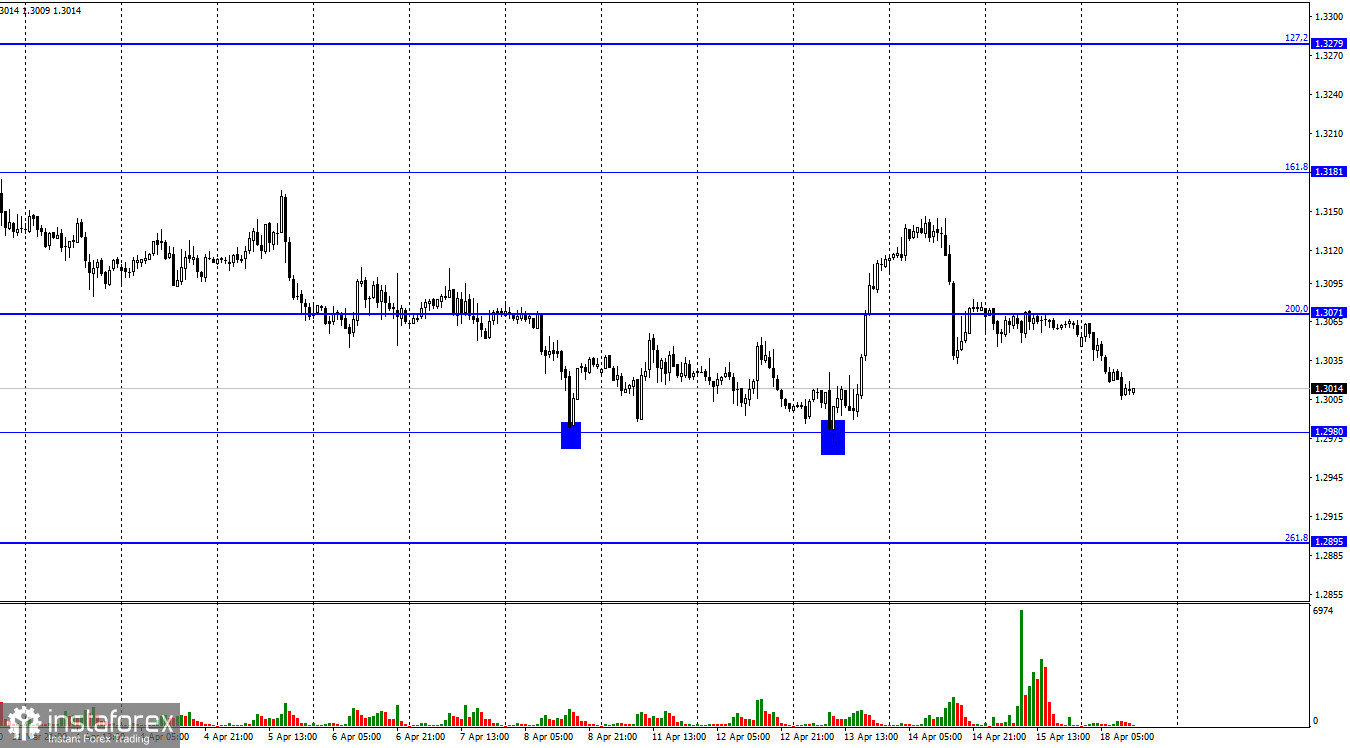

According to the hourly chart, the GBP/USD pair on Friday, after closing under the corrective level of 200.0% (1.3071), could not continue the process of falling. But I was able to resume it today, on Monday. Thus, the fall of the British dollar began again in the direction of the level of 1.2980, near which two rebounds were performed last week. Fixing the pair's rate below this level will allow us to count on a further fall in the direction of the next corrective level of 261.8% (1.2895). There was no background information on Friday. It was quite strong on Monday, Tuesday, and Wednesday last week, but all the strongest movements happened when there were no statistics and events: on Wednesday evening and Thursday. There will be very few economic statistics this week, and even fewer global events. Although I will note that there will be speeches by Andrew Bailey and Jerome Powell, as well as some FOMC members, which is always interesting. However, it is impossible to count on whether these events will necessarily cause a reaction from traders. They may or may not call. To a lesser extent, this concerns economic statistics this week. First, it will be frankly weak. Second, traders are now generally not too interested in reports on inflation or GDP. Now all the attention of traders is focused on the actions of the Bank of England, the ECB, and the Fed, as well as on geopolitics. Since there will not be a single central bank meeting this week, it seems to me that everything will depend on a European and a Briton on the aggravation of the military conflict in Eastern Ukraine. According to Kyiv's statements, the offensive of Russian troops began in the Donetsk and Luhansk regions a few days ago and the onslaught is intensifying every day. Today, there were rocket attacks on Lviv, Dnipro, and Kharkiv. Mariupol continues to fight back. President of Ukraine Volodymyr Zelensky said that if Mariupol falls, Kyiv will withdraw from any negotiations with Moscow. However, these negotiations have already failed, this is clear to absolutely everyone. The worse the situation in Ukraine becomes, the more likely it is that the euro and the pound will fall again.

