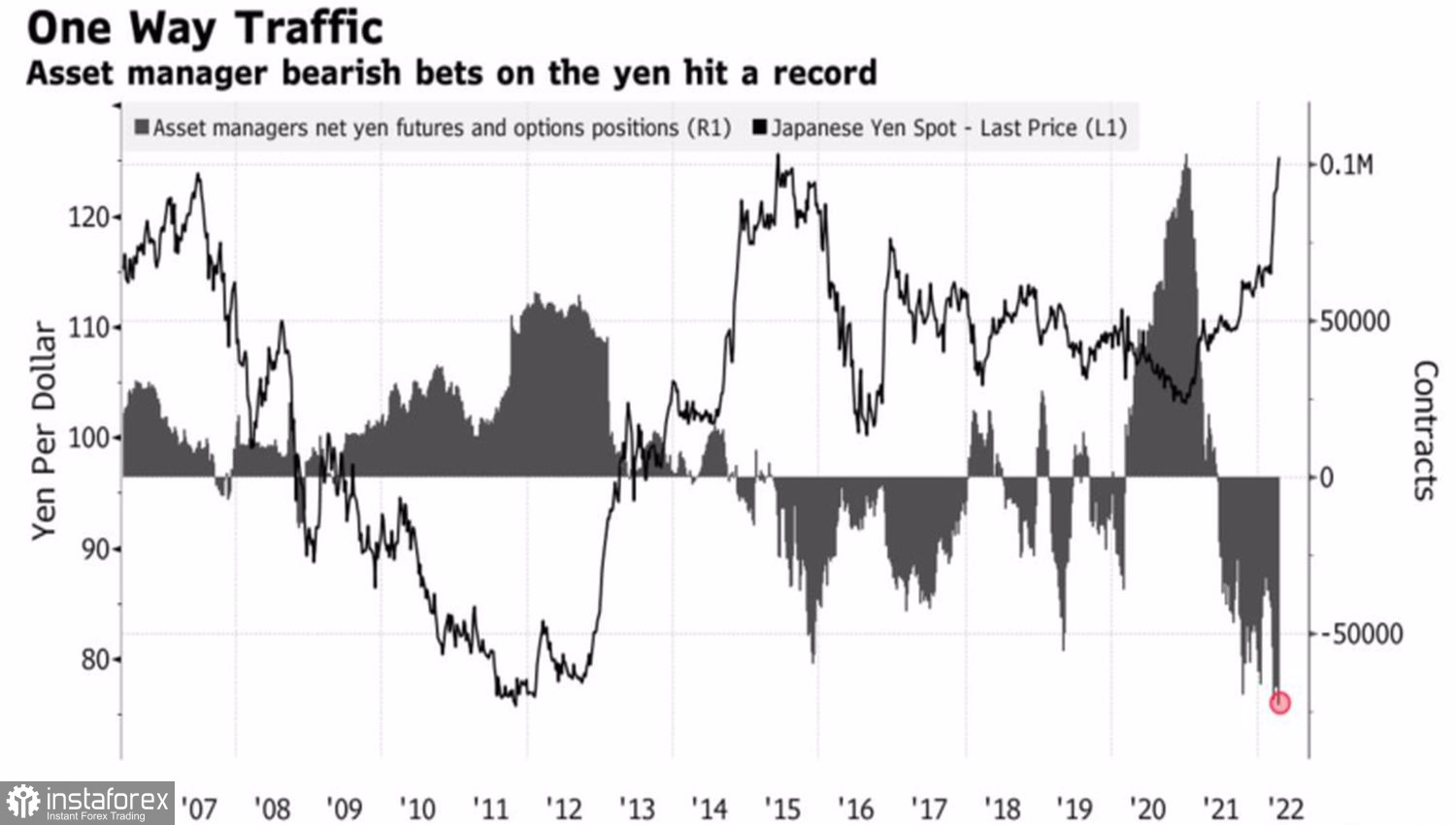

Eleven consecutive days of closing in the red zone. Falling to the area of 20-year lows and losing about 10% of its value since the beginning of March. All this refers to the Japanese yen. Which, due to the divergence in the monetary policy of central banks and the growth of the negative balance of foreign trade in Japan, has now settled in the status of an obvious outsider among the G10 currencies.

The US markets were closed, and in conditions of insignificant trading volumes on Forex, the risks of profit-taking on excessively inflated speculative longs for the US dollar and yen shorts usually increase. This time, the big players decided not to trap the crowd. Apparently, the potential of the USDJPY rally is far from exhausted.

Dynamics of USDJPY and speculative positions on the yen

While investors expect the Fed to raise the federal funds rate to 3% in 2023, pushing US Treasury yields to their highest level since late 2018, the Bank of Japan is holding on to an ultra-loose monetary policy with its teeth. Bank of Japan Governor Haruhiko Kuroda has repeatedly talked about the benefits of a weak yen for exporters and inflation, but the USDJPY rally in March–April was so impressive that even he was forced to hold his horses.

