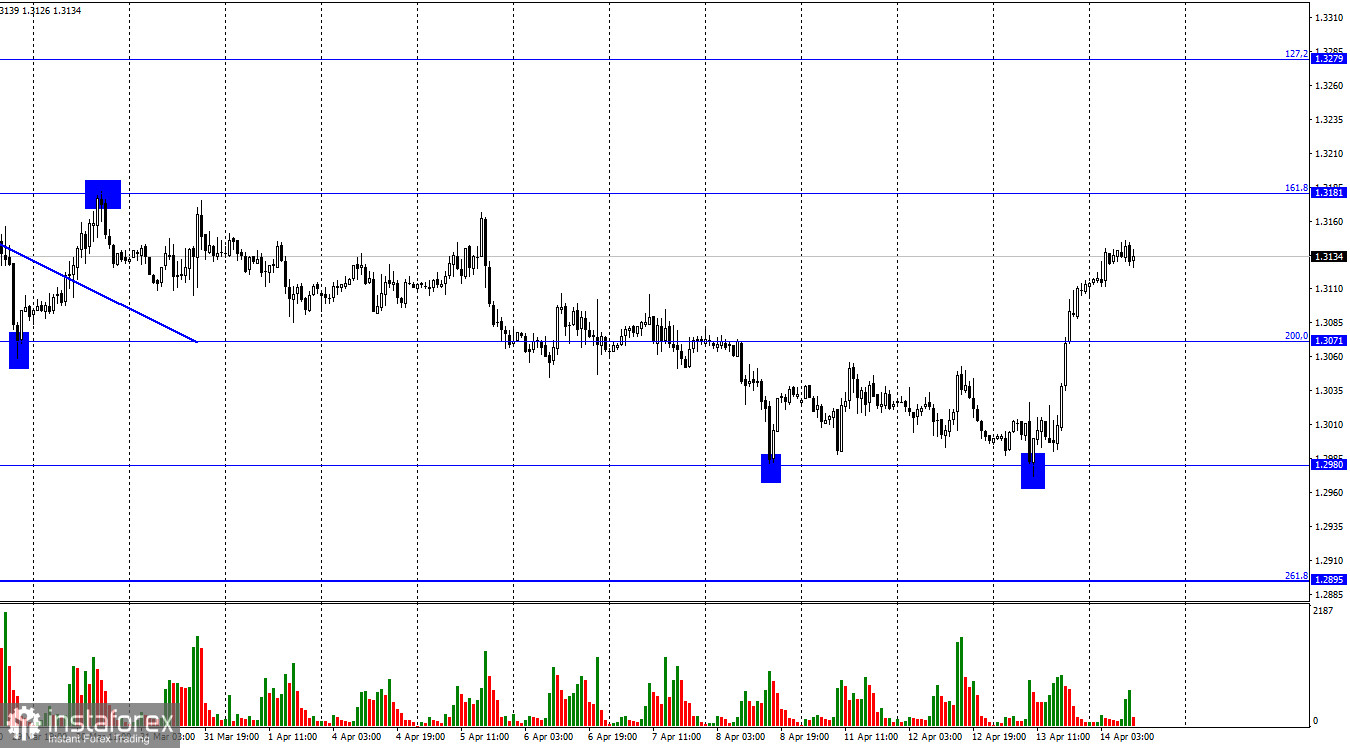

According to the hourly chart, the GBP/USD pair on Wednesday performed a fall to the corrective level of 1.2980, a rebound from this level and a reversal in favor of the British with an increase of 150 points. It is quite difficult for me to say what caused such a strong growth of the British dollar, which began later than the publication of all the reports yesterday. Perhaps the traders lost their nerves. Perhaps the information that caused such a strong growth was not received in the media. One way or another, the British can continue the growth process towards the next corrective level of 161.8% (1.3181). At the moment, it could not even reach his previous maximum. That is, even 150 points of growth is less than the last section of the pair's fall. I think that the British and European have already shown the maximum of their growth yesterday and can restore the main movement in the coming days. If the European may have grounds for new growth today (if Lagarde unexpectedly strengthens the "hawkish" rhetoric), then the pound is unlikely to have such grounds today.

