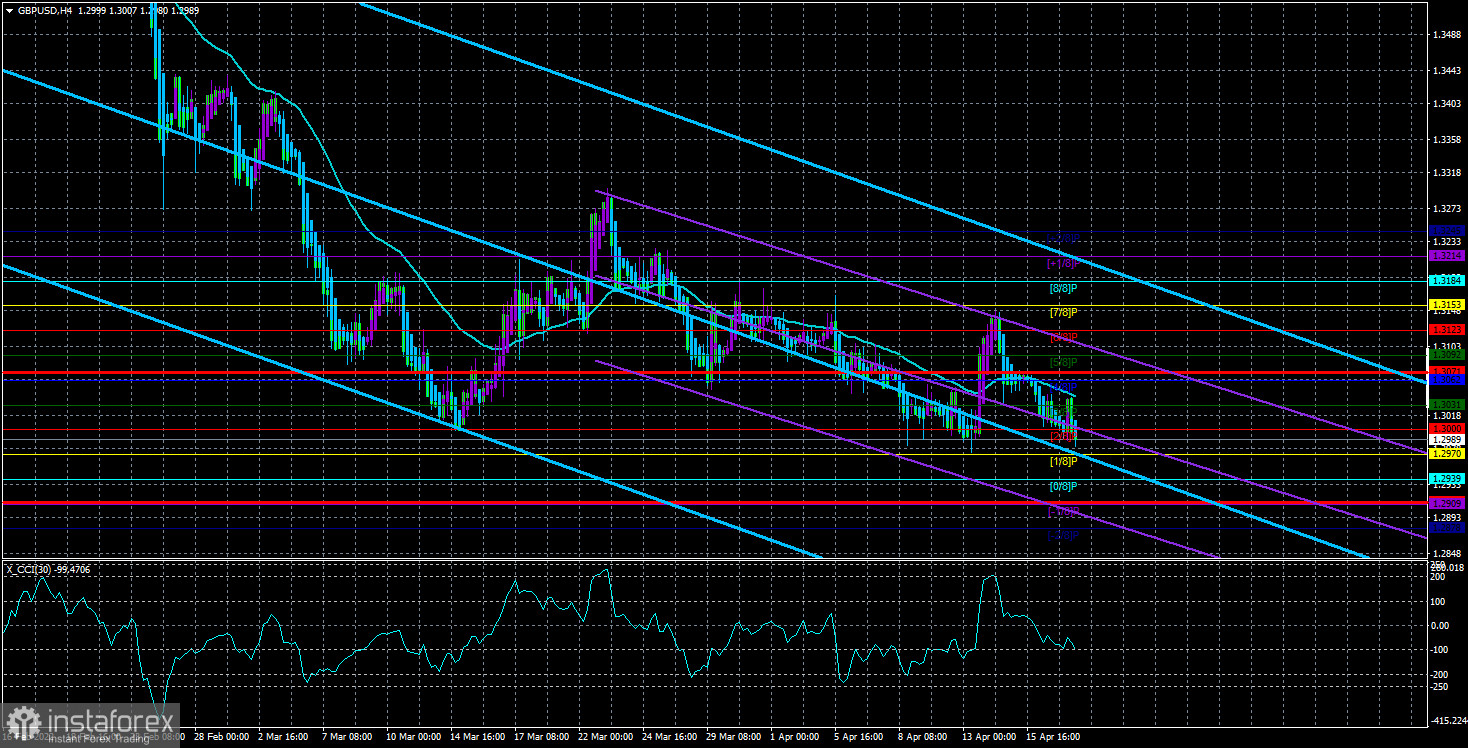

The GBP/USD currency pair on Tuesday for the nth time fell to the Murray level of "2/8" - 1.3000, which is also a psychological mark for the market. And once again I failed to overcome it. However, during the day it also failed to once again start an upward correction. Thus, the downward trend persists, as evidenced by both linear regression channels, as well as the downward direction of the moving. Therefore, we continue to believe that sooner or later the 1.3000 level will be overcome, which will allow the British pound to continue falling against the US currency. Although the British Central Bank takes a much more "hawkish" position in comparison with the European Central Bank, the pound sterling has been falling against the dollar in recent weeks as cheerfully as the euro currency. Accordingly, the geopolitical conflict is of greater importance now, and there has been no positive news from the fronts of Ukraine. The pound remains a risky currency, while the dollar remains a "reserve" and safe. COT reports continue to say that major players continue to increase sales of the British currency. The absolute majority of factors continue to support the growth of the dollar.

There has been very little news from the UK in the last few weeks. Boris Johnson, who continues to be Russia's main opponent in the information and sanctions space, has made very little comment on the "Ukrainian crisis" in the last couple of weeks. Britain has already imposed all possible sanctions on Russia and has seized all possible property of all Russian oligarchs, so perhaps it has nothing left to put pressure on the Kremlin. However, Johnson is unlikely to stop there. According to political scientists, Johnson sees himself as someone like Winston Churchill and does not want to repeat the mistakes that he once made. Johnson believes that "anti-Russian rhetoric" coupled with massive assistance to Ukraine will allow him and the Conservative Party to regain political ratings lost in recent years and retain control of power in the country. It seems that this is what the British Prime Minister is betting on now.

The "hawkish" mood in the Fed is intensifying.

