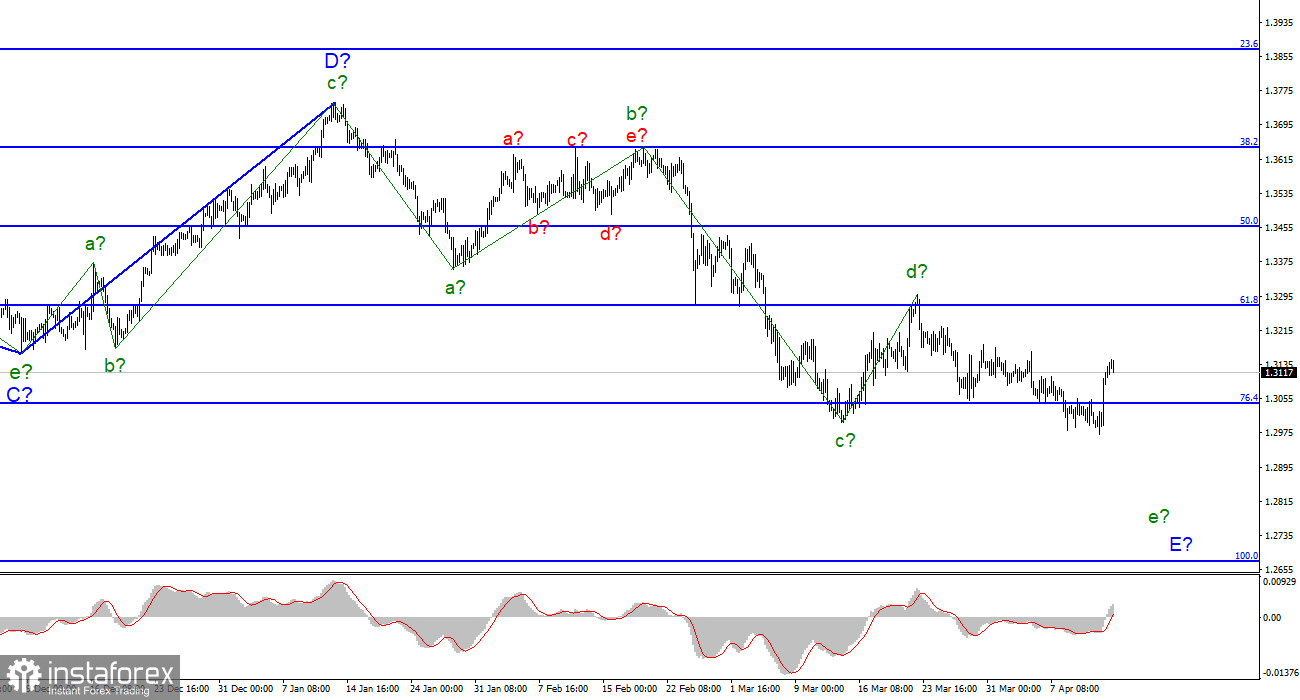

For the pound/dollar instrument, the wave markup continues to look very convincing, even taking into account yesterday's growth. The expected wave d-E is completed, and there should be five waves in total inside wave E, respectively, as in the case of the euro/dollar instrument, the downward trend section can continue its construction for some time within the framework of wave e-E. A successful attempt to break through the 76.4% Fibonacci level did not allow the market to continue selling the instrument due to the low wave c-E. Near this mark, the instrument turned sharply upwards and began a powerful increase. Thus, the wave e-E may be extended, or it may be shortened. Since the low of the supposed wave c-E is still broken, the wave e-E can end at any moment. However, I still expect that the decline in the British dollar within this wave will be much stronger, given the current situation in Ukraine and the economic background in the UK, USA, and Europe. In general, the wave pattern still looks very organic. I am not considering alternative options yet.

The British rose 170 points for no reason.

The exchange rate of the pound/dollar instrument increased by 120 basis points on April 13, although I wrote in yesterday's article that it decreased by 10 points. For the remaining 6-7 hours of the day, the Briton managed to grow in price by just 120 points and continued to grow tonight, which totaled about 170 points. In the article on the euro/dollar, I already wondered what could have caused such a strong decline in the US currency throughout the market? There is no unambiguous answer to this question, only hypotheses, and assumptions. I suggest considering this growth as an internal corrective wave and not looking for explanations for its construction. It has already been built anyway, and hardly anyone has had time to predict it. How to make money on it. Thus, we have the following picture: in the first three days of the week, when there were a large number of economic statistics in the US and the UK, the instrument continued to decline rather sluggishly, often without showing any interest in reports (among which there were two resonant inflation reports). But on Wednesday evening, when there were no reports, and in the case of the British, there were even no impending events, the US currency suddenly sharply declines. From my point of view, there was profit-taking on sales by large players or something similar. Something that could not have been foreseen. Consequently, in the near future, the construction of a downward trend section and a downward wave may resume.