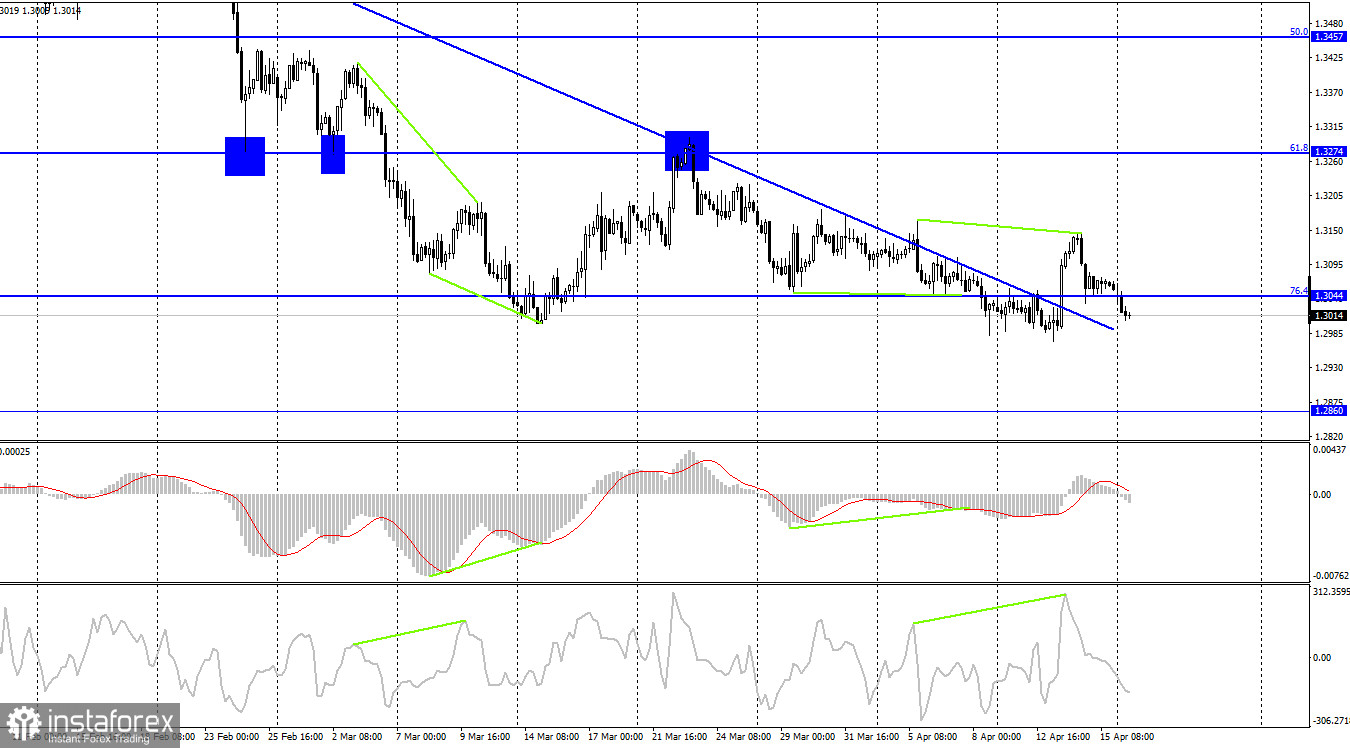

On the 4-hour chart, the pair performed a reversal in favor of the UK currency and anchored above the descending trend line. However, the "bearish" divergence of the CCI indicator allowed the pair to return to the corrective level of 76.4% (1.3044), and then close below it. Thus, the process of falling quotes continues now in the direction of the next level of 1.2860, and you can forget about the trend line.

