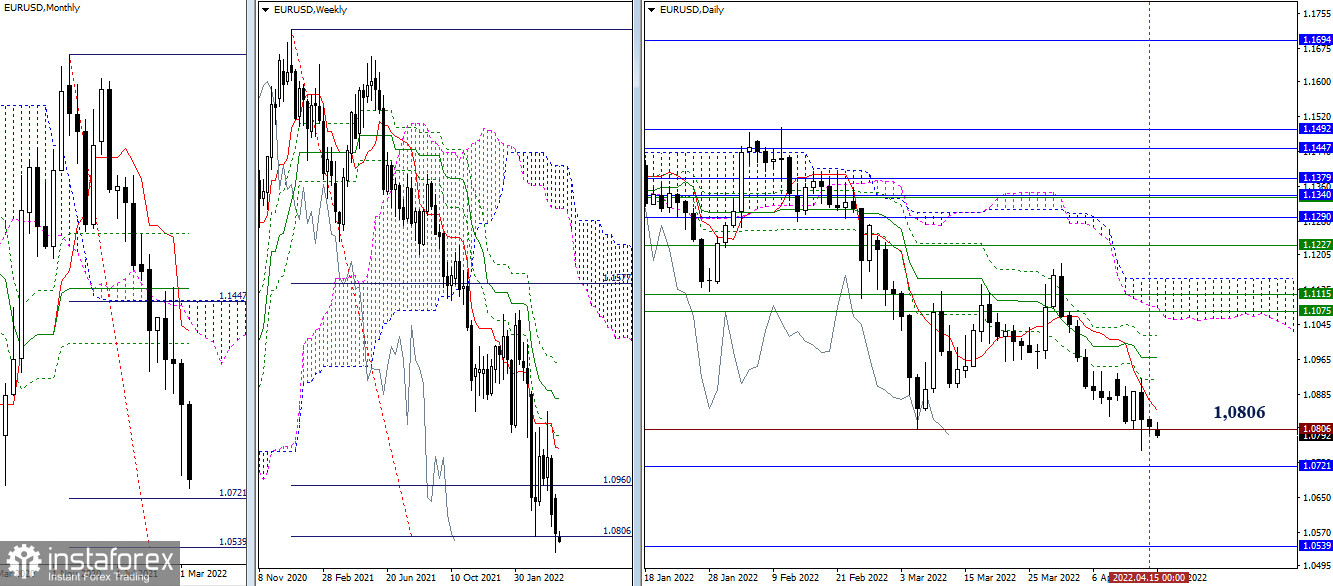

EUR/USD

Higher timeframes

Bears failed to overcome the weekly target to break the cloud (1.0806) at the close of last week. Today, this task remains relevant, and its implementation will allow shifting our attention to the downward target of the next timeframe – the target for the breakdown of the monthly cloud (1.0721 – 1.0539). In parallel, the most significant resistance in this area of the market is now concentrated at 1.1075 – 1.1115 (weekly levels + daily cloud). On the way to these lines, there is a daily Ichimoku cross (1.0849 – 1.0921 – 1.0972 – 1.1022), which is why the immediate and priority task for bulls in the current conditions is the elimination of the daily Ichimoku death cross.

