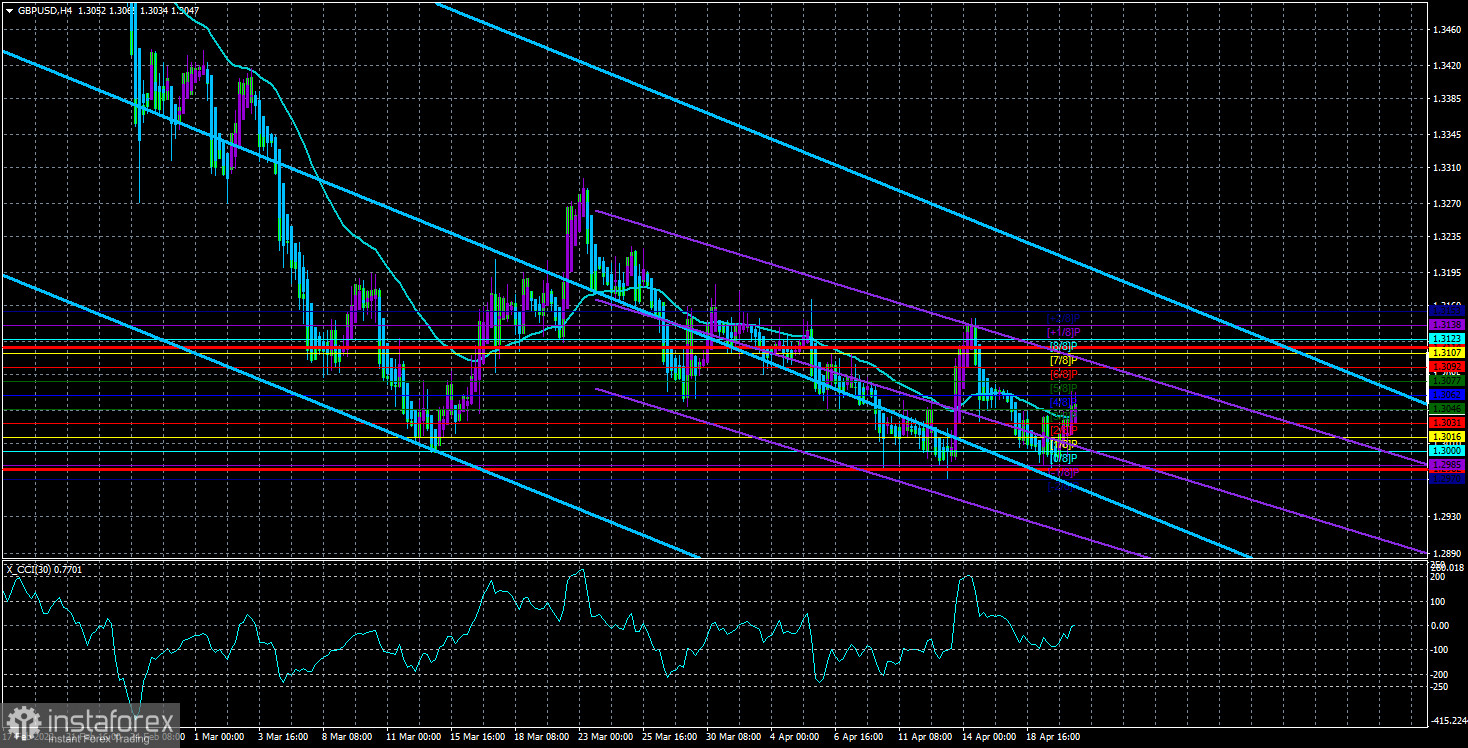

The GBP/USD currency pair failed to break through the 1.3000 level for the third or fourth time. Since the pair has been exclusively between the levels of 1.3160 and 1.3100 in the last few weeks, all the Murray levels have been redrawn and now there is a distance of 15-16 points between them. That is, absolutely any sense in using these levels is lost. And what's the point of them if the bears can't overcome the 1.3000 level for several weeks? Yesterday, the price once again tested this level for strength and once again bounced off it. Moreover, each new rebound does not lead to a noticeable correction or at least to a hint of the possible formation of a new upward trend. Look carefully at the illustration above: each subsequent price peak is lower than the previous one. The same is true on a 24-hour TF. And this is an unambiguous sign of the continuation of the downward trend. Thus, well, the pound/dollar pair bounced for the fourth time from the 1.3000 level, it doesn't matter. It will overcome it on the fifth attempt or just a little later. The most important thing is that neither the pound nor the euro currency now has the necessary reasons to be in demand. If there were no geopolitical conflicts in Eastern Europe, then the grounds for growth could be found. But geopolitics confused all the cards for market participants in the first months of the new "mind-blowing" year.

There is practically no news in the UK right now. The most interesting events, as always, are connected with Johnson's figure. Yesterday, in Parliament, he offered his deepest apologies for violating quarantine rules during the pandemic... and he did not admit his guilt. Earlier, Scotland Yard handed him and Rishi Sunak fines for violating quarantine. Labor, in particular their leader Keir Starmer, again called on Johnson to resign and considered his statements "an insulting mockery of the entire British people." However, Boris Johnson has already seized the initiative on this issue. Now in the UK and around the world, few people are interested in what the British Prime Minister did a couple of years ago and what wine was drunk at 10 Downing Street at the height of the lockdown. The whole world is focused on the events in Ukraine, and here Johnson has unlimited initiative and support. Therefore, Johnson is not in danger of resignation. No impeachment threatens him. No vote of no confidence threatens him. And he, of course, is not going to leave his post. Moreover, thanks to Ukraine, he can significantly increase his political ratings and restore the faith of the Conservative Party in himself.

