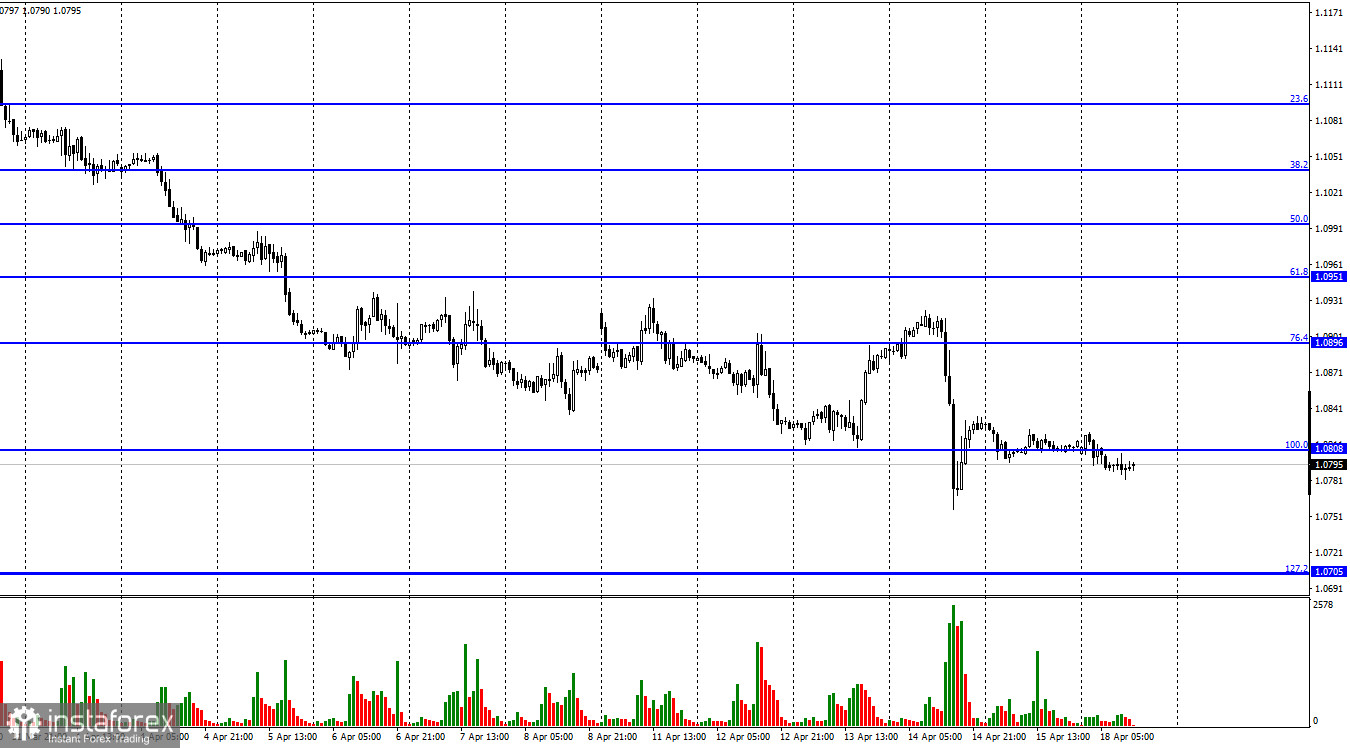

The EUR/USD pair traded all day along with the corrective level of 100.0% (1.0808) on Friday, showing no desire to resume the fall or start growth. Already this morning, there was a consolidation of quotes under the Fibo level of 100.0%, which now allows us to count on the continuation of the fall in the direction of the next corrective level of 127.2% (1.0705). However, on Friday and Monday, the activity of traders is very weak. Both on Friday and Monday, the information background is almost completely absent. On the last day of last week, a report on industrial production in February was released in America, but traders did not pay any attention to it. Today, they have nothing to pay attention to. Only geopolitics promises to get much worse in the next few weeks. And it seems that traders are just waiting for geopolitical news. The fact is that after the withdrawal of Russian troops from all the northern regions of Ukraine, it became clear that Russia could not attack in nine directions at once. In the last weeks of the battles in the North of Ukraine, the Russian military has not made any progress. Therefore, Moscow decided to redeploy its troops to where there is at least some chance of victory, namely to the East and the Southeast. Over the past two weeks, military equipment and units have been actively transferred to Donetsk, Luhansk, and Kharkiv regions. It is in these directions that the Kremlin is going to attack Ukraine in the coming weeks. At the same time, the European Union is developing a sixth package of sanctions against Russia, which will already contain some restrictions on oil, as well as against Sberbank, which is the largest bank in Russia. Also, the European Union, Australia, the USA, Canada, and other countries of the world continue to help Ukraine with humanitarian supplies, weapons, and finances. Moscow continues to threaten all countries that support Ukraine in this conflict. This is especially true of the United States. In general, I would say that the geopolitical situation in the world continues to deteriorate, and not vice versa.

