The fall of the Japanese yen, which can be observed since December 2020, makes the governor of the Bank of Japan Haruhiko Kuroda nervous. In a recent interview, he expressed concerns about the sharp movements of the yen down against the US dollar, trying to guarantee investors and traders that despite all this, there will be no cracks between the government and the central bank about the continuation of monetary stimulus. "The recent movements of the yen have been very fast," Kuroda said. "This may cause problems for several companies in planning their future activities, which will lead to negative changes in the future, and we need to take this into account."

Other Japanese politicians also believe that excessive and erratic fluctuations of the currency, which is now at a 20-year low, can have negative consequences. Finance Minister Shunichi Suzuki described the sudden changes as "very problematic" and said a weak yen could be bad for the economy as the government tightened its stance on the currency.

In the current situation, Kuroda needs to act as carefully as possible. Recently, he has repeatedly stated that the regulator will do everything necessary to further stimulate the fragile economy, but now he needs to do so in order not to further harm the exchange rate, which is strongly prone to weakening. Many traders are now saying that due to the actions of the central bank in the coming months, the yen will easily reach the 130 mark against the dollar. Kuroda's forced statements are aimed at reassuring traders and investors who also fear a weakening of the economy against the background of what is happening in the geopolitical arena now. Kuroda is trying to show that he and the government of the country are now on the same wavelength. It is worth noting that the central bank's main position on keeping interest rates at a minimum level is sharply different from most of the world's central banks outside Japan, which are aggressively raising interest rates to combat high inflation. This also creates additional downward pressure on the yen and weakens it against several currencies of these countries.

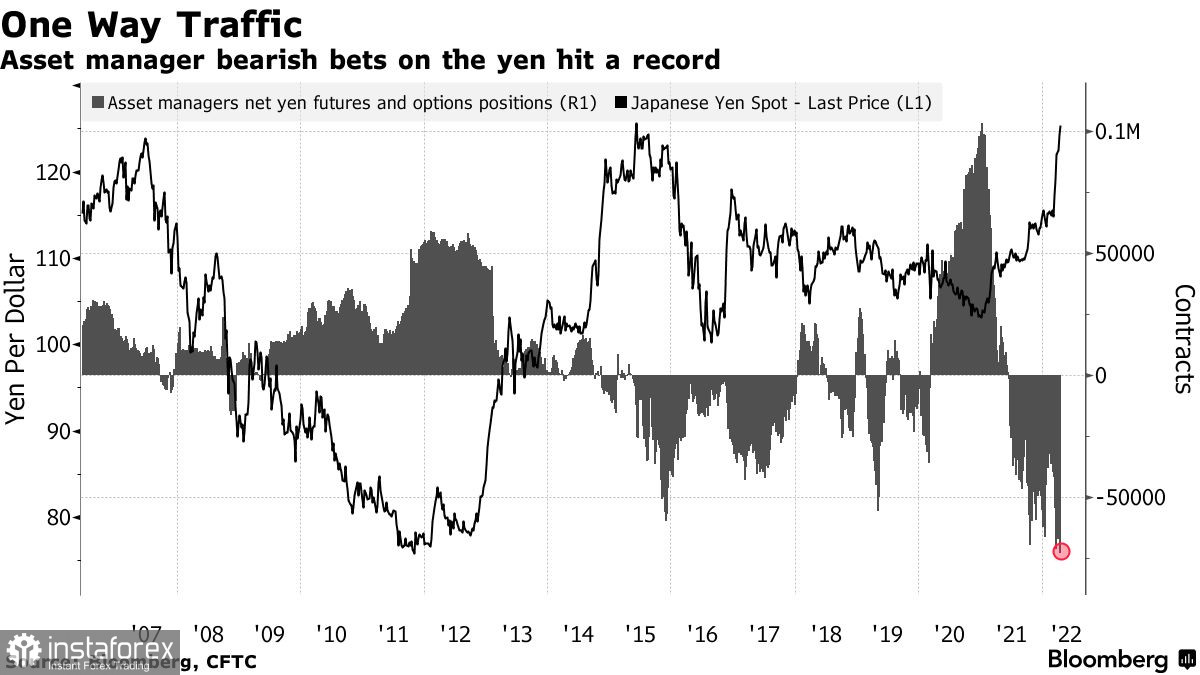

And although many are confident that the Bank of Japan will stick to incentives during Kuroda's last year at the helm, some already see a real possibility of making adjustments in the near future. Hideo Hayakawa, a former chief economist at the central bank, recently said he expects a policy adjustment as early as July this year. It will be aimed at stopping the weakening of the yen. Investors are also betting that the divergence in interest rates between the Federal Reserve and the Bank of Japan will outweigh the efforts of government officials to stop the downward trend of the yen. According to the Commodity Futures Trading Commission, last week, large fund managers increased short positions on the yen to a new record level.

Hence, the conclusion suggests that the trend of further growth of the USDJPY pair will remain unchanged - it's just that the pace of the bull market will only slow down a little. But the more hawkish the Fed's policy will be in May this year, the stronger the yen will lose against the US dollar,

As for the technical picture of the USD/JPY pair

The fact that the level around 125.80 was easily passed recently - which was the maximum of 2015 - indicates that there are simply no people willing to defend even such large levels. While trading will be conducted above 125.80, we can expect a smooth upward movement to the area of 129.20, and then to 132.30. These are longer-term levels to which we can move by the end of this year. If the pressure on the trading instrument returns, and this is unlikely - given the different policies of central banks, buyers will actively defend the levels: 124.00, 122.20, and 119.10.

As for the technical picture of the EURUSD pair

The euro has failed to demonstrate anything interesting. As a result, the pressure on the trading instrument remains and it is very early to talk about the prospects of its correction. Worsening geopolitical tensions due to Ukraine's refusal to negotiate forces Russia to act more aggressively again, which does not add confidence in the future and restrains demand for risky assets. Given the aggressiveness of the Fed's policy, it is best to bet on further strengthening of the dollar. To return the market under their control, euro buyers need a break above 1.0835, which will allow them to build a correction to the highs: 1.0885 and 1.0930. In the event of a decline in the trading instrument, buyers will be able to count on support around 1.0760. Its breakdown will quickly push the trading instrument to the lows: 1.0710 and 1.0640.

As for the technical picture of the GBPUSD pair

The sharp rise in the pound turned out to be fake. As a result, the pair lost everything that it managed to pick up last week and the pressure on the pound is only continuing. Now buyers of risky assets need to focus properly on the breakdown and consolidation above the resistance of 1.3050. Going beyond this range will lead to a resumption of correction and will allow updating new local highs in the area of the 31st figure and the area of 1.3130. When the pressure on the trading instrument returns, buyers will most likely prefer to act more actively around 1.2990, but their appearance is not excluded only in the 1.2950 area. Larger support is seen around 1.2910.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română