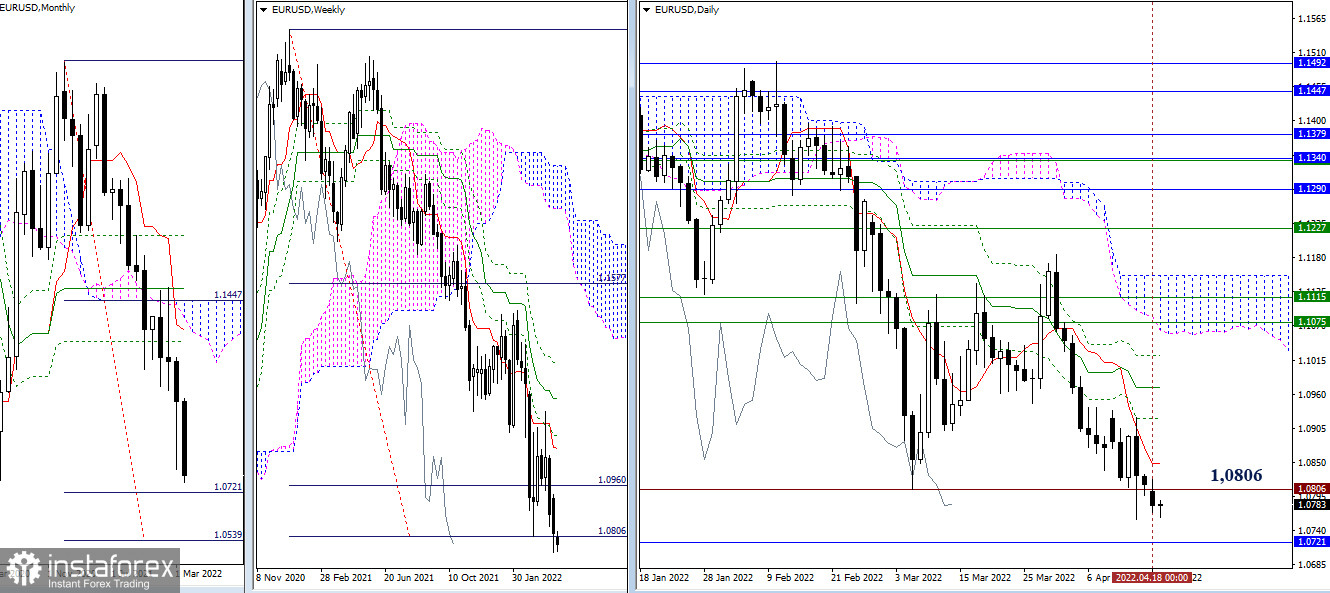

EUR/USD

Higher timeframes

Bears realized a slight decline yesterday, but they still have not been able to update the low of last week (1.0758). Under the current conditions, the level of working out the weekly target for the breakdown of the cloud (1.0806) continues to exert its influence and attraction. If the decline continues, then the next reference points will be the support of the monthly target for the breakdown of the Ichimoku cloud – 1.0721 (the first target) and 1.0539 (the level of 100% target completion). In the event of the emergence of a corrective upsurge, bulls will run into the resistance of the daily death cross (1.0849 – 1.0921 – 1.0972 – 1.1022).