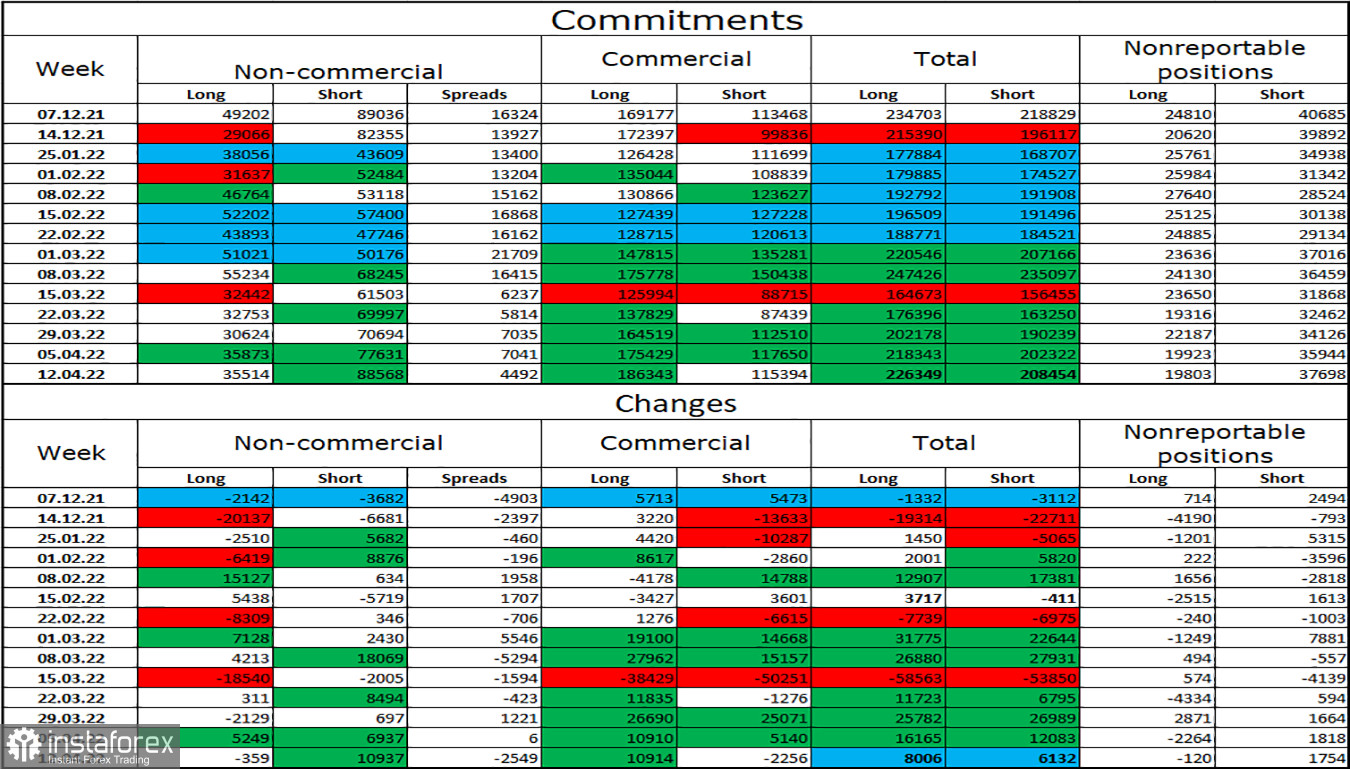

Commitments of Traders (COT) Report:

The mood of the "Non-commercial" category of traders has changed a lot over the past week. The number of long contracts in the hands of speculators decreased by 359, and the number of short contracts increased by 10,937. Thus, the general mood of the major players has become much more "bearish". The ratio between the number of long and short contracts for speculators still corresponds to the real state of things on the market - longs are 2.5 times more than shorts. The big players continue to get rid of the pound. Thus, I expect the pound to continue its decline. This forecast is made based on geopolitics, based on COT reports, and based on graphical analysis.

News calendar for the USA and the UK:

US - FOMC member James Bullard will deliver a speech (20:00 UTC).

On Monday, the calendar of economic events in the UK is empty. In America, today there will be a speech by the "hawk" James Bullard, who will certainly again declare the need to raise the Fed rate, but this event is later. Until the evening, the information background will not have any effect on the mood of traders.

GBP/USD forecast and recommendations to traders:

I recommended selling the pound with a target of 1.2980 if a rebound from the level of 1.3071 is performed on the hourly chart. Now, these deals can be kept open. I recommend buying the British when rebounding from the 1.2980 level on the hourly chart with a target of 1.3071.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română