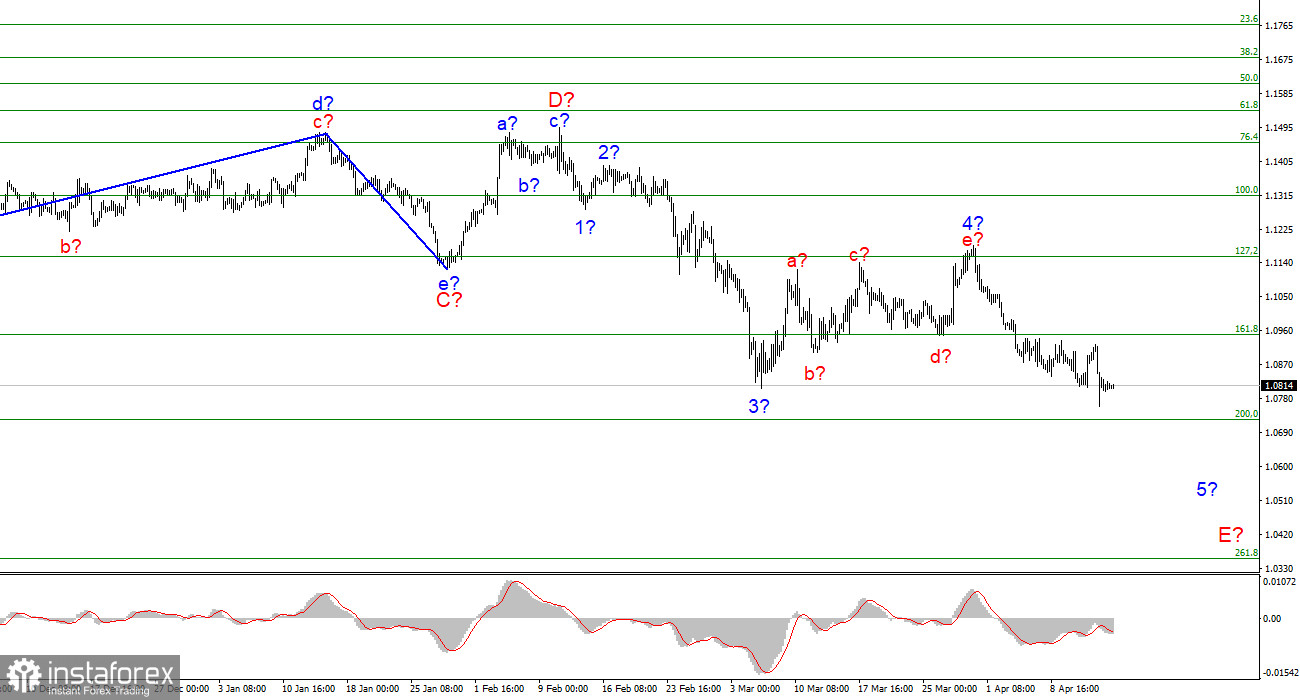

The wave marking of the 4-hour chart for the euro/dollar instrument continues to look convincing. The proposed wave 4 has taken a five-wave, corrective form and has already been completed. The instrument continues the construction of the assumed wave 5-E. If this is true, then the decline in the quotes of the euro currency may continue for several more weeks, since the wave may turn out to be a very long, five-wave in its internal structure. If it turns out to be shortened, then the quotes of the instrument have barely fallen under the low of wave 3-E, that is, wave E cannot yet be considered completed in any case. Thus, the instrument still has a fairly strong potential for decline. The first target is around 1.0721, which equates to 200.0% Fibonacci. An unsuccessful attempt to break through this mark may lead to a departure of quotes from the achieved low and the construction of an internal corrective wave consisting of 5-E. At the same time, much of the instrument in the coming months will depend not only on the economy, but also on geopolitics, gas and oil prices, and the expansion of the zone of military conflict on the territory of other countries.

Demand for the euro currency fell again after Lagarde's speech.

The euro/dollar instrument fell by 20 basis points on Friday, but the overall move down from the peaks reached is 110 points. Thus, over the past day and a half, the demand for the euro currency has decreased very much. It was very low before, as the downward section of the trend has been under construction for more than a year. On Thursday, immediately after the ECB meeting, President Christine Lagarde gave a speech. It took some time for her full speech to become available on the Internet. And now it is possible to say that the "dovish" rhetoric has not gone anywhere from Lagarde's mouth. The FOMC chairwoman said that the rate hike may begin very soon, much later than the completion of the APP program (and its completion is still planned for the third quarter of this year). She noted that the military conflict in Ukraine has created and continues to create additional risks for the European economy, in particular the risks of accelerating inflation. Because of this, the ECB wants to maintain maximum room for maneuver in the issue of monetary policy. In other words, the deadlines for tightening the policy may be shifted to much later date.

