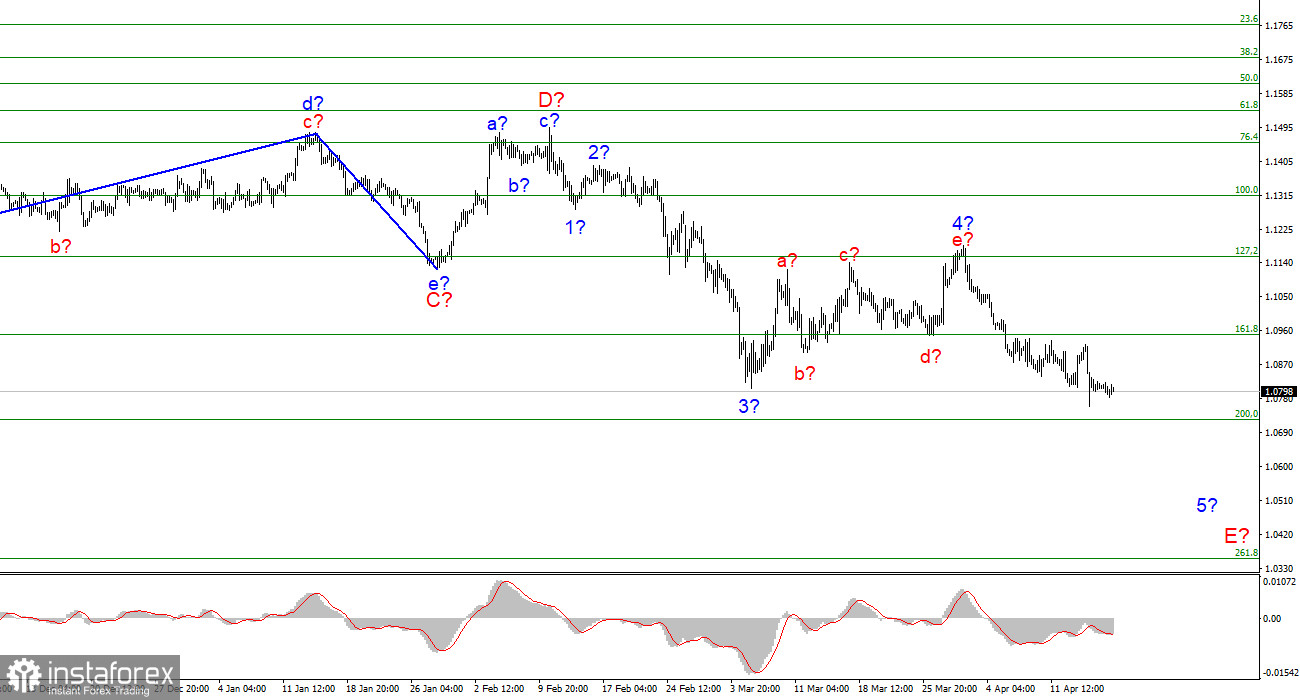

The wave marking of the 4-hour chart for the euro/dollar instrument continues to look convincing and has not changed at all in recent weeks. The proposed wave 4 has taken a five-wave, corrective form and has already been completed. The instrument continues the construction of the assumed wave 5-E. If this is true, then the decline in the quotes of the euro currency may continue for several more weeks, since the wave may turn out to be a very long, five-wave in its internal structure. It may also turn out to be shortened, but so far wave E cannot be considered complete yet, since its internal wave structure does not give grounds for such assumptions. Thus, the instrument still has a fairly strong potential for decline. The first target is around 1.0721, which equates to 200.0% Fibonacci. An unsuccessful attempt to break through this mark may lead to a departure of quotes from the achieved low and the construction of an internal corrective wave consisting of 5-E. At the same time, much for the instrument in the coming weeks will depend not only on the economy but also on geopolitics, gas and oil prices, the expansion of the zone of military conflict on the territory of other countries, new sanctions against the Russian Federation.

Monday and Tuesday: holidays, no news.

The euro/dollar instrument did not decrease or increase by a single point on Monday. Let me remind you that today is Easter Monday, so many trading platforms are closed, and the stock and foreign exchange markets are working half-heartedly. Thus, zero market activity both today and last Friday is explained by holidays. But not only that. The instrument is already very low, it has been falling for a very long time, and its wave pattern assumes that the construction of a downward trend section should be completed in the near future. Thus, the lower the quotes of the euro currency fall, the fewer sellers open new deals. Nevertheless, the key factor for the market now remains the Ukrainian-Russian conflict. Moreover, there was not and will not be a single important event or report in the USA and the European Union on Friday, Monday and Tuesday. What should the market react to in such conditions? Either to stand in one place for nothing or to follow geopolitics more closely.