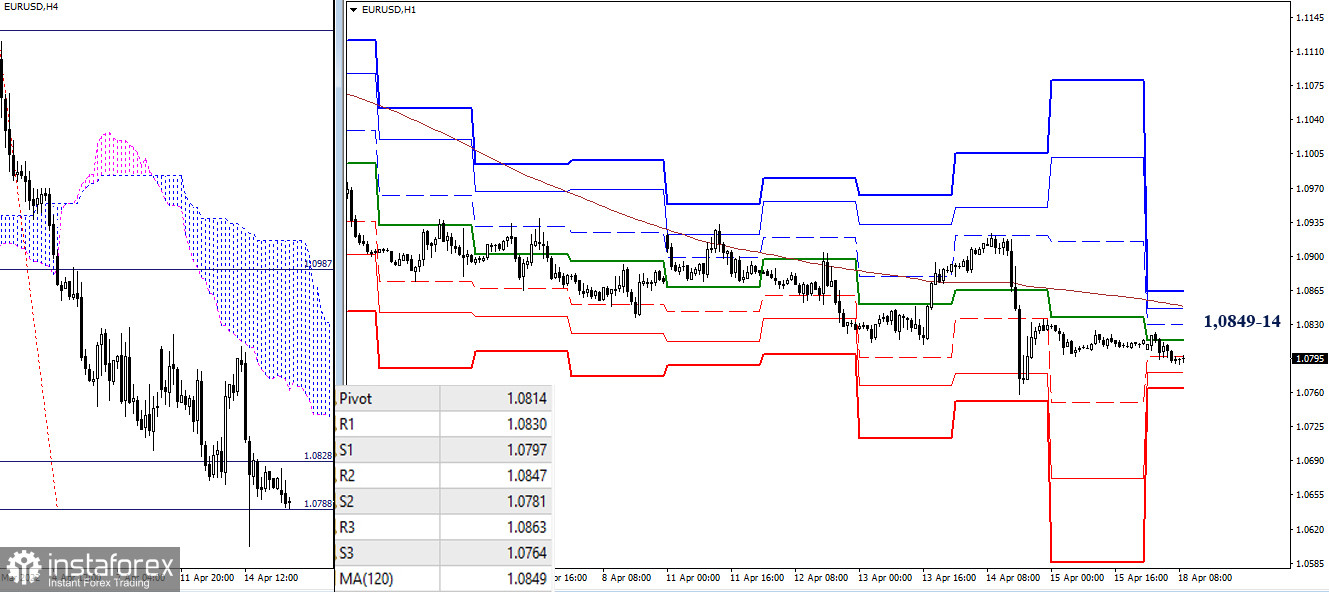

H4 – H1

In the lower timeframes, the pair remains in the upward correction zone for a long time. The target for the breakdown of the H4 cloud has been worked out, whose reference points now serve as support (1.0788). To further strengthen bullish sentiment, it is necessary to gain a foothold above the key levels, which today combine their efforts in the area of 1.0849–14 (central pivot point + weekly long-term trend), and reverse the moving average.

