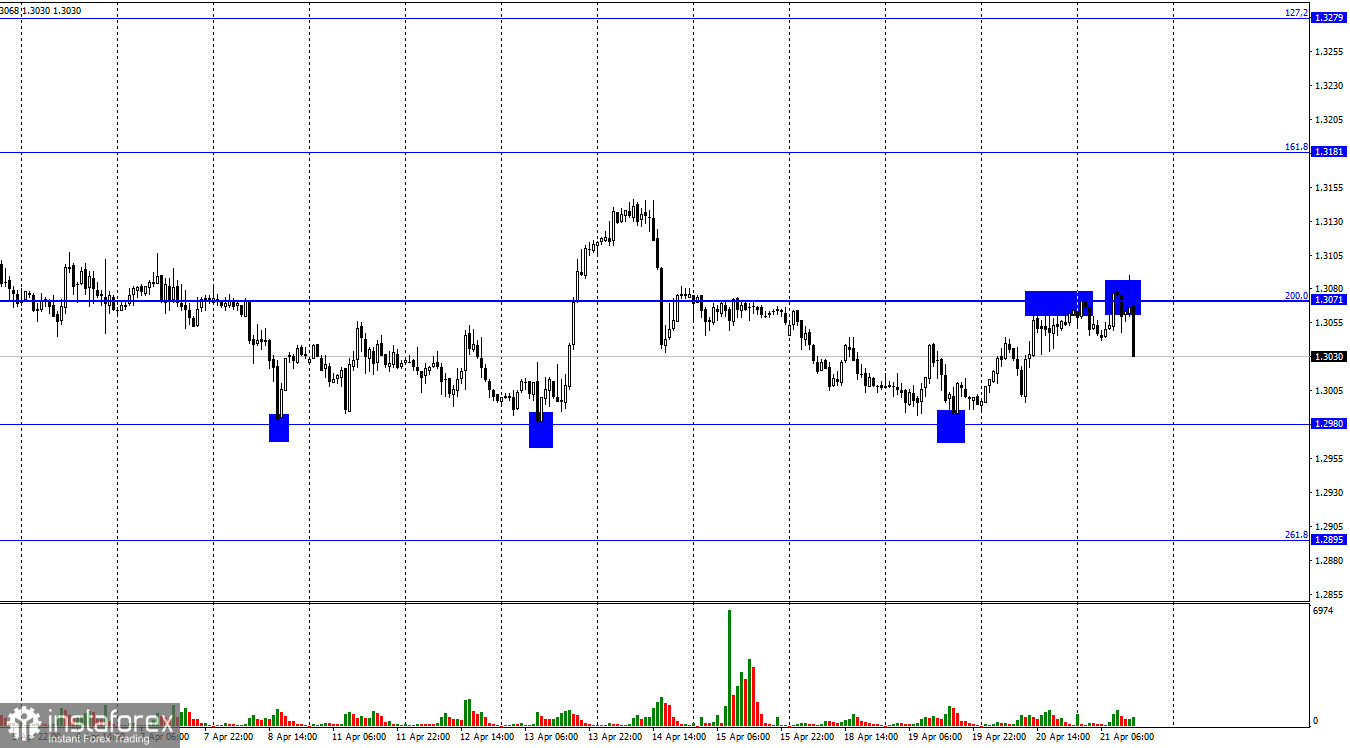

According to the hourly chart, the GBP/USD pair on Wednesday performed an increase to the corrective level of 200.0% (1.3071). The double rebound of the pair's exchange rate from this level worked in favor of the US currency and began to fall in the direction of the already well-known 1.2980 level, from which there have already been three rebounds in the last 2 weeks alone. Thus, on the fourth attempt, traders can still close below the level of 1.2980, which will increase the probability of a further fall in the direction of the next corrective level of 261.8% (1.2895). The pound is still not very popular with traders who prefer not to buy this currency. Let me remind you that the Bank of England has already raised the interest rate three times, but this does not help the pound to resist the US dollar. I believe that geopolitics is now a little more important for traders than the economy, which explains the fall of the euro and the pound in the last few months. Thus, the European currency can experience only a very short-term surge of strength and optimism.

In general, I believe that both currencies will remain in a losing position against the dollar until the Ukrainian-Russian conflict is completed or at least transferred to the stage of a positional war without attempts to move forward. At the moment, there is not a single sign that the military operation in Ukraine is coming to an end. Fierce fighting continues in eastern Ukraine, where the Russian army is trying to move forward. At the same time, the UK and the European Union are preparing new packages of sanctions against the Russian Federation. In the European Union, in Germany, a change of power is brewing after it turned out that the current Chancellor Olaf Scholz personally refused to supply Ukraine with heavy weapons. In the next few days, the opposition forces want to pass a vote of no confidence in him and dismiss him. At the same time, Germany is ready to abandon purchases of Russian oil, but there is no consensus within its ruling elite. This issue may be resolved in the next few days. Thus, the military situation in Ukraine and the economic situation in Europe are still deteriorating, not improving.