Kuroda said the yen's recent moves have been very fast. This can cause problems for companies when drawing up business plans, so the central bank should take into account the negative impact of a weak currency. This speech echoes the words of Finance Minister Shunichi Suzuki, who said that excessive and erratic fluctuations in the USDJPY could be negative for Japan's economy. The joint verbal intervention of the BoJ and the government had its effect: the bulls on the analyzed pair retreated. But not for long. Soon they resumed their attacks, and there are good arguments for this.

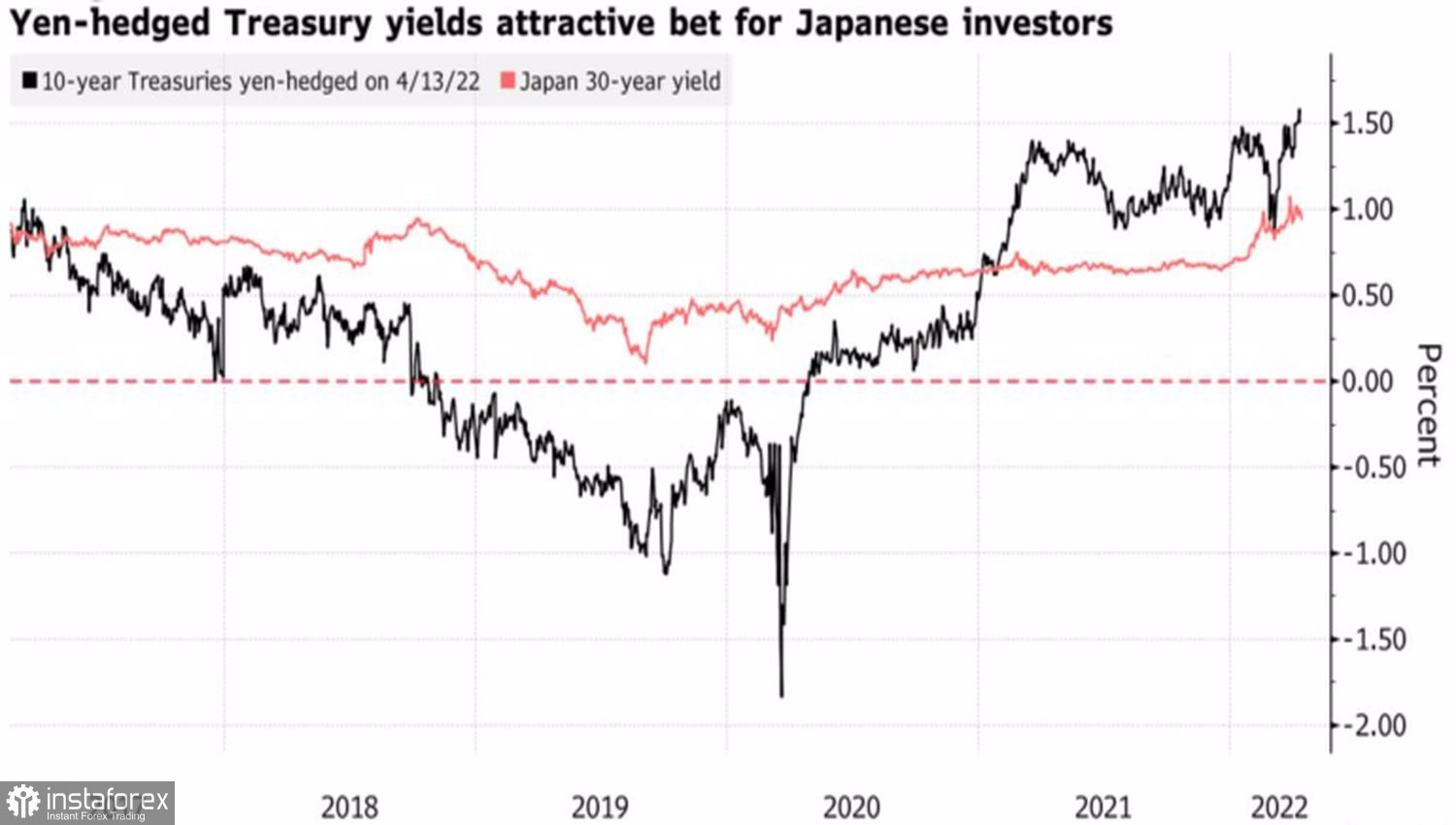

At present, due to the rapid rally in US Treasury yields, Japanese insurance companies and pension funds can capitalize on a 1.6% spread in 10-year interest rates, even after accounting for hedging costs. The 30th debt securities of Japan offer about 1%. Under such conditions, the flow of capital from Asia to North America becomes another important trump card for the USDJPY bulls.

