Analysis of EUR/USD and trading tips

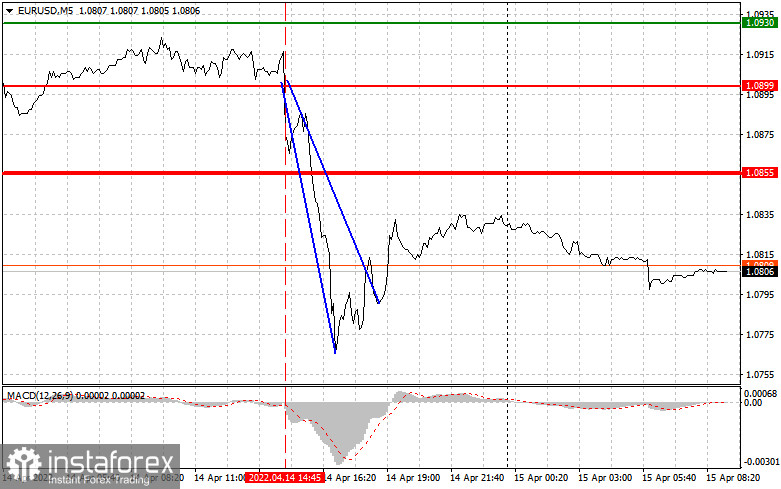

Yesterday, the euro/dollar pair tested 1.0899 only once. As a result, traders received only one sell signal. When the pair touched the level, the MACD indicator just started moving downwards from the zero level. This proved the sell signal once again. As a result, the pair slumped by more than 100 pips. There were no other points to enter the market.

Yesterday, the market situation highly depended on the ECB's behavior and Christine Lagarde's comments. The ECB president announced the measures taken to taper the QE program and the regulator's plans for the interest rate hike. However, the ECB president did not say anything new. That is why the euro did not have enough momentum to jump. In the second part of the day, the US disclosed quite strong reports, including retail sales and consumer price index. The data only supported the idea that the Fed would remain stuck to its hawkish approach to stabilize inflation.

Early today, traders should pay attention to France's and Italy's consumer price index figures. Both indicators are likely to meet forecasts. That is why the euro will hardly jump. The second part of the day is expected to be more interesting. The US is going to publish a bulk of information.

Thus, the country will disclose data on Empire State manufacturing index, industrial production, manufacturing production, and capacity utilization rate. If the indicators increase, traders should bet on the US dollar appreciation and the euro's drop to new yearly lows. The current geopolitical situation and the ongoing conflict in Ukraine are just intensifying pressure on risk assets.

Signals to buy EUR

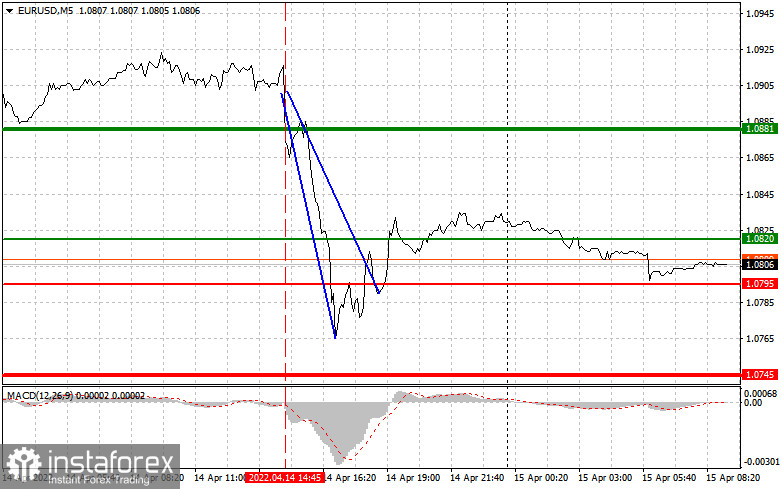

Scenario 1: today, traders can buy the euro if it hits 1.0820 (a green line on the chart) with the target at 1.0881. At this point, it is recommended to leave the market and sell the euro, expecting a change of 20-25 pips. The euro will jump if the eurozone inflation reports exceed forecasts. In the second part of the day, we should take into account the US statistical data that may boost the greenback. Before buying the asset, make sure that the MACD indicator is above the zero level and is just starting to rise from it.

Scenario 2: today, it is also possible to buy the euro if the price touches 1.0795. At this moment, the MACD indicator should be in the oversold area, thus capping the downward momentum and causing the price reversal. The euro may climb to 1.0820 and 1.0881.

Signals to sell EUR:

Scenario 1: once the euro reaches 1.0795 (a red line), traders may go short. The target is located at 1.0855, where it is recommended to leave the market and open buy positions, expecting a change of 20-25 pips. The euro may find itself under pressure at any moment as traders interest in risk assets began falling at the end of the week. It is highly likely that traders will start selling off the euro. Importantly, before opening sell orders, make sure that the MACD indicator is below the zero line and is starting to move from it.

Scenario 2: it is also possible to open short positions on the euro if the price touches 1.0820. At that moment, the MACD indicator should be in the overbought area, thus capping the upward potential and causing the price reversal. The pair may decline to 1.0795 and 1.0745.

What we see on the trading charts:

A thin green line is the entry price at which you can buy a trading instrument.

A thick green line is the estimated price where you can place a take-profit order or lock in profits by yourself, since the price will hardly go above this level.

A thin red line is the entry price at which you can sell the trading instrument.

A thick red line is the estimated price where you can place a take-profit order or lock in profits by yourself, since the price is unlikely to decline further.

The MACD indicator. When entering the market, it is important to take into account overbought and oversold zones.

Beginning traders should be very cautious when making decisions to enter the market. It is better to open positions ahead of the publication of important reports in order to avoid price fluctuations. If you decide to enter the market amid the news release, place stop orders to minimize losses. Otherwise, you may lose all your funds, especially if you do not use money management and trade big volumes.

Please remember that successful trading requires an accurate trading plan similar to the one described above. Knee-jerk decisions made amid the current market situation is a losing strategy of an intraday trader.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română