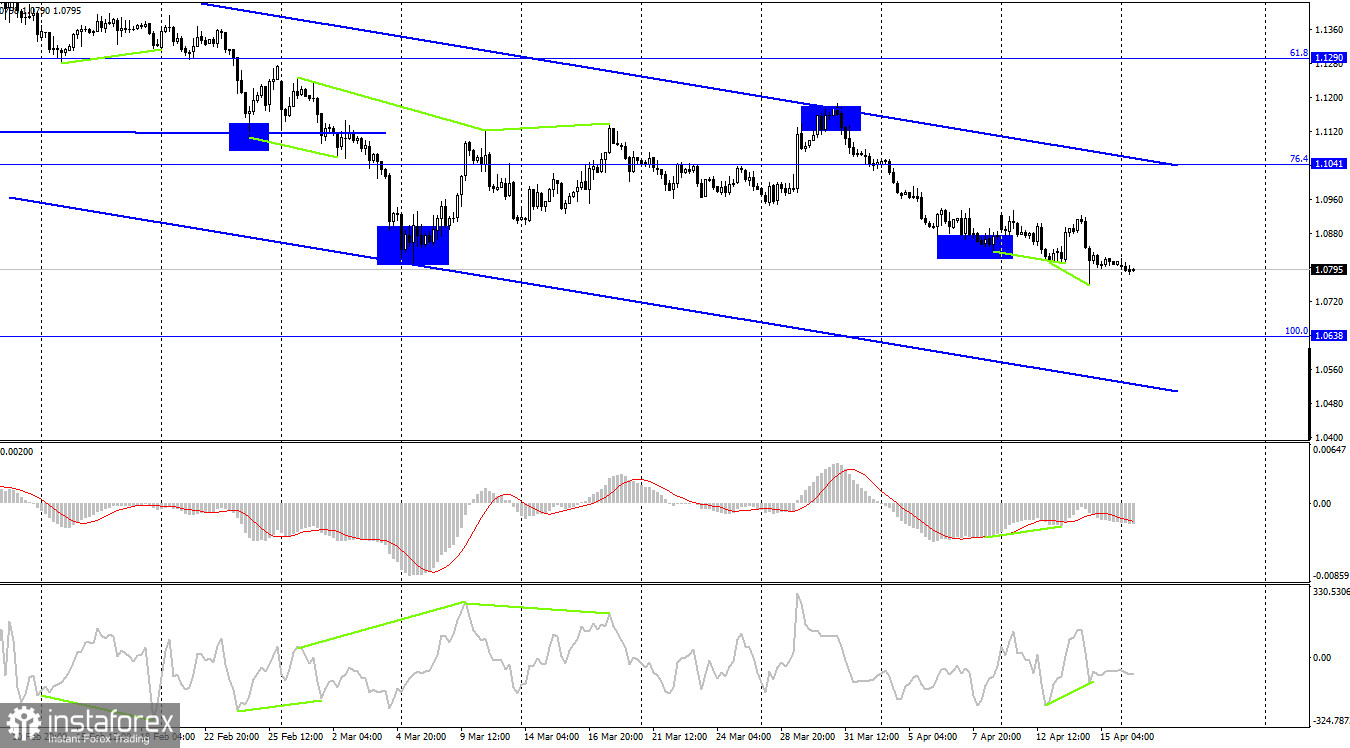

On the 4-hour chart, the pair continues the process of falling towards the corrective level of 100.0% (1.0638) despite the formation of two "bullish" divergences. The downward trend corridor continues to characterize the mood of traders as "bearish". The rebound of quotes from the Fibo level of 100.0% (1.0638) will work in favor of the EU currency and some growth in the direction of the upper limit of the descending corridor.

