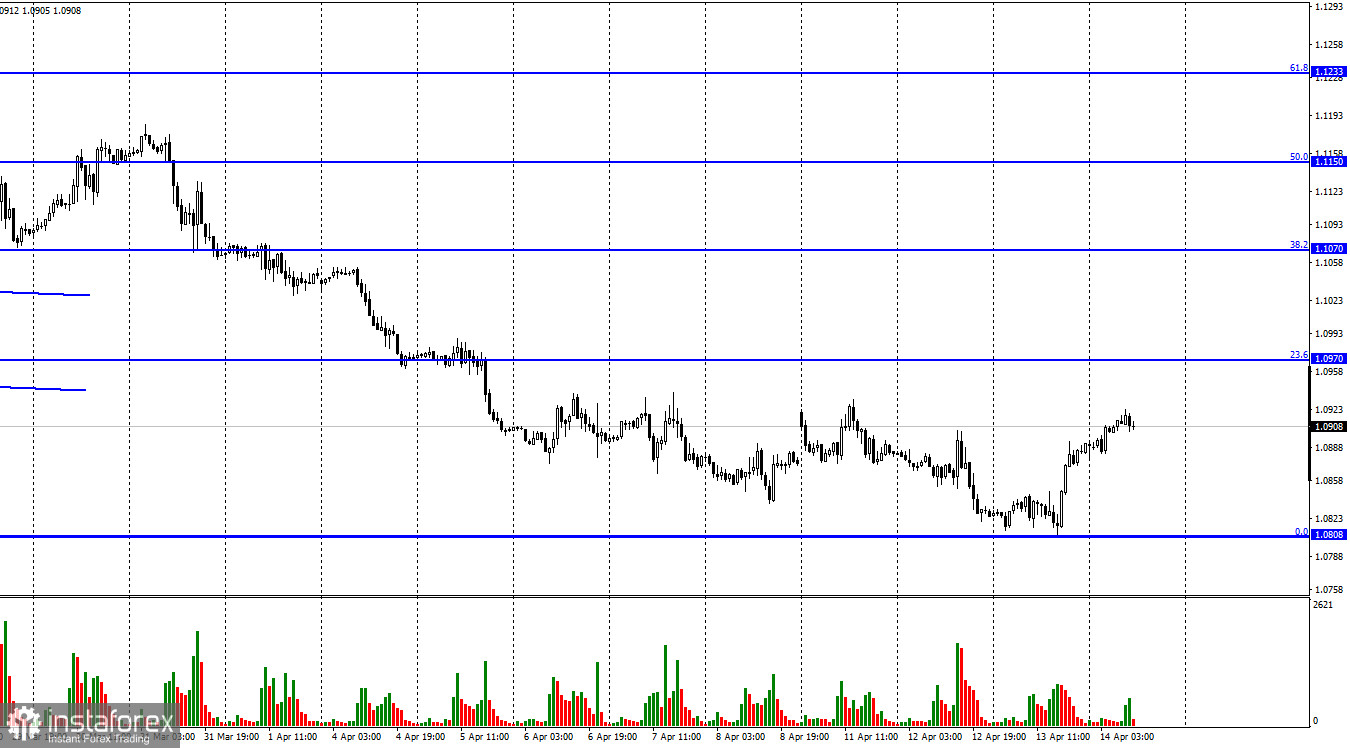

The EUR/USD pair on Wednesday performed a fall to the corrective level of 0.0% (1.0808), rebounding from it, and a reversal in favor of the European currency. The process of growth in the direction of the Fibo level of 23.6% (1.0970) has begun. However, at the moment, the entire growth of the European currency is about 110 points, which is even less than the last section of the fall. In my opinion, there is still no reason to say that the long-awaited upward trend will begin now. The results of the ECB meeting will be summed up today, and this is always dangerous for the European currency. Especially in the last few years, when the deposit rate has been reduced to -0.5%. This means that when placing a deposit in a bank, you pay 0.5% to the bank. Such unprecedented conditions in monetary policy are "dovish" or "soft". And the milder the conditions, the weaker the central bank's currency. And if in the USA or the UK in the last few months they have tuned in to tighten the PEPP, then in the European Union this is out of the question.