Interesting events are not expected in the UK today, and yesterday's inflation report caused a rather strange reaction among traders. The reaction was very weak to a very strong report, according to which inflation has already risen to 7% y/y, which may force the Central Bank of England to raise the rate again at the next meeting. It is possible that it was because of such a conclusion that the British pound rose in price yesterday. But why did the euro grow then? No one expects the ECB to tighten the PEPP now. Thus, I tend not to try to find an explanation where there is none or it is not obvious. The pound and the euro rose, but the graphical picture of both pairs has not changed. I believe that if a new fall starts in the coming days, then next week both pairs will be able to return to their April lows. Well, the third fall to them will significantly increase the probability of fixing quotes under them.

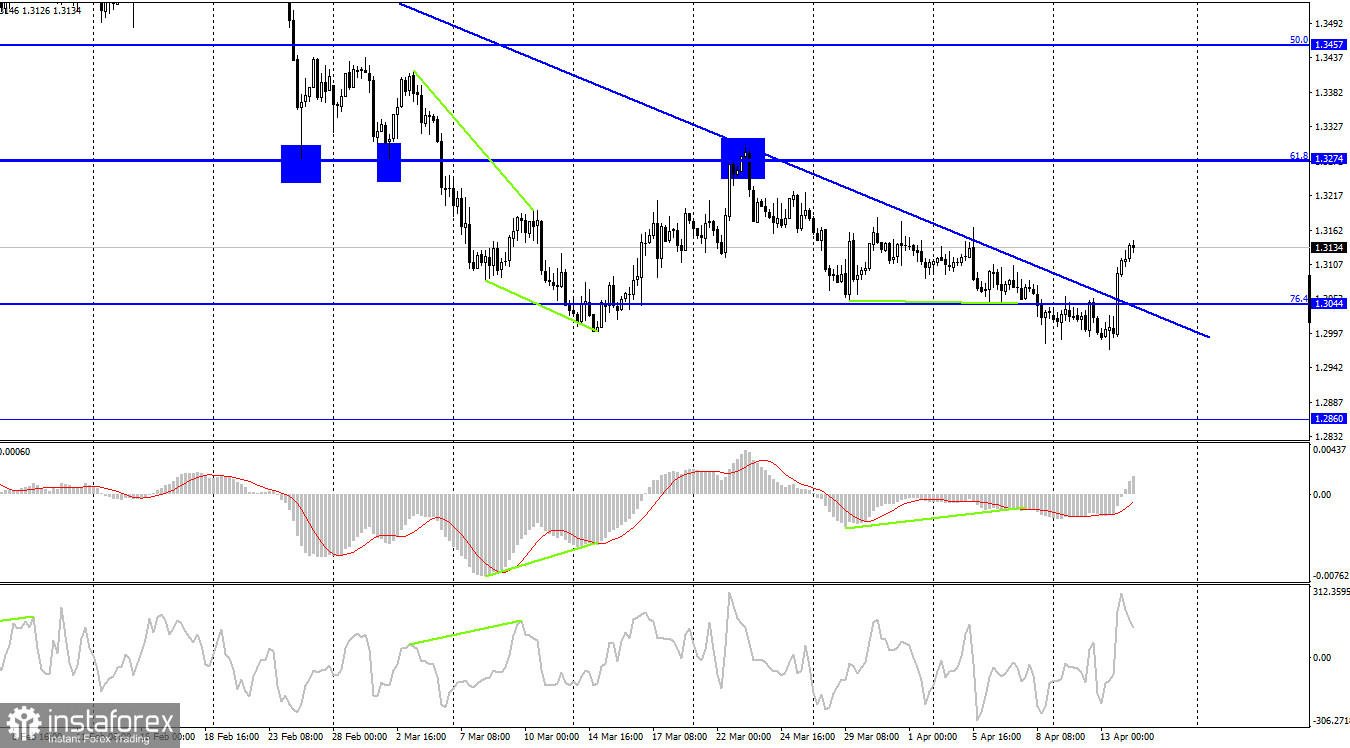

On the 4-hour chart, the pair performed a reversal in favor of the UK currency and anchored above the descending trend line. Thus, the mood of traders has changed to "bullish", and the growth process can be continued towards the next corrective level of 61.8% (1.3274). The CCI indicator has a bearish divergence brewing, which can send the pair back down. Despite the closure above the trend line, I don't believe in the further growth of the British dollar yet.

