Markets were practically non-operational on Friday, as not only in Europe, but also in the United States, it was a public holiday. So it is not surprising that the single European currency actually stood still. Although it is clear that after the results of the last meeting of the Board of the European Central Bank, the prospects for the euro do not look good. In the near future, it will move exclusively in the direction of its decline. And apparently, today it will significantly decrease more actively, despite the fact that it is still a day off in Europe. After all, today is a full-time work day in the United States. So from the opening of the US trading session, we will see an increase in activity.

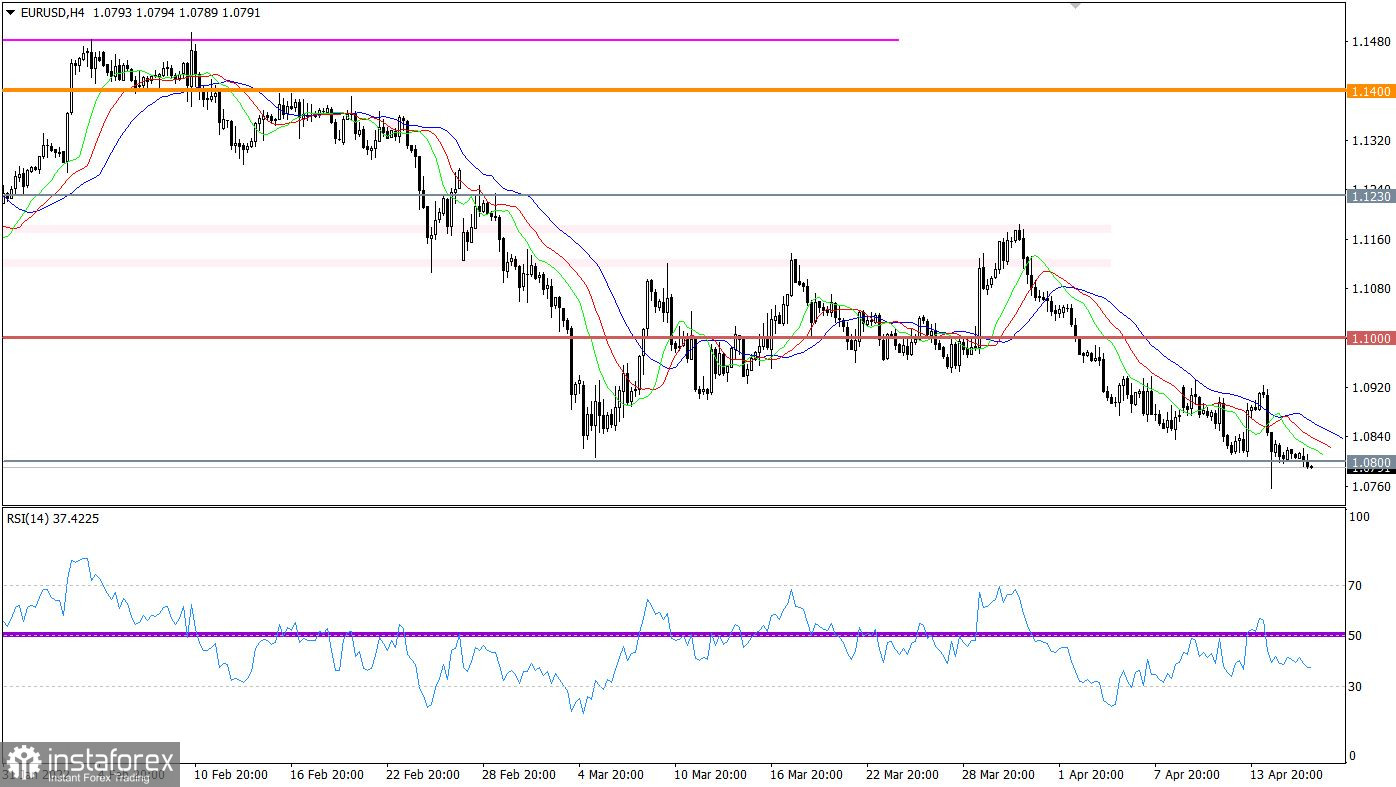

The EURUSD currency pair completed the stagnation within the support level of 1.0800 with its breakdown along a downward trajectory. This was a signal of the prolongation of the medium-term downward trend.

The RSI technical instrument moves in the lower area of the indicator in the four-hour and daily periods. This movement indicates traders' prevailing interest in short positions.

The Alligator H4 and D1 indicator indicates a downward cycle, the MA sliding lines are directed downwards.

Expectations and prospects:

Firmly keeping the price below the support level of 1.0800 in a four-hour period increases the chances of bears for a subsequent downward move. As possible prospects, traders consider the area of local lows in 2020, this is 1.0635/1.0660.

Comprehensive indicator analysis gives a sell signal in the short, intraday and medium term due to the downward cycle.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română