At the moment, Europe is at an extreme disadvantage due to the conflict between Russia and Ukraine, as these countries are major suppliers of raw materials and food products to EU countries. Due to sanctions against the Russian Federation and military actions on the territory of Ukraine, the volume of imports from these countries will seriously decrease, which will cause a shortage and an additional increase in prices. At the current time, the European Union should urgently reorient its economy to other exporting countries of necessary goods and raw materials. The gas and oil embargo against Russia will probably still be imposed, so in any case, we will have to look for other hydrocarbon markets. Military operations on the territory of Ukraine will not end soon, therefore, it is necessary to count on the food base from this country in 2022-2023. But the sowing campaign in Ukraine has started, so certain supplies will still be to the EU countries.

General conclusions.

Based on the analysis, I still conclude that the construction of wave 5-E. If so, now is still a good time to sell the European currency with targets located around the 1.0721 mark, which corresponds to 200.0% Fibonacci, for each MACD signal "down". In the next few days, an internal correction wave of 5-E may be built, after which I expect a new decline in the instrument.

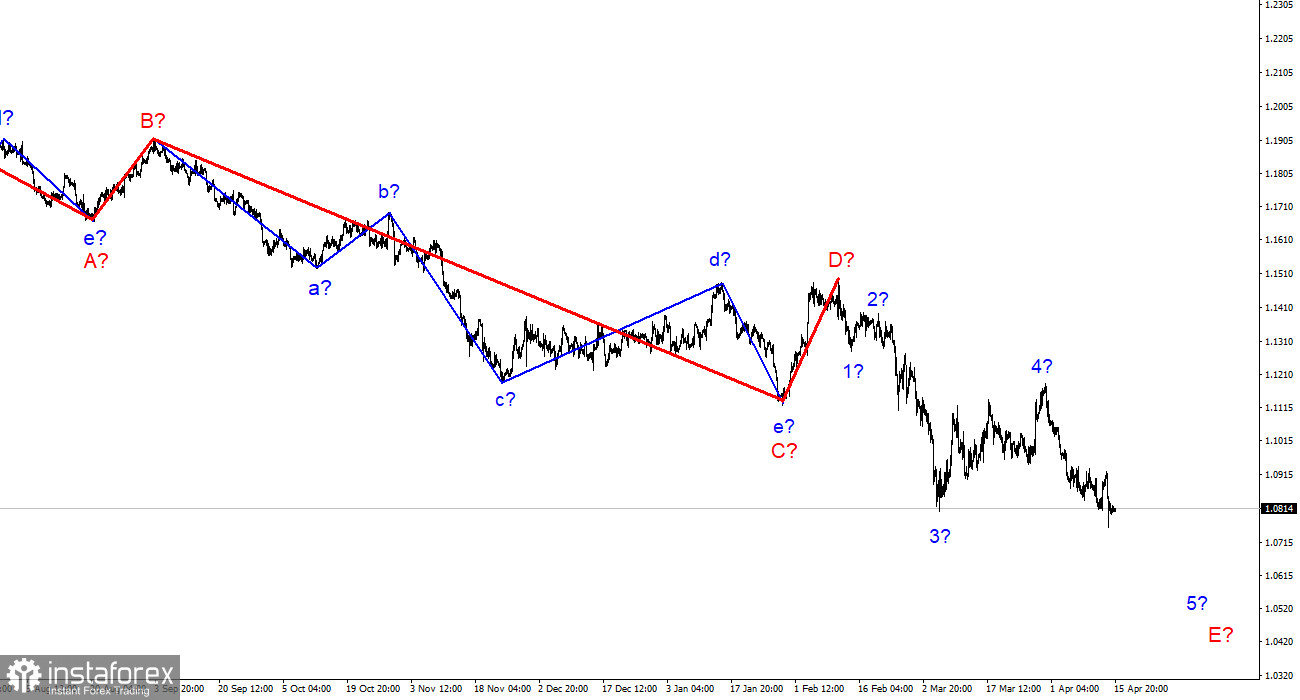

On a larger scale, it can be seen that the construction of the proposed wave D has been completed, and the instrument has updated its low. Thus, the fifth wave of a non-pulse downward trend section is being built, which may turn out to be as long as wave C. If this assumption is correct, then the European currency will still decline.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română