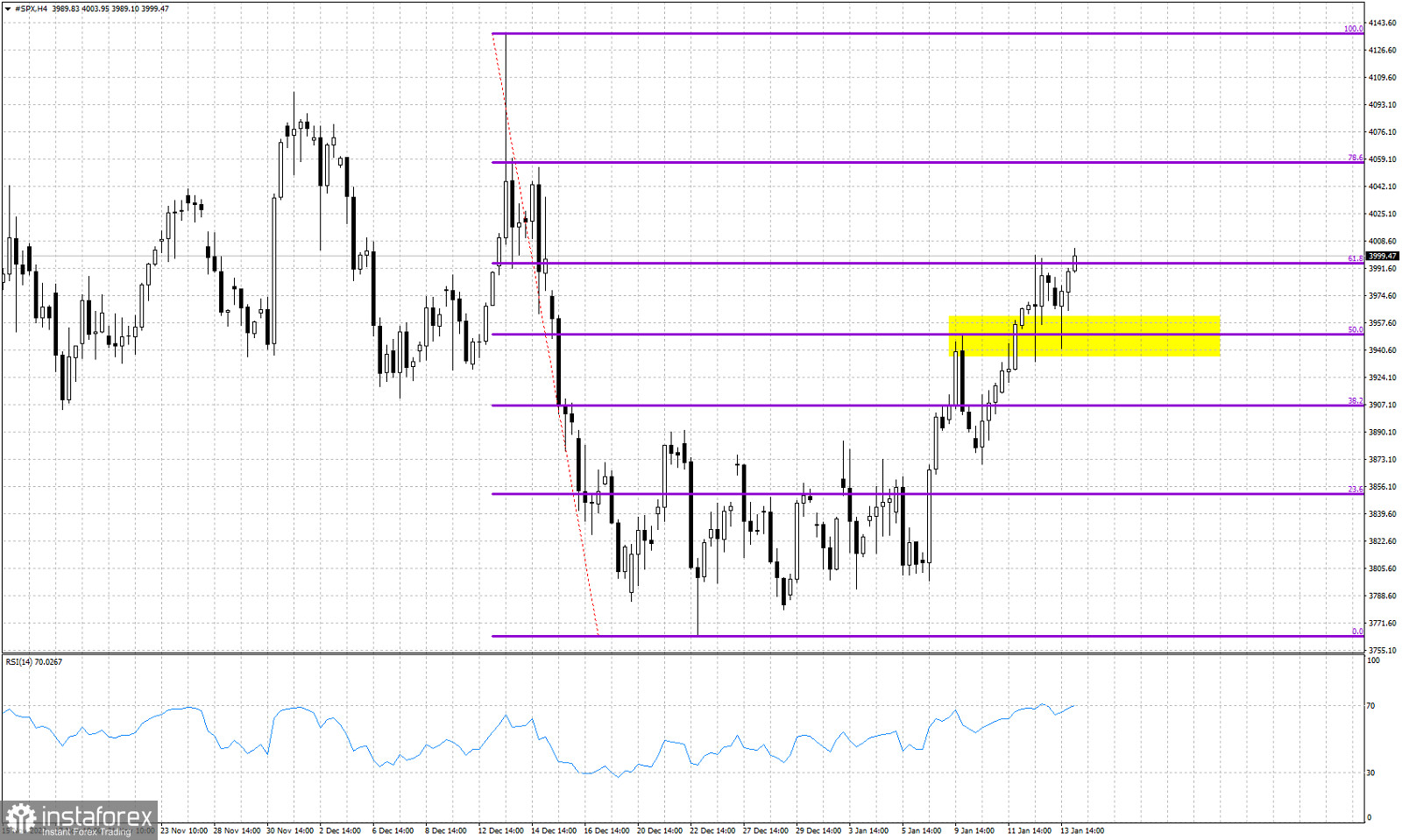

Violet lines- Fibonacci retracement levels

yellow rectangle- support

SPX remains in a short-term up trend making higher highs and higher lows. Price has now retraced 61.8% of the decline from 4,136 top at December 13th. The 61.8% Fibonacci retracement is key short-term resistance level. Price recently made two pull backs towards 3,940 and both times price was respected and trend supported. This is now key short-term support. Bulls do not want to see price break below this level. On the other hand, short-term upside target is the next Fibonacci retracement level at 4,050-60. At the 61.8% retracement level we usually see trend reversals. In this case if we see a rejection and a break below 3,940 we will see that trend has reversed to bearish. Until then bulls remain in control.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română