The GBP/USD pair continues to move somehow sideways in the short term. The price action tries to accumulate more bullish energy before extending its growth. Fundamentally, the US Consumer Price Index reported lower inflation in December, that's why the greenback remains bearish.

Today, the UK data came in mixed. The GDP rose by 0.1% beating the 0.2% drop expected, Construction Output reported a 0.0% growth versus the 0.3% drop forecasted, while the Goods Trade Balance came in at -15.6B versus the -14.9B forecasts. In addition, Industrial Production and Manufacturing Production came in worse than expected.

The rate continues to stay within the current range as the US Prelim UoM Consumer Sentiment came in better thane expected, at 64.6 points versus the 60.8 forecasts.

GBP/USD Sideways Movement!

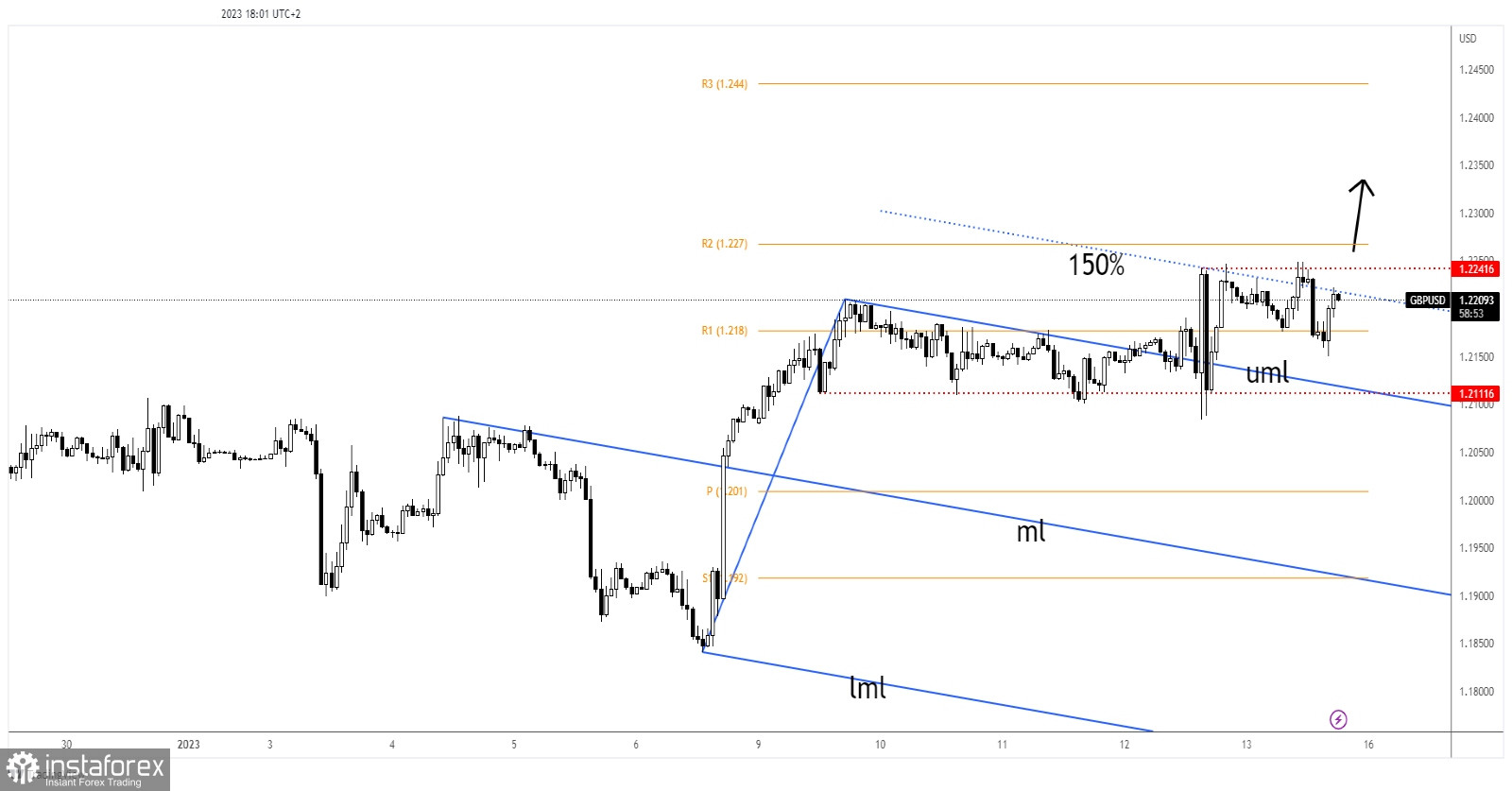

Technically, the GBP/USD pair maintains a bullish bias as long as it stays above the 1.2111 static support. 1.2241 stands as a static resistance while the 150% Fibonacci line represents a dynamic obstacle.

Still, staying near these upside obstacles may signal an imminent breakout and further growth. The current sideways movement could represent an accumulation.

GBP/USD Outlook!

Jumping and closing above 1.2241 opens the door for an upside continuation. This scenario brings new buying opportunities.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română