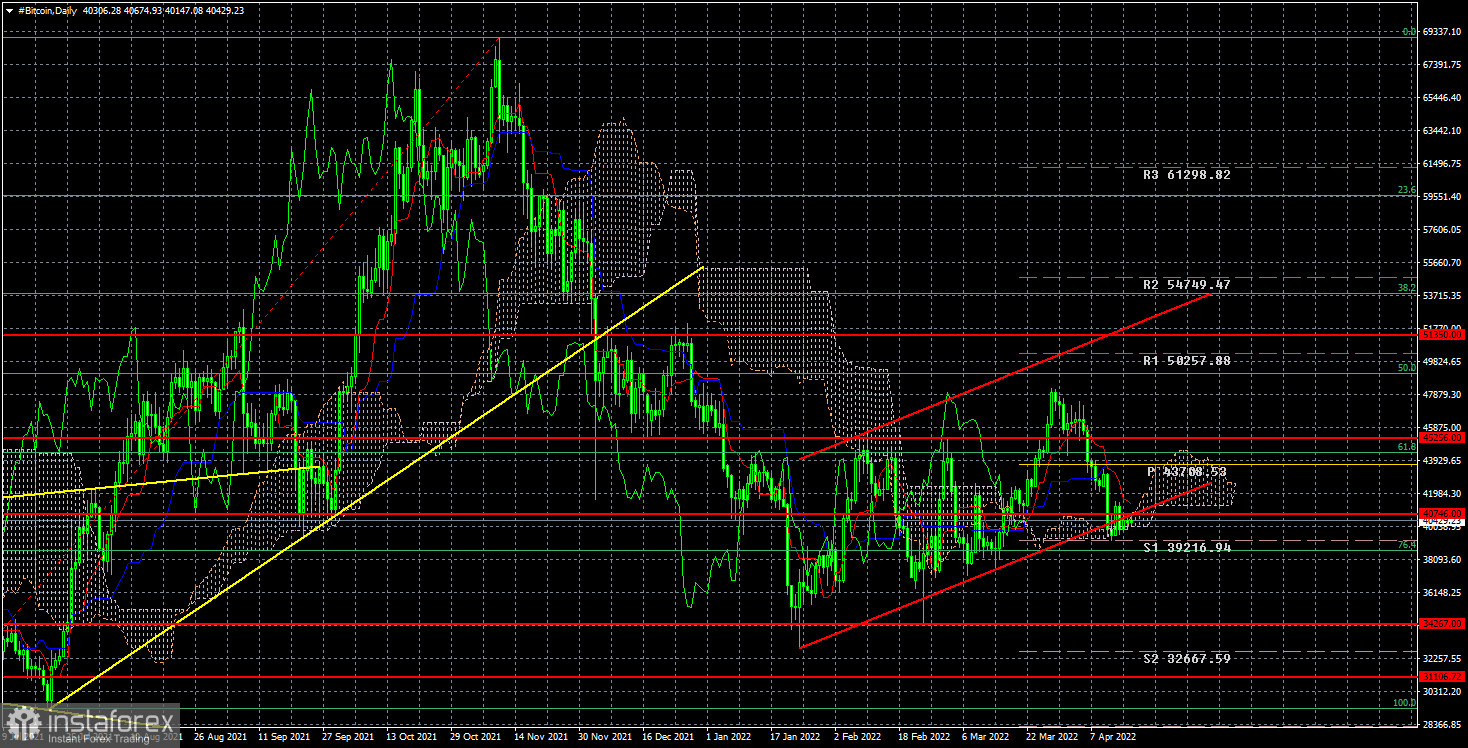

On Saturday, bitcoin practically did not move from its place. The cryptocurrency is currently located exactly "on" the lower border of the ascending channel and "on" the Senkou Span line B. That is, at this time, it is impossible to say with certainty whether these lines have been overcome or whether a rebound will follow from them. The situation is very strange since usually, any tool does not ignore such important lines. However, bitcoin once again decided to surprise market participants. We recommend relying nevertheless on the Senkou Span B line. If there is a rebound from it, then we will expect another round of corrective growth, in which the "bitcoin" has been since January 24.

What drives Bitcoin?

If we discard various fantasies about "bitcoin will conquer the world" and "bitcoin will displace fiat money," it becomes clear that bitcoin is just a new tool, a new technology that has already spawned a whole cloud of other new tools and technologies. But one way or another, bitcoin is something that has its cost price (the cost of mining), and the market value (which often changes). What will happen if the market value falls below the cost price for a long period? Let's figure it out. Bitcoin miners received a reward of 25 coins for 1 block mined until 2016. After halving in 2016 - 12.5 coins. And after halving 2020 - 6.25. The next halving is scheduled for 2024 and the reward will drop to 3,125 coins per block mined. That is, in theory, at each halving, bitcoin should have a market value (the average for a certain period) twice as high as at the last halving. Only in this case, the meaning of its mining remains in an era when a dozen new coins appear every day. And this, from our point of view, is the main long-term problem of bitcoin.

Bitcoin currently costs $ 40,000, but such a high price was provided by the Fed and other central banks, which inflated the money supply for two years, and now for several years they will blow it back like a balloon. Before the crisis in 2020, the average cost of bitcoin was 6-12 thousand dollars per coin. And in 2020, halving occurred. That is, in theory, what matters now is how much bitcoin will cost before the next halving in 2024, since by that time it will become clear what the Fed's rates will be, what inflation will be, and what the Fed's balance will remain. In the next two years, bitcoin will undergo some kind of strength test. If its growth was based on monetary injections from the Fed alone, then it will be blown back to 6-12 thousand dollars per coin. And then at the halving of 2024, the miners' incomes will simply fall by half. And if the same time bitcoin does not start to get more expensive, then over time even more people will refuse to mine it. If bitcoin stays at least above $ 30,000 in the next two years, it will still have to rise in price at the halving of 2024, since inflation will eat up most of the value of this $ 30,000 by then.

In the 24-hour timeframe, the quotes of the "bitcoin" dropped to the lower limits of the Ichimoku cloud and the ascending channel. A rebound with an upward reversal may occur from these lines, after which the cryptocurrency may begin another round of growth. If this signal is generated, it can be used for purchases with goals of $ 45,256 and $ 49,066. Sales should be considered when anchoring below the ascending channel with targets of $ 34,267 and $ 31,100.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română