***

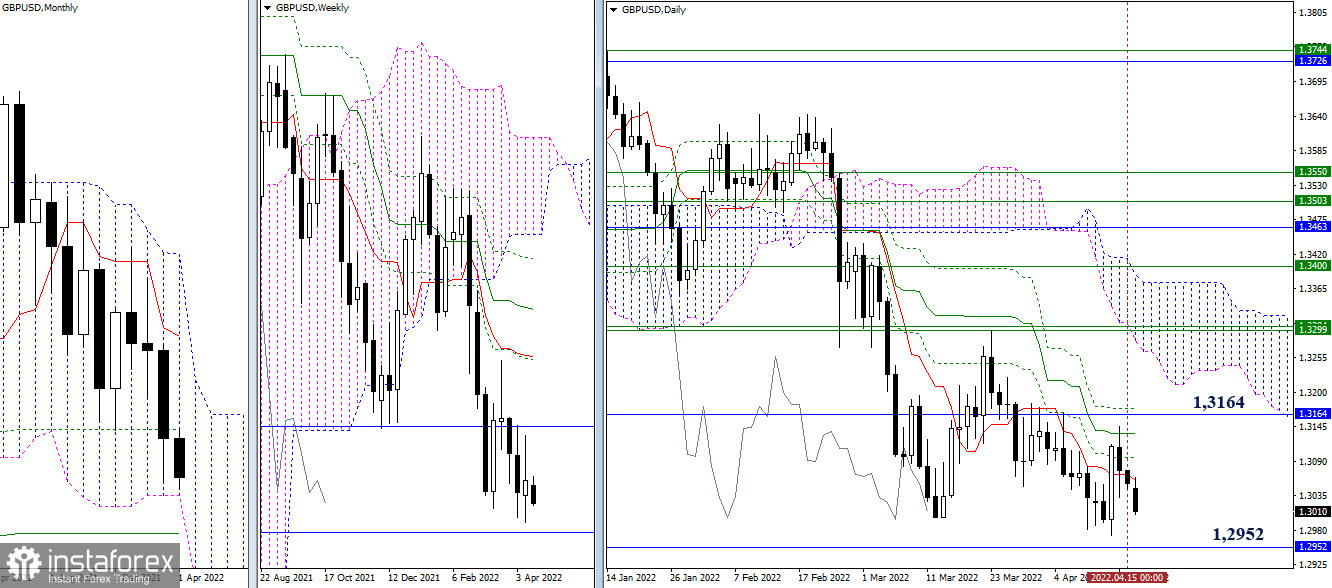

GBP/USD

Higher timeframes

Last week, bulls failed to develop the emerging correction. The levels that held the defense – the daily Ichimoku death cross (1.3059 – 1.3097 – 1.3135 – 1.3173), reinforced by the monthly resistance (1.3164), retain their significance and are still paramount on the path of the bulls on this section of the road. At the same time, the support of the lower border of the monthly cloud (1.2952) continues to be the nearest important reference point for the development of the bearish scenario.

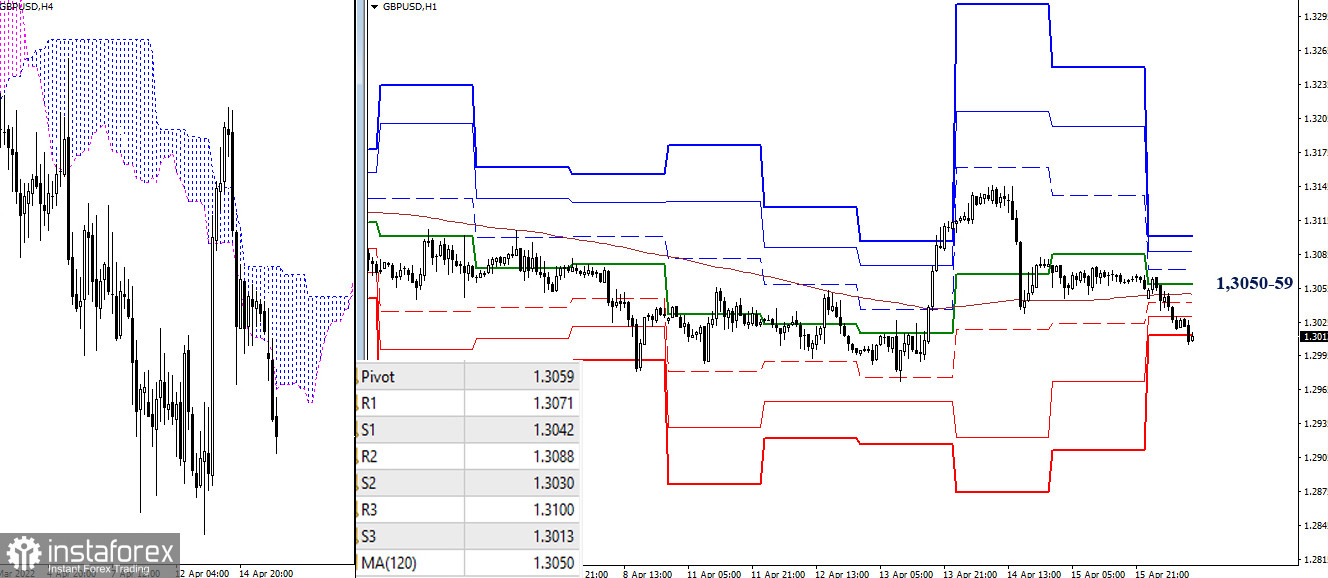

H4 – H1

In the lower timeframes, bears insist on strengthening their positions and sentiments. They have already tested intraday reference points in the form of supports for the classic pivot points. Further, the continuation of the decline to the reference points of the higher timeframes will be important, where the support of 1.2952 is of the greatest importance. The key levels of lower timeframes today are consolidating into a resistance zone around 1.3050–59 (central pivot point + weekly long-term trend). Consolidation above can change the current balance of power and form the prerequisites for bullish sentiment.

***

In the technical analysis of the situation, the following are used:

higher timeframes – Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română