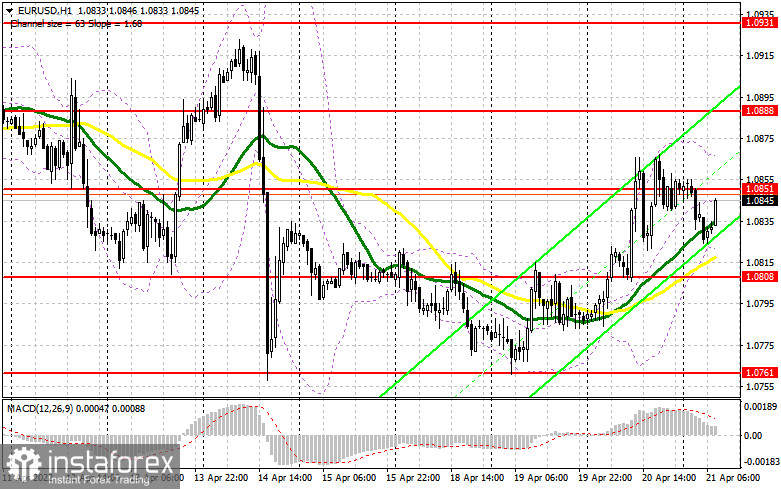

Yesterday, traders received several good signals to enter the market. This allowed them to make a profit. Let us switch to the 5-minute chart to find out what happened. Earlier, I asked you to pay attention to the level of 1.0808 to decide when to enter the market. After the euro dropped to this level, a perfect buy signal appeared, thus supporting the bullish movement during the Asian trade. Strong data from Germany also supported the euro, thus boosting it to 1.0848. Soon after that, the pair exceeded this level, but did not downwardly break it. As a result, the pair climbed by more than 60 pips. In the second part of the day, bears regained control over the level of 1.0848, upwardly testing it. Thus, traders got a sell signal and the euro dropped by approximately 25 pips. However, during the US trade, bulls returned to 1.0848, thus giving a buy signal. However, opening a position, traders earned just 15 pips.

Conditions for opening long positions on EUR/USD:

Today, all eyes will be turned to speeches provided by presidents of global central banks. The comments of ECB President Christine Lagarde and Fed Chair Jerome Powell will be of primary importance for the euro. Notably, all announcements will be made in the second part of the day during the US trade. That is why during the European session, traders will focus on the eurozone inflation report. It is very important that the data meet the preliminary estimate. According to the forecast, in March inflation accelerated to 7.5% on a yearly basis. Even if the data turns out to be better than expected, this will hardly support the euro. The fact is that the ECB is not planning to launch monetary policy tightening or start raising the benchmark rate amid a sharp economic slowdown. It is obvious that the European economy will tumble amid the Ukrainian conflict and sanctions imposed by the EU due to a negative effect on supply chains and logistics. High inflationary pressure will also have a negative influence on GDP growth. If the euro drops in the first part of the day, only a false break of 1.0808 will give the first buy signal with the target at 1.0851. However, the currency will hardly move above this level. Only a positive reaction to the eurozone inflation report will boost the pair to 1.0851, providing traders with a new long signal. In this case, the pair may recover to 1.0888. If it exceeds this level, which is hardly possible, it may hit such highs as 1.0931 and 1.0970, where it is recommended to lock in profits. If the euro/dollar pair declines and buyers fail to protect 1.0808, it will be wise not to open long orders. It will be possible to go long after a false break of the monthly low of 1.0761. Traders may also open buy positions from 1.0723 or lower – from 1.0636, expecting an increase of 30-35 pips.

Conditions for opening short positions on EUR/USD:

Although sellers are not very active at the moment, they will hardly lose control over the level of 1.0851. However, everything will depend on macroeconomic reports. That is why today, they should first protect the nearest resistance level. A false break of 1.0851 will cause the first sell signal with the target at 1.0808. To go on controlling the market, bears should regain control over this level. A break and an upward test of 1.0808 may cause a sell-off of the euro with a possible drop to the monthly low of 1.0761. Only after a break of this level, the pair will resume falling. An upward rest of 1.0761 will provide traders with a sell signal with the target at 1.0723 and 1.0636, where it is recommended to lock in profits. A farther target is located at 1.0572. However, this scenario will become possible only amid bearish reaction of traders to announcements made by Christine Lagarde and Jerome Powell. Notably, according to the recent rumors, the Fed may raise the benchmark rate by 0.75% instead of 0.5%. If the rumors come true, demand for the greenback will surge. If the euro gains in value in the first part of the day and bears fail to protect 1.0851, the euro may rapidly jump. In this case, short positions could be initiated after a false break of 1.0888. Trades may go short from 1.0931 or higher – from 1.0970, expecting a decline of 25-30 pips.