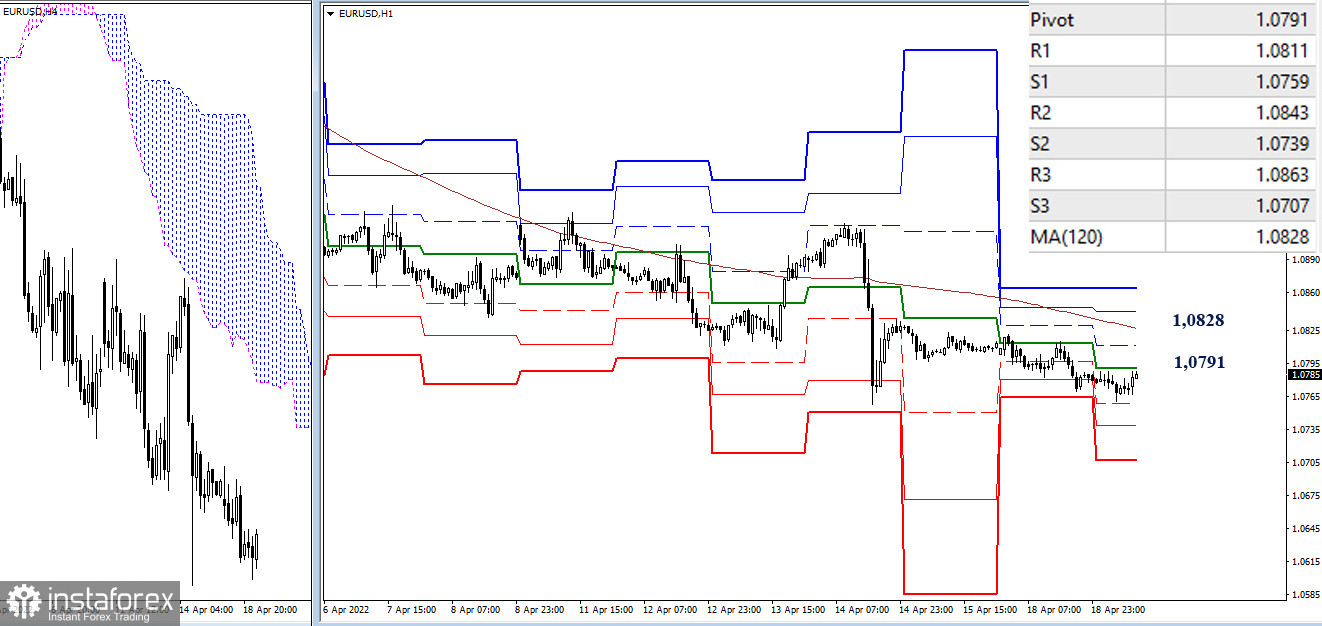

H4 - H1

In the lower timeframes, the advantage is on the side of the bears. The support of the classic pivot points can serve as reference points for the decline within the day (1.0759 – 1.0739 – 1.0707 ). The key levels of the lower timeframes are still the resistance, blocking the bulls the way to changing the current balance of power. The key levels are now located at 1.0791 (central pivot point) and 1.0828 (weekly long-term trend). Consolidation above and reversal of the moving average will contribute to the emergence of prospects for further strengthening of bullish sentiment.