On the contrary, we are talking about the fact that the soft policy will continue for a long time. Christine Lagarde regularly reports on the weakness of the European economy, notes high risks for it, but dismisses the threat of stagflation. Traders do not believe her too much on the issue of stagflation, which puts even more pressure on the euro currency. Inflation is growing and is approaching the US rate of growth already. But if the US rate has already started to increase, and by the end of the year it may rise to 2.5%, then if the ECB raises the rate once in 2022, it will be very good and a "surprise". The best that there is reason to hope for so far is the completion of all incentive programs (QE, APP, PEPP) in Europe. However, this is only a rejection of incentives, but not a tightening of PEPP. These measures cannot even theoretically lead to a reduction in inflation. GDP growth rates also do not allow raising the rate, otherwise, the economy will slide into recession. In general, let's see what ECB President Lagarde will say today. Her performance is the most interesting event of the day.

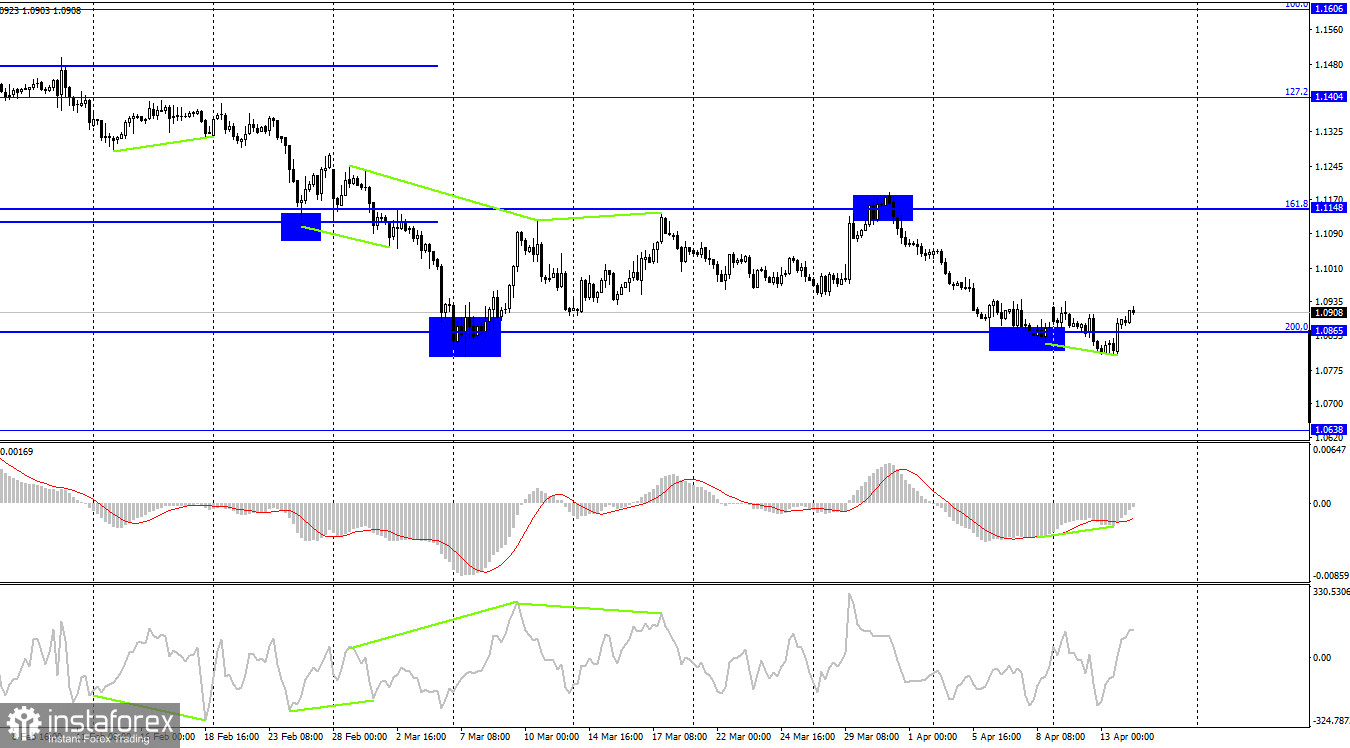

On the 4-hour chart, the pair performed a consolidation under the corrective level of 200.0% (1.0865), but after the formation of a bullish divergence at the MACD indicator, it performed a reversal in favor of the euro and closed above 1.0865. Thus, the growth process can be continued in the direction of the corrective level of 161.8% (1.1148). But I don't believe in the further growth of the EU currency yet.