The result of the elections in France is already predetermined.

A no less important political event for the whole of Europe, for Ukraine, is the presidential election in France. The day before last Sunday, the first round was held, which was won by Marine Le Pen and Emmanuel Macron, as predicted by all experts. This Sunday, the second round will be held and all polls conducted by French agencies predict Macron's victory. About 56% of the French are ready to vote for him. Accordingly, the maximum possible number of votes that Le Pen can get is 44%. However, it should be borne in mind that there is a certain part of the population that has not yet decided on their votes. However, as practice shows, usually, these people do not have too much influence on the final result. Some journalists and publications report that in any statistical and social research, one should always keep in mind the errors. And we want to remember the 2020 US presidential election. 51.3% of voters voted for Biden, and 46.9% voted for Trump. It would seem that the gap is minimal and the pendulum could lean towards the Republicans. However, let's now look at the absolute, not relative numbers. 81 million Americans voted for Biden, 74 million for Trump. That is, the difference is 7 million people. Of course, there is a smaller population in France, but the 56% to 44% alignment means that a couple of million more Frenchmen will vote for Macron than for Le Pen. Therefore, we believe that any errors have already been leveled by the absolute results.

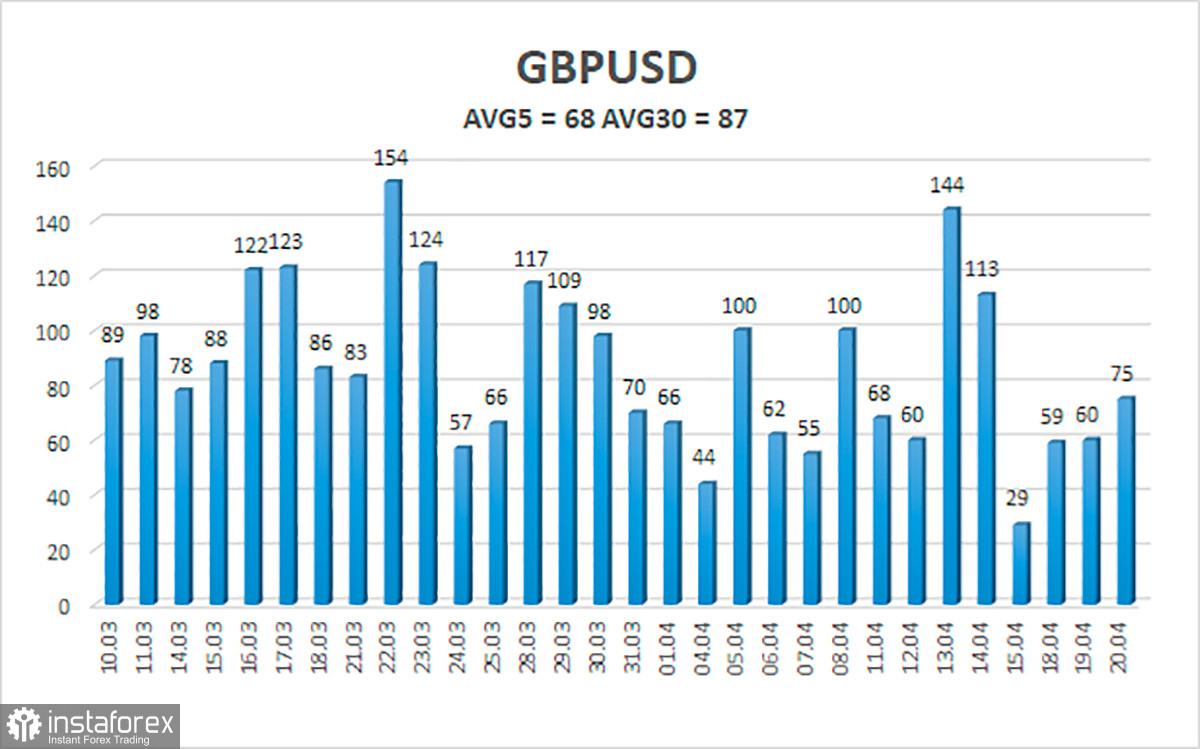

The average volatility of the GBP/USD pair over the last 5 trading days is 68 points. For the pound/dollar pair, this value is "average". On Thursday, April 21, therefore, we expect movement inside the channel, limited by the levels of 1.2982 and 1.3114. The reversal of the Heiken Ashi indicator downwards signals a new round of downward movement. The level of 1.3000 has not been overcome.

Nearest support levels:

S1 – 1.3031

S2 – 1.3000

S3 – 1.2970

Nearest resistance levels:

R1 – 1.3062

R2 – 1.3092

R3 – 1.3123

Trading recommendations:

The GBP/USD pair on the 4-hour timeframe again unsuccessfully tested the Murray level "2/8" - 1.3000. Thus, at this time, sell orders with targets of 1.3000 and 1.2970 should be considered in case of a rebound from the moving average. It will be possible to consider long positions if the price is fixed above the moving average line with targets of 1.3092 and 1.3123.

Explanations of the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română