Yesterday morning there were rumors that the European Central Bank may announce the acceleration of the rate of curtailment of the quantitative easing program, which gave the single European currency an additional dose of optimism. But after the meeting's results were announced, it just vanished like dust. The ECB not only left everything as it is, but also did not give any specifics about what will happen next. Back in December last year, the central bank decided that in April the volume of asset buybacks would amount to 40 billion euros, in May 30 billion euros, and in June 20 billion euros. What will happen in July is not specified. Yesterday, ECB President Christine Lagarde said that the parameters of the quantitative easing program in the third quarter will be adjusted based on the prevailing conditions. In other words, the central bank itself has no idea whether the program will work or not. It is clear that in such a situation there is no need to talk about interest rates. They will continue to remain at current levels. So it is not surprising that the market immediately turned around and the dollar began to rapidly strengthen its position. So the upward trend in the dollar, which began in late spring, early summer last year, continues. And apparently, this trend will continue for a very, very long time.

Today, the market will be uniformly stagnant, as it is a holiday in Europe and America on the occasion of the celebration of Good Friday. Markets are basically closed. The dollar will continue to grow by next week.

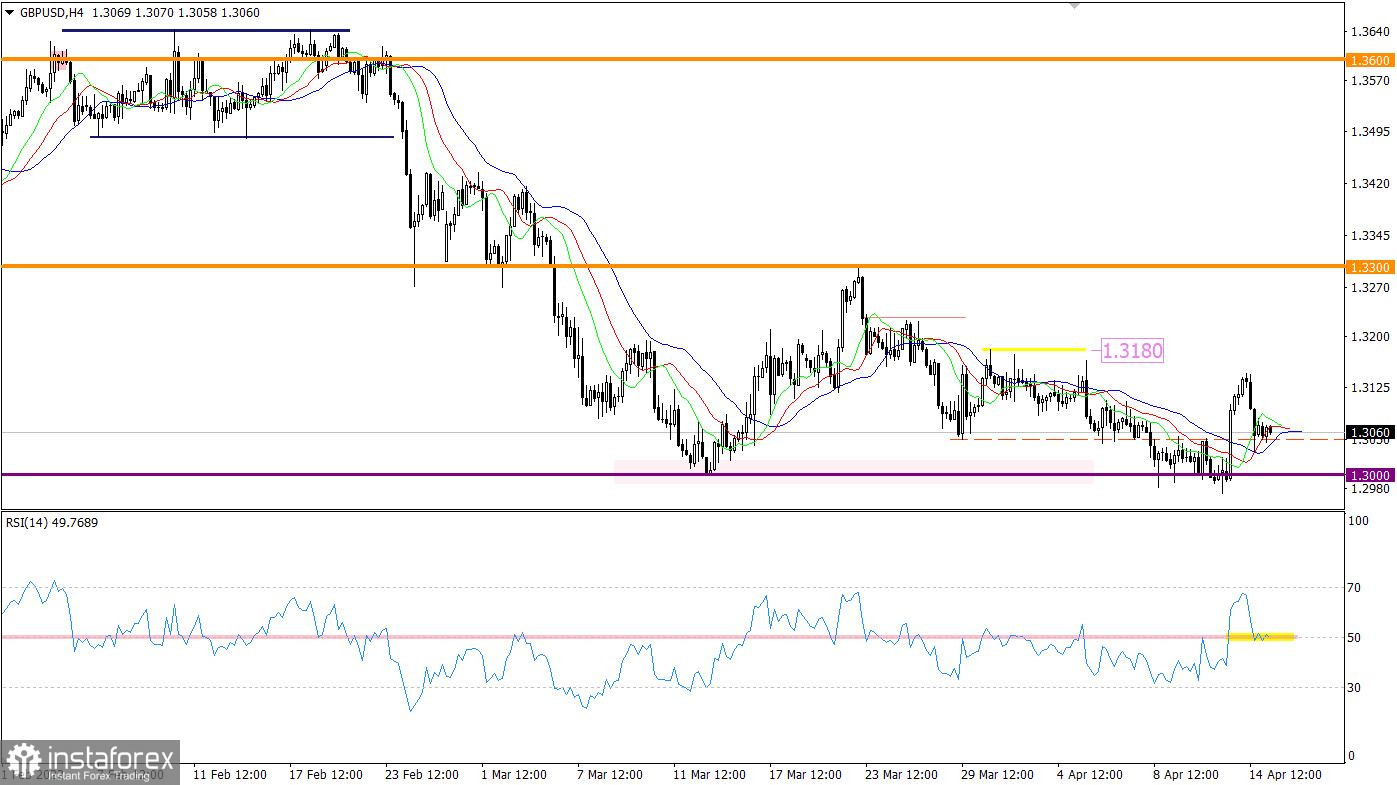

Following the euro, the GBPUSD pair rushed down, confirming the fact of a positive correlation on the market. This speculative cycle returned the quote to the area of the upper boundary of the psychological level 1.3000, the deviation is 1.3050. There was a reduction in the volume of short positions in the region of this value and, as a result, stagnation-rollback.

The technical instrument RSI in the four-hour period returned to the limit of the 50 line. This suggests that the ascending cycle was not stable the day before and the trading interest may change.

The Alligator H4 indicator again has a crossover between the MA moving lines, which may be the beginning of a change in direction. Alligator D1 is ignoring recent price changes, the MA line indicates a downward trend.

Expectations and prospects:

Downward potential remains in the market despite all the price changes during the outgoing week. It can be assumed that today the market will be stagnant due to reduced trading volumes. With the onset of a new trading week, another attempt to break through the psychological level of 1.3000 is being considered.

Comprehensive indicator analysis gives a sell signal in the short, intraday and medium term due to the downward cycle.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română