***

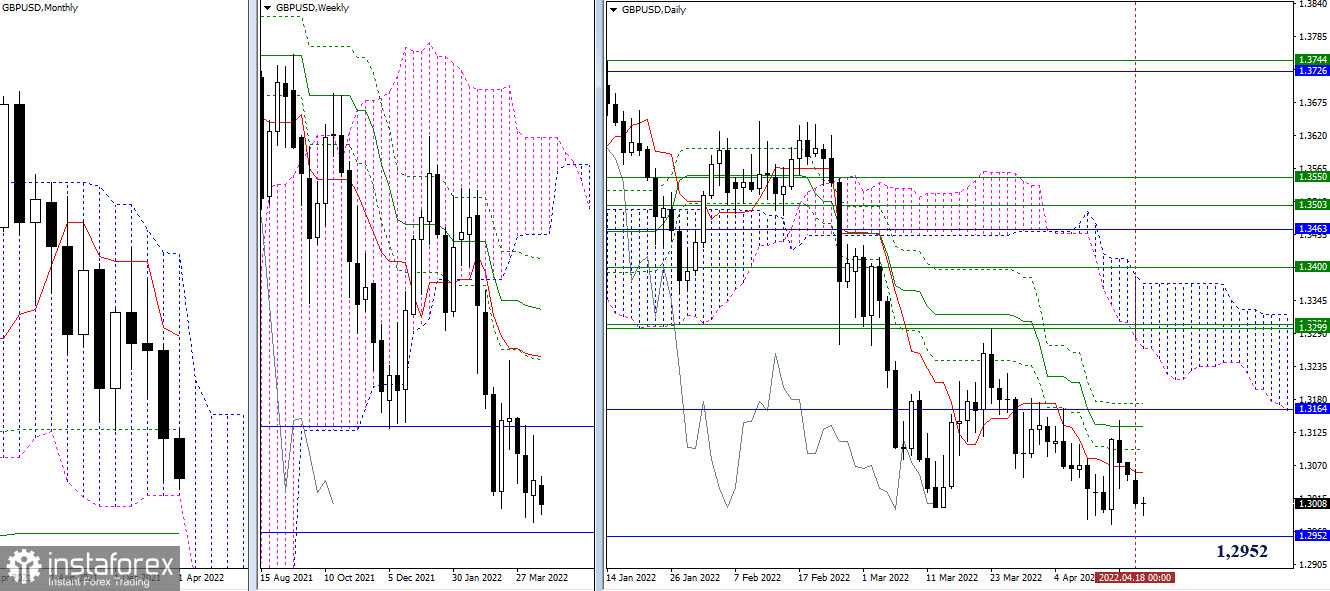

GBP/USD

Higher timeframes

Bears worked out the downward scenario yesterday but also failed to break below last week's low at 1.2972. Therefore, the bearish target of this area (lower boundary of the monthly Ichimoku cloud 1.2952) continues to maintain its value and location. In case of a change of priorities, the bulls will aim at conquering a wide resistance zone, strengthened by the monthly resistance (1.3164) and allowing to liquidate the daily Ichimoku cross (1.3059 – 1.3097 – 1.3135 – 1.3173).

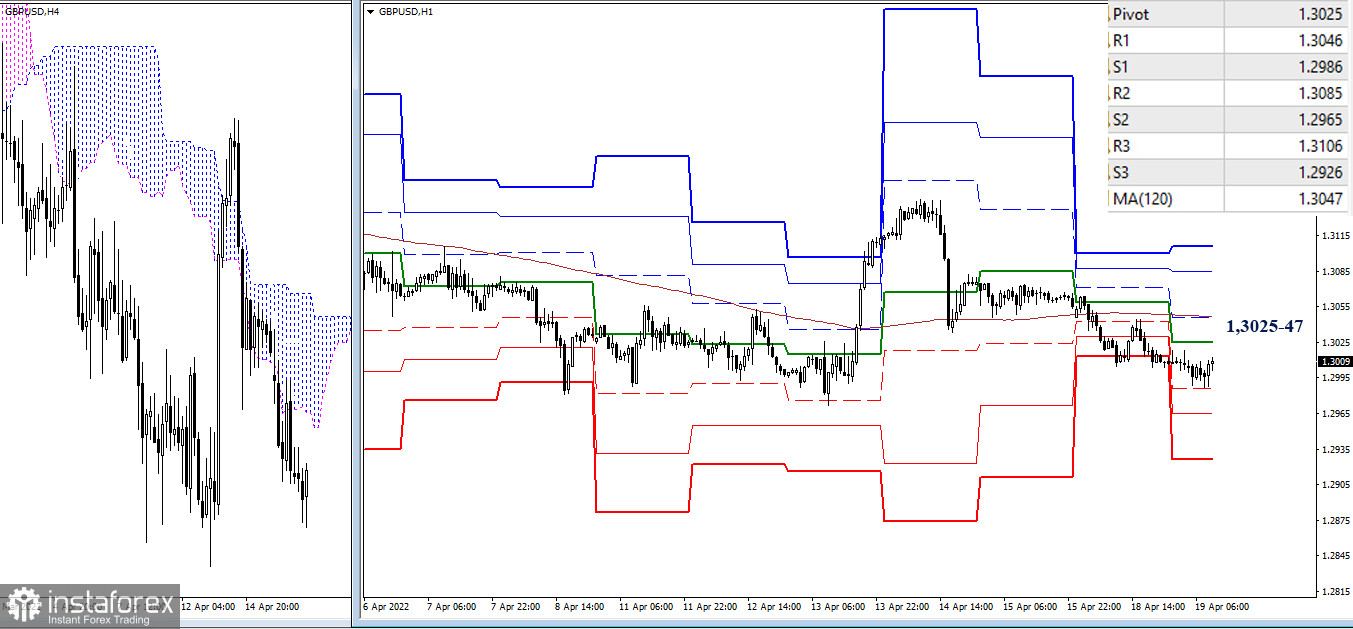

H4 - H1

The key levels of the lower timeframes are now located almost horizontally, which gives preference to uncertainty. Nevertheless, the main advantage still remains on the side of the bears, as the pair is working below the key levels, which today form a resistance zone at 1.3025–47 (central pivot point + weekly long-term trend). The consolidation above and the reversal of the moving average will change the current balance of power. Additional intraday reference points can be noted at 1.2986 – 1.2965 – 1.2926 (support of classic pivot points) and at 1.3046 – 1.3085 – 1.3106 (resistance of classic pivot points).

***

In the technical analysis of the situation, the following are used:

higher timeframes – Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română