The news background has not changed anything for the British and American this week. There was few geopolitical news, but they all have potentially very dangerous consequences. The most important news of recent days is the possible accession of Finland and Sweden to NATO this summer. Entry, despite warnings from Moscow about "Russia's forced reaction to these steps." Thus, another military conflict may begin in Europe in the coming months. Of course, in this case, the European economy will suffer even more than it has already suffered due to the conflict in Ukraine. And the UK economy, despite Brexit, has not far escaped from the European one. The pound and the euro remain in danger.

General conclusions.

The wave pattern of the pound/dollar instrument still assumes the construction of wave E. I continue to advise selling the instrument with targets located near the 1.2676 mark, which corresponds to 100.0% Fibonacci, according to the MACD signals "down", since the wave e-E does not look complete yet.

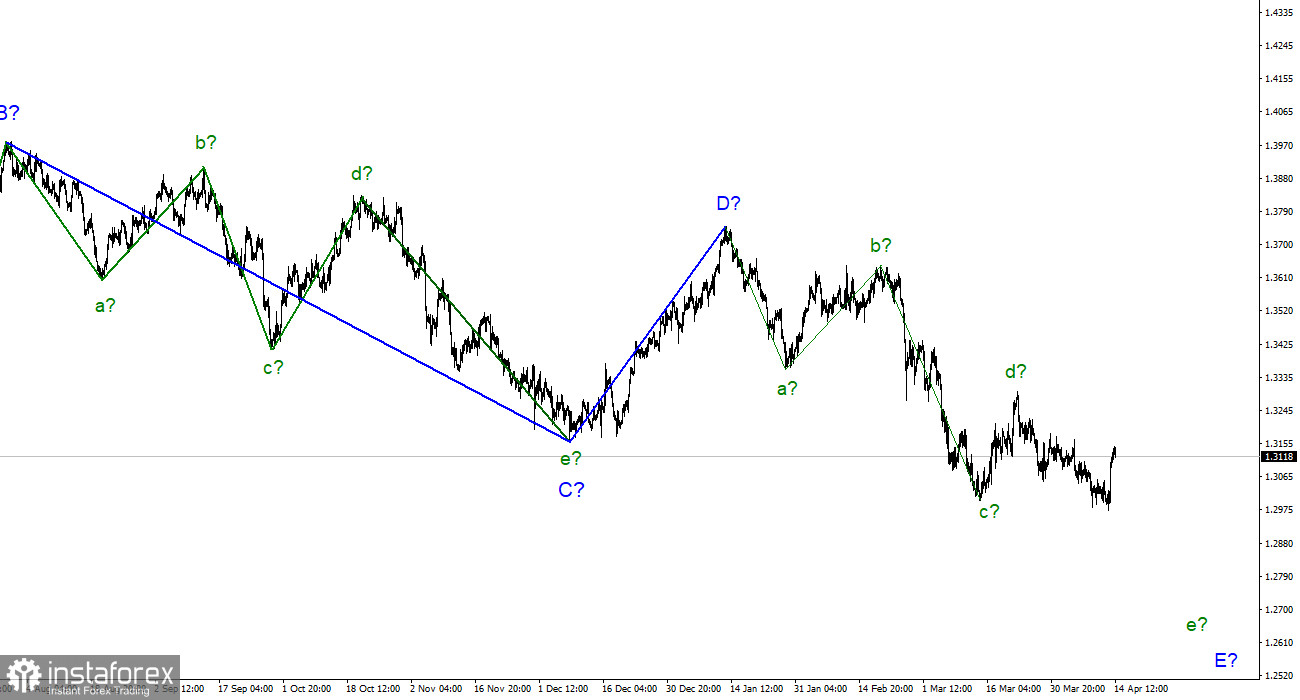

At the higher scale, wave D looks complete, but the entire downward section of the trend does not. Therefore, in the coming weeks, I expect the decline of the instrument to continue with targets well below the low of wave C. Wave E should take a five-wave form, so I expect to see the British quotes around the 27th figure.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română