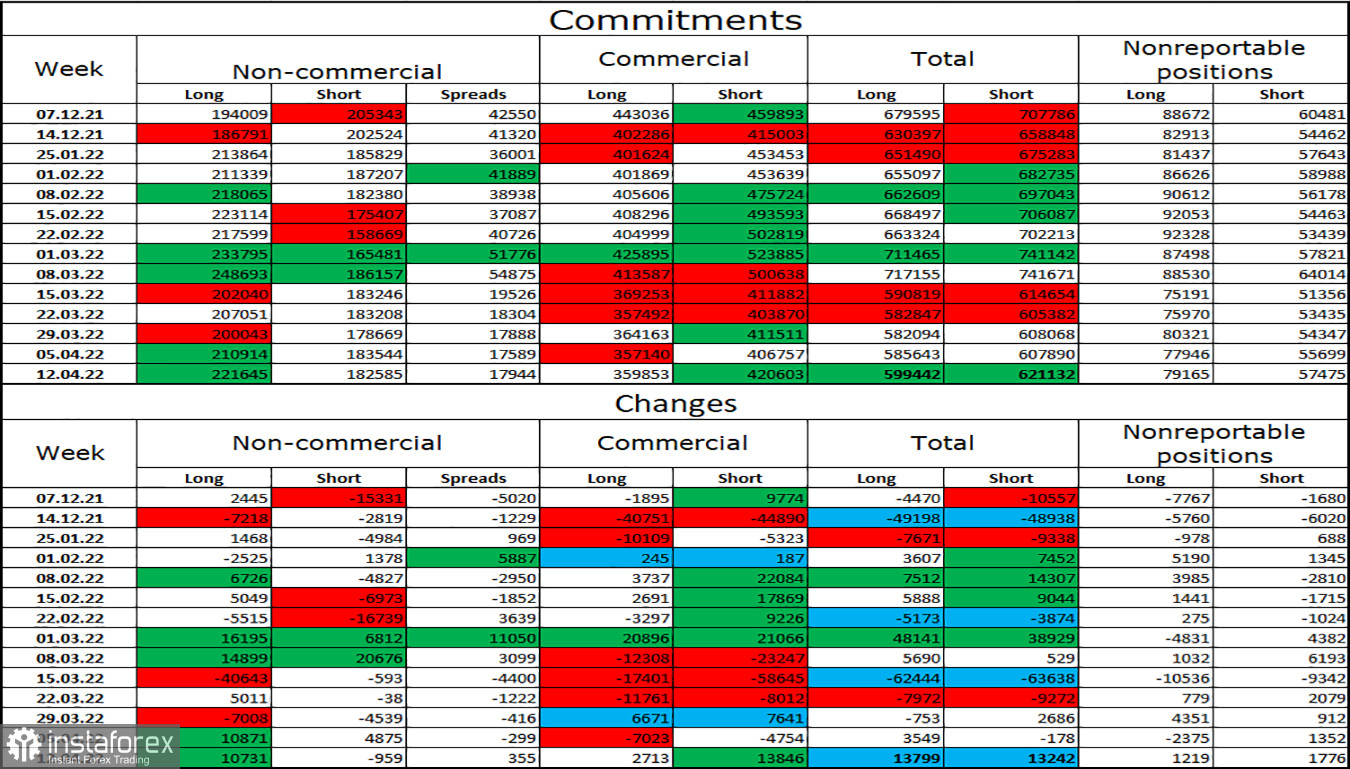

Commitments of Traders (COT) Report:

Last reporting week, speculators opened 10,731 long contracts and closed 959 short contracts. This means that the bullish mood of the major players has intensified even more. The total number of long contracts concentrated on their hands now amounts to 221 thousand, and short contracts - 182 thousand. Thus, in general, the mood of the "Non-commercial" category of traders is characterized as "bullish". In this scenario, the European currency should show growth. But for several weeks, it continues to fall into the abyss without any hope of salvation. Thus, it is impossible to draw adequate conclusions from the COT reports now. A very strong influence on the mood of traders is the possible continuation of hostilities in Ukraine, the deterioration of relations between the West and the Russian Federation, and new sanctions against Russia.

News calendar for the USA and the European Union:

US - FOMC member James Bullard will deliver a speech (20:00 UTC).

On April 18, the calendars of economic events of the United States and the European Union contain one entry for two. James Bullard's speech will take place late in the evening, so during the day, it will not affect the mood of traders in any way.

EUR/USD forecast and recommendations to traders:

I recommend selling the pair now, as it closed at 1.0808 on the hourly chart with a target of 1.0705. I do not recommend buying a pair yet, since the probability of a new fall in the European currency is too high.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română