On the 4-hour chart, the pair performed a reversal in favor of the UK currency and anchored above the descending trend line. And the "bearish" divergence of the CCI indicator allowed the pair to return to the corrective level of 76.4% (1.3044), and then close below it. Nevertheless, now the pair can neither continue the process of falling nor begin the process of growth. We are waiting for developments.

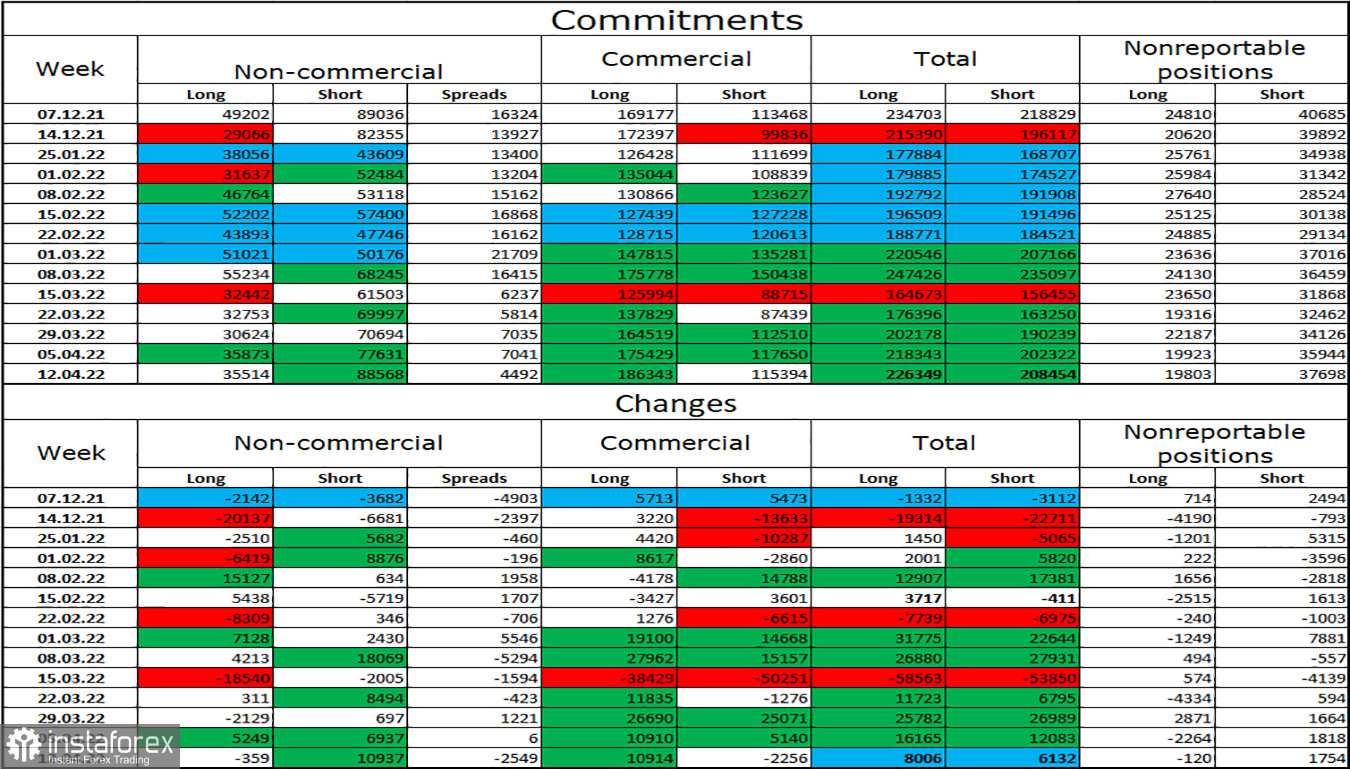

Commitments of Traders (COT) Report:

The mood of the "Non-commercial" category of traders has changed a lot over the past week. The number of long contracts in the hands of speculators decreased by 359, and the number of short contracts increased by 10937. Thus, the general mood of the major players has become much more "bearish". The ratio between the number of long and short contracts for speculators still corresponds to the real state of things on the market - longs are 2.5 times more than shorts. The big players continue to get rid of the pound. Thus, I expect the pound to continue its decline. This forecast is made based on geopolitics, based on COT reports, and based on graphical analysis.

News calendar for the USA and the UK:

US - number of initial and repeated applications for unemployment benefits (12:30 UTC).

US - Chairman of the Fed Board of Governors Jerome Powell will deliver a speech (15:00 UTC).

UK - Bank of England Governor Andrew Bailey will deliver a speech (16:30 UTC).

There was not a single event in the UK and the US on Thursday. All events (performances by Bailey and Powell) are scheduled for a later time. Unlike the euro/dollar pair, the pound is trading more modestly today and is waiting for the above-mentioned events.

GBP/USD forecast and recommendations to traders:

I recommended selling the pound with a target of 1.2980 if a rebound from the level of 1.3071 is performed on the hourly chart. I recommended buying the British when rebounding from the 1.2980 level on the hourly chart with a target of 1.3071. This goal has been achieved.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română