Buyers of the EUR/USD pair made an unexpected breakthrough, testing the 1.0900 mark. Traders have updated the weekly high and are now trying to gain a foothold within the 9th figure. This may be a rather difficult task, given the strong position of the US currency. But within the framework of a large-scale correction, EUR/USD buyers still have a power reserve to the resistance level of 1.0990 (the Kijun-sen line on the daily chart). But for this, bulls need to overcome another price barrier – the 1.0930 mark (the average line of the Bollinger Bands indicator on the same timeframe). Only in this case will it be possible to say that the correction will stretch to the borders of the 10th figure.

There are two main reasons why the euro was able to open a second wind. First of all, these are unexpected statements by some representatives of the European Central Bank, who in unison said that the regulator could raise interest rates as early as July. Here it is necessary to make a small digression, recalling the results of the last ECB meeting. So, according to the text of the accompanying statement, the Asset Purchase Program will be completed in the third quarter of this year. And only after that moment the regulator will consider the issue of raising interest rates.

At the final press conference, journalists asked Lagarde what kind of time range can be laid in the period between the end of the APP and the rate increase? The answer to this question was quite unexpected: "from a few weeks to several months." In other words, the European regulator, even in the conditions of record inflation growth in the eurozone, has laid a fairly wide time gap, leaving, in fact, the issue of tightening monetary policy in limbo.

That is why recent statements by ECB representatives have provided such significant support to the euro. In particular, ECB Vice President Luis de Guindos, said today that he "sees no reason why Asset Purchase Program cannot end in July." Guindos added that an interest rate increase "is possible in July," depending on data. A similar position was voiced yesterday by another member of the ECB Governing Council, Martins Kazaks. According to him, the regulator may raise interest rates as early as July, given the "significant" inflation risks. Moreover, he later added that these risks are likely to require further tightening of monetary policy within the current year.

After these statements, a correspondence discussion among experts arose on the market – by what amount the rates would be raised. According to some analysts – by 25 basis points, according to others – by 50 points. Some also allow the option of a 75-point increase. Such inflated market expectations may later play a cruel joke on the euro, but all this will be much later. And at the moment, the European currency has received quite strong verbal support. If ECB President Christine Lagarde's speech also toughens up her rhetoric, buyers may decide to storm the 10th figure.

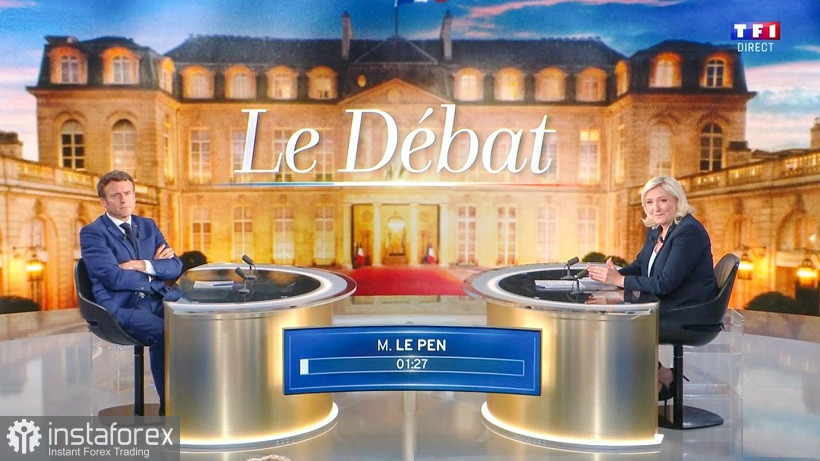

The euro was also supported by yesterday's election debates in France. According to the latest polls, Emmanuel Macron has every chance of winning the second round and remaining for another presidential term. Sociologists say that he has from 53% to 56% support. While 44% to 47% of French citizens surveyed are ready to vote for Marine Le Pen.

Decisive debates could change this political alignment, as many French citizens have not yet decided on their choice. But apparently, Macron still remains the favorite of the election race. French media report that the majority of viewers found the current French president "more convincing." So if about 60% of citizens agreed with Macron, then Marine Le Pen's position was shared by about 40% of the audience.

Thus, the EUR/USD pair demonstrates a corrective growth quite justifiably. But here we need to focus on the fact that this is a correction, not a trend reversal. The only question is how large-scale this corrective pullback will be. It is necessary to monitor the behavior of the pair at key price points – 1.0930 (the average line of the Bollinger Bands on D1) and 1.0990 (the Kijun-sen line on the same timeframe), and, of course, in the area of the main resistance level of 1.1000.

In order to develop further movement upward, buyers need to gain a foothold within the 10th figure, and for this to overcome the above price boundaries. If EUR/USD buyers fail to cope with the minimum program (that is, they will not be able to settle at least in the range of 1.0930-1.0990), then sellers will certainly seize the initiative, dragging the price into the area of the eighth figure.

Therefore, at the moment, it is advisable to maintain a wait-and-see position for the pair. Longs are risky due to their unreliability, whereas appropriate information impulses are needed to resume sales. Summarizing what has been said, it should be recalled that just last week (April 14), EUR/USD traders similarly tried to gain a foothold in the area of the 9th figure, but after reaching the 1.0925 mark, the pair turned around and updated the two-year low, collapsing to the 1.0758 mark.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română