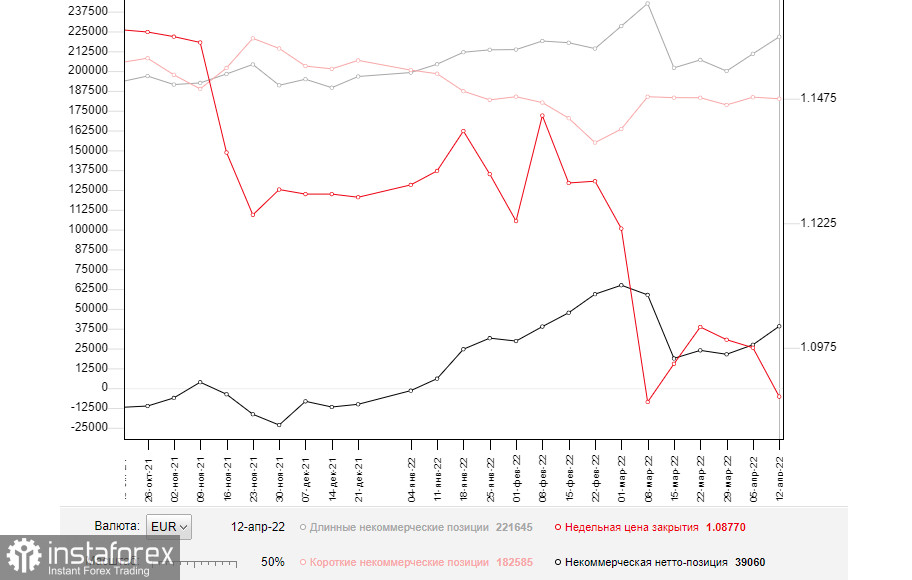

COT report

According to the COT report from April 12, the number of long positions surged, whereas the number of the short ones dropped. Such a change reflects expectations that the ECB will take some measures to cap inflation growth. Christine Lagarde announced such a possibility last week. The fact is that the ECB is planning to complete the asset purchase program by the third quarter of the year and start increasing the benchmark rate to curb inflation that has a significant influence on households. Notably, many countries have faced such a problem. The previous week's report unveiled that the US consumer price index approached the highest level last seen 40 years ago. This fact may force the Fed to take even more radical measures. During the next meeting, which is scheduled for May, the regulator may raise the key interest rate by 0.5%. Against this backdrop, demand for the US dollar remains high, thus pushing the euro/dollar pair lower. The euro is also affected by the Russia-Ukraine conflict and the lack of progress

in the negotiations.The COT report reads that the number of long non-commercial positions increased to 221,645 from 210,914, whereas the number of short non-commercial positions inched down to 182,585 from 183,544. Although the number of long positions jumped, we should remember that the COT report is of minor importance since the market situation changes rapidly. In other words, these figures do not reflect the real state of affairs. On the other hand, a drop in the euro makes it more attractive for investors. That is why a jump in long positions was quite expectable. According to the previous week's results, the total non-commercial net position climbed to 39,060 from 27,370. The weekly closing price slumped by almost 100 pips to 1.0877 from 1.0976.

Signals of indicators:

Moving Averages

Trading is performed above the 30- and 50-day moving averages, thus pointing to an attempt to form an upward correction.

Note: The period and prices of moving averages are considered by the author on the one-hour chart that differs from the general definition of the classic daily moving averages on the daily chart.

Bollinger Bands

In case of a rise, the upper limit of the indicator located at 1.0870 will act as resistance. A break of the lower limit of the indicator located at 1.0820 will increase pressure on the euro.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing volatility and noise). The period is 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing volatility and noise). The period is 30. It is marked in green on the graph.

- MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages). A fast EMA period is 12. A slow EMA period is 26. The SMA period is 9.

- Bollinger Bands. The period is 20.

- Non-profit speculative traders are individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions is a total number of long positions opened by non-commercial traders.

- Short non-commercial positions is a total number of short positions opened by non-commercial traders.

- The total non-commercial net position is a difference in the number of short and long positions opened by non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română