We have repeatedly recently drawn the attention of traders to the fact that the Fed has not just set the course for a whole cycle of rate hikes. The Fed continues to tighten its rhetoric on rates almost every week. Recall that at the end of last year, there were talks about 2-3 rate increases in 2022. Then 2-3 promotions turned into 4-5 promotions. Now we are talking about 6 increases this year and at least 10 increases in total. Also, now the Fed members are getting closer to the decision to raise the rate not by 0.25% at each meeting, but by 0.5% at once. Of course, it's all the fault of inflation and high GDP growth in the United States. For a long time, the Fed, as well as the ECB, believed that the rise in inflation was a "temporary phenomenon," as Jerome Powell stated in almost every speech. However, time passed, and the "temporary phenomenon" still did not end. The price growth does not stop now, and it does not even slow down. Therefore, the Fed finally decided to start "catching up with the train that has already departed from the platform."

Now the US Central Bank will have to raise rates aggressively, and GDP growth rates allow it to do this since a slight cooling will not harm the American economy and will not slide it into recession. On Monday, the head of the St. Louis Fed, James Bullard, said that to stabilize the inflation situation, the rate should be raised to 3.5%. He also noted that the rate in May could be raised immediately by 0.75%, or during all Fed meetings this year, the rate could be increased by 0.5% each time. Naturally, the US dollar simply cannot fall on such messages, statements, and events. After all, this is no longer an increase in "hawkish" rhetoric with the unchanged plans of the Fed. This is already strengthening the plans themselves to tighten monetary policy.

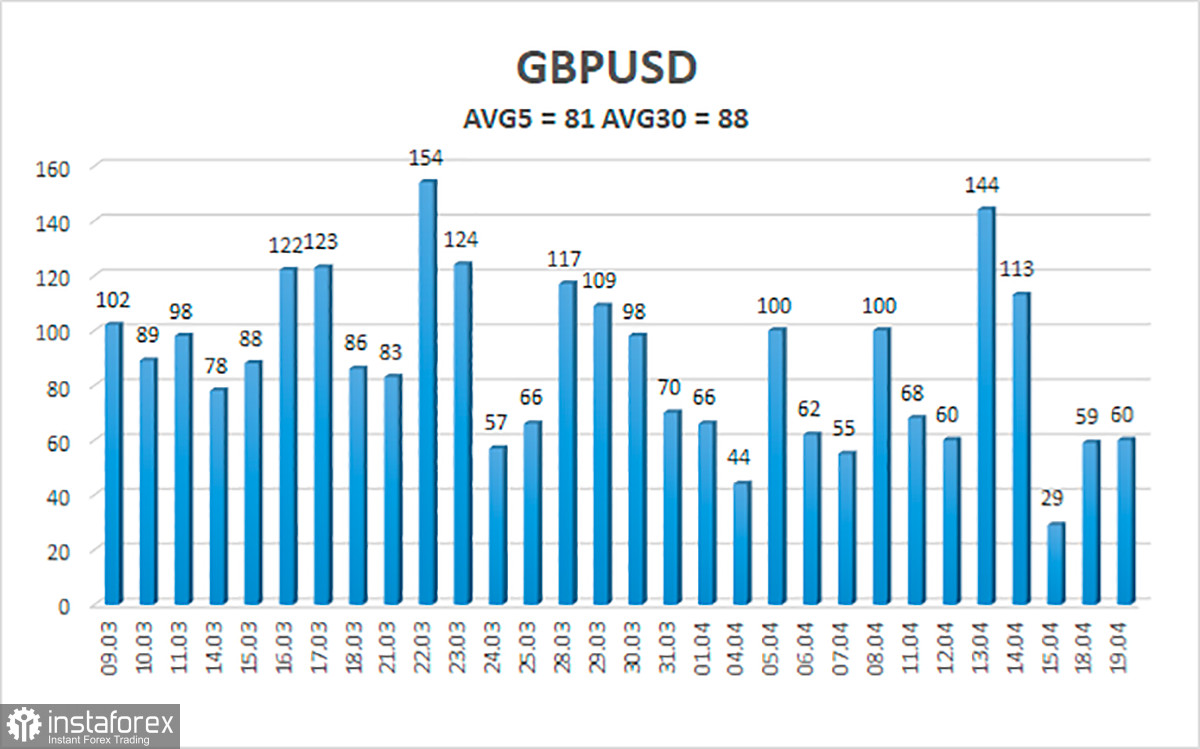

The average volatility of the GBP/USD pair over the last 5 trading days is 81 points. For the pound/dollar pair, this value is "average". On Wednesday, April 20, thus, we expect movement inside the channel, limited by the levels of 1.2909 and 1.3071. A reversal of the Heiken Ashi indicator upwards will signal a new round of upward movement. The level of 1.3000 has not been overcome.

Nearest support levels:

S1 – 1.3000

S2 – 1.2970

S3 – 1.2939

Nearest resistance levels:

R1 – 1.3031

R2 – 1.3062

R3 – 1.3092

Trading recommendations:

The GBP/USD pair on the 4-hour timeframe is again testing the Murray level of "2/8" - 1.3000. Thus, at this time, you should stay in sell orders with targets of 1.2970 and 1.2939 until the Heiken Ashi turns upwards, but remember that there may be another rebound from the 1.3000 level. It will be possible to consider long positions if the price is fixed above the moving average line with targets of 1.3092 and 1.3123.

Explanations of the illustrations:

Linear regression channels - help to determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română