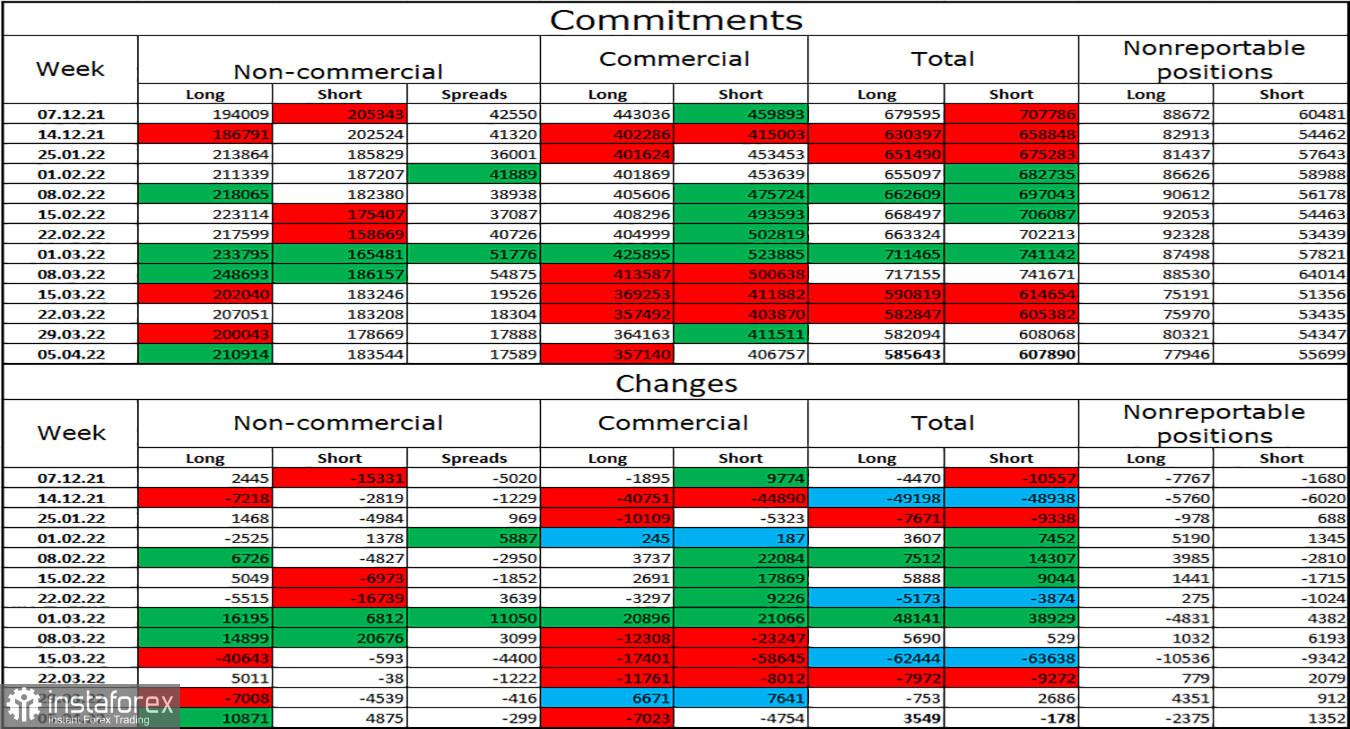

Commitments of Traders (COT) Report:

Last reporting week, speculators opened 10,871 long contracts and 4,875 short contracts. This means that the bullish mood of the major players has intensified. The total number of long contracts concentrated on their hands now amounts to 211 thousand, and short contracts - 183 thousand. Thus, in general, the mood of the "Non-commercial" category of traders is characterized as "bullish". In this scenario, the European currency should show growth. But it should have been showing it for several weeks, and instead, it continues to either fall or is just very low. Thus, it is impossible to draw adequate conclusions from the COT reports now. A very strong influence on the mood of traders from geopolitics and the status of the dollar as the "world reserve currency".

News calendar for the USA and the European Union:

EU - publication of the ECB decision on the main interest rate (11:45 UTC).

EU - monetary policy report (11:45 UTC).

EU - ECB press conference (11:45 UTC).

US - change in retail trade volume (12:30 UTC).

US - number of initial and repeated applications for unemployment benefits (12:30 UTC).

US - consumer sentiment index from the University of Michigan (14:00 UTC).

On April 14, the calendars of economic events in the United States and the European Union contain many interesting entries. I think that the greatest attention should be paid to Christine Lagarde's speech at the press conference and the retail trade report. Thus, today the information background can affect the mood of traders.

EUR/USD forecast and recommendations to traders:

I recommend selling the pair if there is a rebound from 1.0970 on the hourly chart with a target of 1.0808. I recommended buying the pair if there is a rebound from the 1.0808 level on the hourly chart with a target of 1.0970. These deals can be kept open, but they can already be closed in profit since I am not sure that the growth of the euro will continue today.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română