Dynamics of profitability of operations with bonds

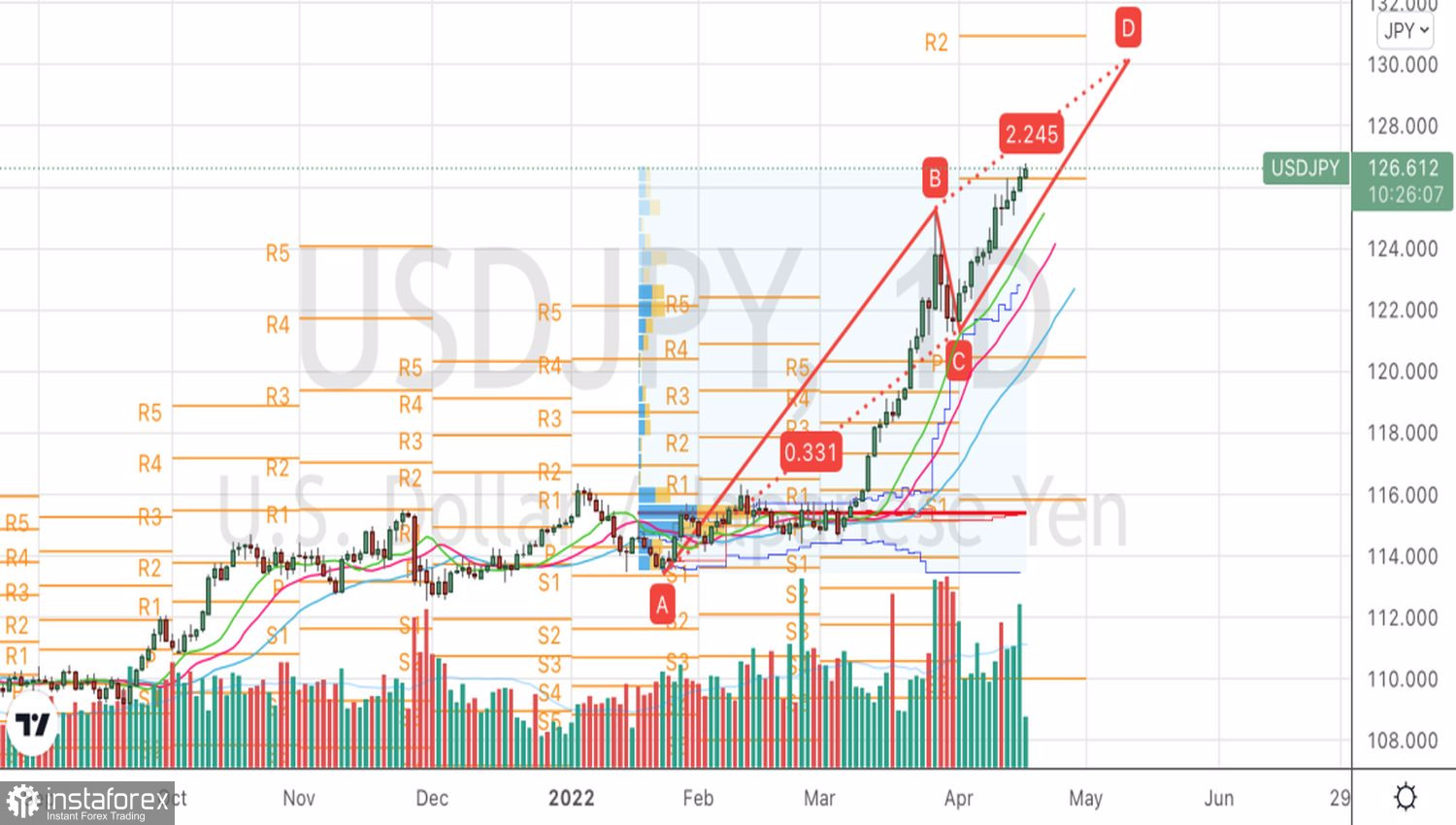

Thus, neither the thin holiday market nor the verbal interventions of the Bank of Japan and the government did not deter the sellers of the yen. The market is actively discussing the question of when exactly the US dollar will reach £130, and they doubt that the levels of £128 and £129 will be able to stop buyers of the American currency. The Fed looks too aggressive, ready to raise federal funds rates by 50 basis points in May, and the conservative Bank of Japan, which is not going to give up control of the yield curve.

Technically, there is no doubt about the strength of the upward trend in USDJPY. The 224% target for the AB=CD harmonic trading pattern is located near the 130 mark. The recommendation is to buy.

USDJPY, Daily chart

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română