Geopolitics has become a fundamental backdrop, backed by minor factors that directly affect the cryptocurrency market. On April 15, it is evident that the macroeconomic situation has changed due to the hostilities in Ukraine, the Fed's monetary policy tightening and Western sanctions. All current or future global events are a direct or indirect consequence of building a new world order.

In this case, there are several options for the development of events. Currently, the outlook for the cryptocurrency market is almost the same as for the stock market. Bank of America experts released another report which stated that the US economy would face a recession by the end of 2022. The war in Ukraine had a profound impact on this issue. Therefore, the Fed officials face challenges fighting inflation. Ironically, the dollar has suffered from inflation as well as the actions of the US government. Investors do not consider the USD for long-term investments due to the Russian asset freeze.

Despite this fact, Bank of America experts believe that the Fed will continue its policy of quantitative easing. Experts believe that the SPX will fall by 11% by the end of 2022. Moreover, a bear market will become dominant. According to bank experts, the decline of the funds will have a negative impact on Bitcoin and the cryptocurrency market. Forecasters expect BTC to fall to $30,000. It will resume the uptrend afterwards.

It is significant that bank experts analyze the situation based on the current state of Bitcoin. In mid-April, Bitcoin increased its correlation between the SPX and the stock market. However, it is likely that the main cryptocurrency will not face the same challenge as SPX. Investors' sentiment and their strategies regarding BTC are of key importance. With the tightening of monetary policy, investors mainly focus on searching for affordable and safe financial instruments to preserve capital. Bitcoin is considered such an instrument as its exchange balances continue to decline.

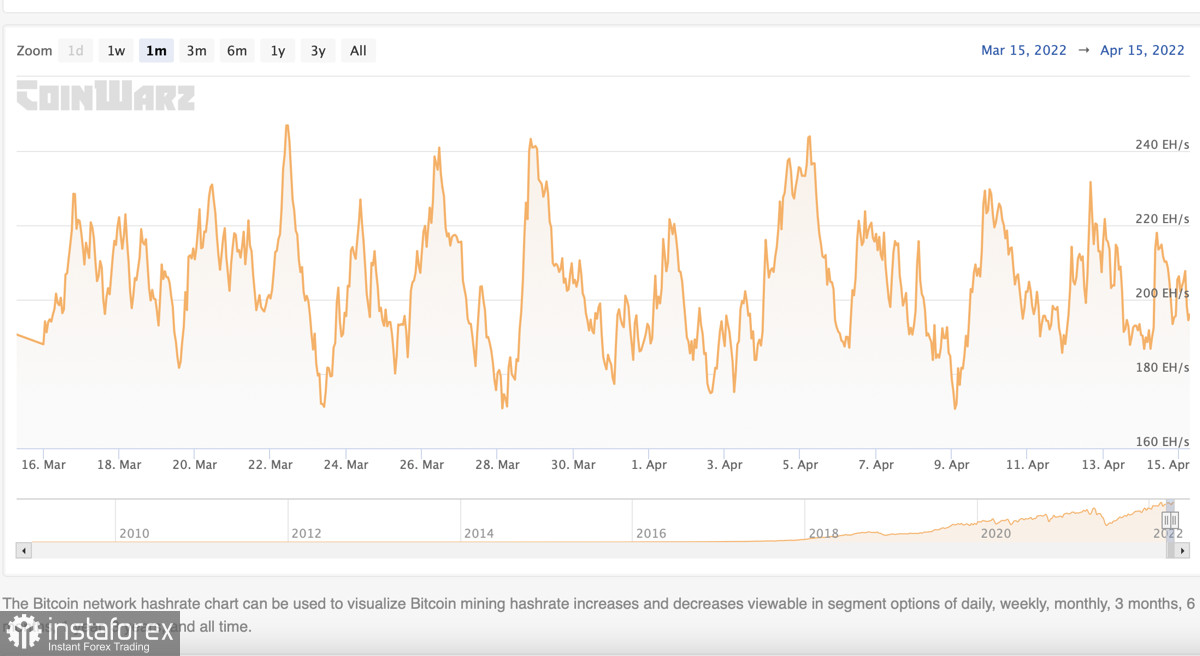

However, the key point is passive storage of BTC. In this case, other mechanisms are applied. Moreover, the cryptocurrency is likely to become a key part of investment flows. As mining of BTC coins becomes more complex and the hash rate grows, the demand for the asset will increase. Apart from it, about 90% of all Bitcoin assets have been mined. Ultimately, this fact could trigger the shortage of BTC and significantly increase its value. However, to implement this scenario, it is essential to end the ongoing process of redistribution of capital. Therefore, the stock market will be hit the hardest as its investments are more numerous than BTC.

Consequently, the market players will complete the process of distribution and preserving capital. Another crucial issue will be to maximize it. In this case, cryptocurrency will become one of the key criteria of high returns at low risk by implementing medium- and long-term strategies.

However, during this period Bitcoin may lose its upward potential and sink profoundly into the downward fluctuation channel. The BTC/USD pair is trying to hold the $40,000 mark. However, technical indicators point to continued price decline. The MACD is moving in the red zone and the RSI and the stochastic oscillator are moving sideways. This is not typical of indicators in case of a full recovery or strong buying activity. Taking this aspect into account, BTC is likely to avoid a decline to $30,000 in the long term. However, Bitcoin could renew its local bottom until it is recognized as a profitable and safe haven asset.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română