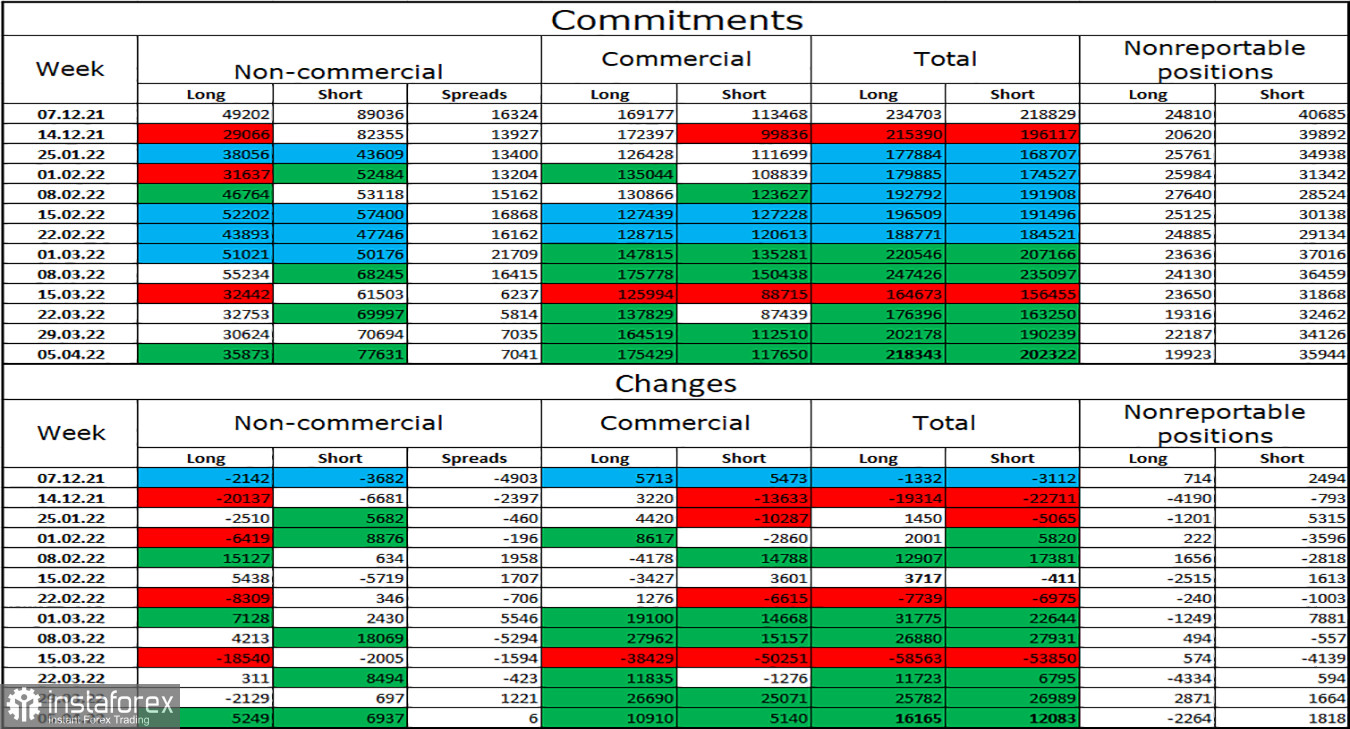

Commitments of Traders (COT) Report:

The mood of the "Non-commercial" category of traders has not changed much over the last reporting week. The number of long contracts in the hands of speculators increased by 5,249, and the number of short - by 6,937. Thus, the general mood of the major players has become even more "bearish". The ratio between the number of long and short contracts for speculators corresponds to the real state of things on the market - longs are 2 times more than shorts. The British dollar is falling, and major players are more likely to sell the pound than buy it. Thus, I expect the pound to continue its decline. This forecast is based on geopolitics, based on COT reports, and based on graphical analysis.

News calendar for the USA and the UK:

US - change in retail trade volume (12:30 UTC).

US - number of initial and repeated applications for unemployment benefits (12:30 UTC).

US - consumer sentiment index from the University of Michigan (14:00 UTC).

On Thursday, the calendar of economic events in the UK is empty. Several reports will be released in America, among which I can single out a report on retail trade. It is he who has the greatest number of chances to influence the mood of traders.

GBP/USD forecast and recommendations to traders:

I recommend selling the British today with the goals of 1.3071 and 1.2980 if the rebound from the level of 1.3181 is performed on the hourly chart. I recommended buying the British when closing above the trend line on the 4-hour chart with targets of 1.3181 and 1.3274. Now, these deals can be kept open, but carefully.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română