There is little news in Ukraine right now. Reports are coming from Kyiv that the Russian army has intensified in the eastern direction and many military experts predict fierce and large-scale battles in the Luhansk and Donetsk regions in the coming weeks, which will determine the outcome of this conflict. According to the absolute majority of military analysts, it is the "battle for Donbas" that will allow the conflict to come closer to its resolution. Unfortunately, the peace talks have practically failed, but the results of the "battle for Donbas" may give additional trump cards in the hands of one or the other side. Accordingly, the losing side may become more compliant in new negotiations. Unfortunately, there is no way to avoid new military clashes, which were announced both in Moscow and in Kyiv. It remains only to wait for how everything will end. And until it is completed, the demand for the European currency may continue to decline.

General conclusions.

Based on my analysis, I still conclude that wave 5 is still building in E. If so, now is still a good time to sell the European currency with targets located around the 1.0721 mark, which corresponds to 200.0% Fibonacci, for each MACD signal "down". In the next few days, an internal correction wave of 5-E may be built, after which I expect a new decline in the instrument.

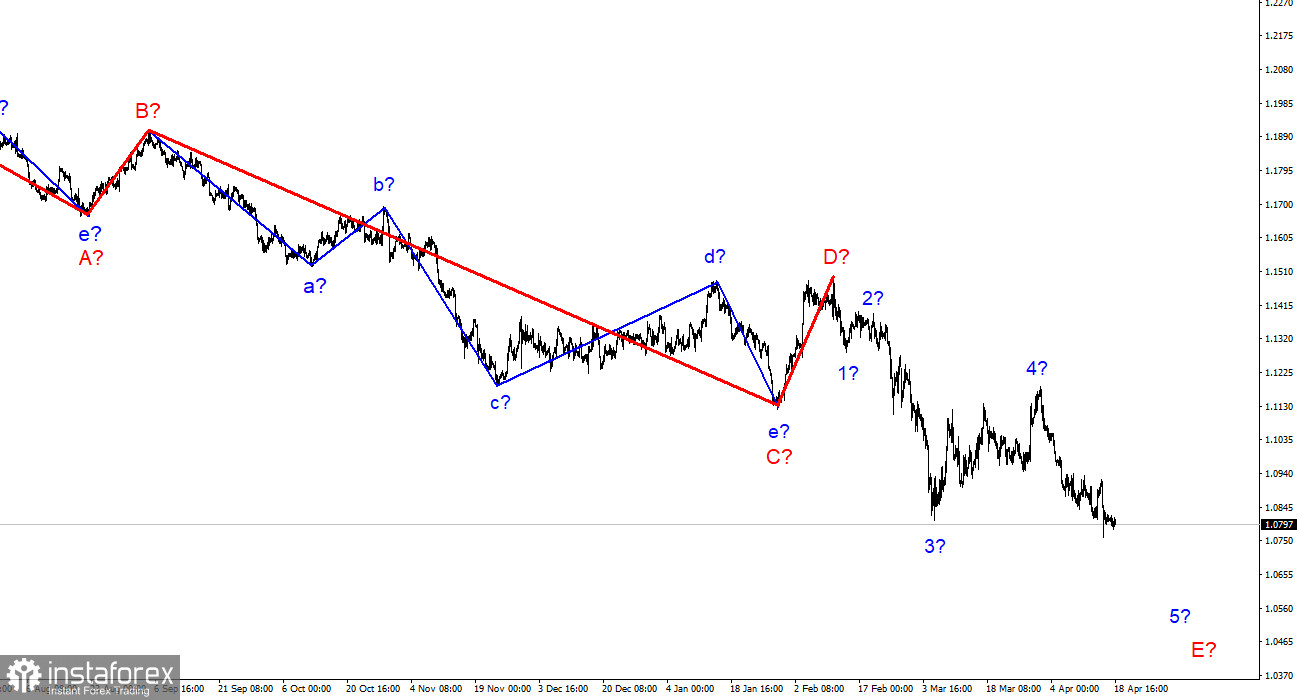

On a larger scale, it can be seen that the construction of the proposed wave D has been completed, and the instrument regularly updates its low. Thus, the fifth wave of a non-pulse downward trend section is being built, which may turn out to be as long as wave C. If this assumption is correct, then the European currency will still decline.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română