Today is quite an important day for the European currency. Yes, it is unlikely that the European Central Bank will raise interest rates and make policy changes, but the signals about how the central bank will act further and what its views are on everything that happens, and there are quite a lot of events that require its intervention - the euro's succeeding direction depends on it.

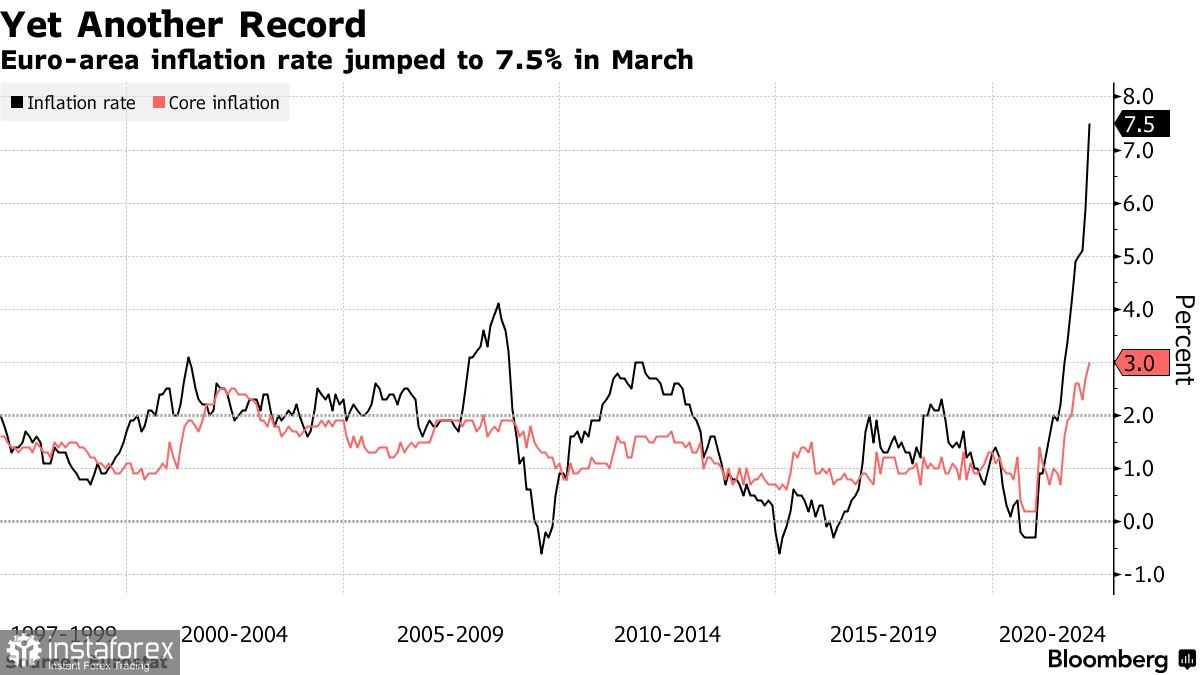

A weak euro, of course, allows the eurozone to feel more confident in the current economic turmoil, especially when it comes to exports and imports of goods, but the central bank's ultra-soft policy, together with high inflation that has climbed beyond 7.0% in the eurozone, could hit the economy where more harm. The ECB is expected today to announce its intention to continue a more active cessation of stimulus measures to support the economy, as it prioritizes curbing inflation, rather than growing risks to the economy, primarily related to events taking place on the territory of Ukraine.

It is expected that the board of governors will refrain from important decisions at this meeting, and most likely the focus will be on the June meeting, at which new economic forecasts should shed light on the consequences of the Russian special operation on the territory of Ukraine — this will more accurately determine the next steps in relation to monetary policy.

Let me remind you that starting from March of this year, ECB officials unexpectedly changed their attitude to the policy, announcing a faster rejection of the purchase of assets worth trillions of euros. The reason for this was high inflation, which jumped to 7.5% — this is almost four times the target level of the ECB. According to chief economist Philip Lane, the inflation peak can be recorded only in the summer in the middle of this year, which means that 7.5% is far from the limit.

More recently, ECB President Christine Lagarde said that the central bank is well aware of the significant risks to the economic growth of the eurozone. High energy prices, rising food prices and emerging problems in supply chains will certainly lead to a larger increase in inflation, which will require the central bank to take more active actions regarding monetary policy. "The best way to deal with uncertainty now is to follow the principles of gradualism and flexibility," Lagarde said in her recent speech. But given that business and consumer confidence is already falling, and energy problems in the EU are just beginning, especially given the rejection of Russian energy resources – all this will lead to further price pressure, as well as provoke a recession in the eurozone countries, and, in particular, in Germany, where import dependence is high.

Concerns about possible stagflation in the eurozone are being dismissed by European politicians for the time being. Despite disagreements over how quickly policy needs to be normalized, there is a general opinion among ECB officials that the bond purchase program needs to be completely curtailed in the shortest possible time.

It is very important that Lagarde informs us today. The press conference will begin a little later, after the release of the decision on interest rates. As I noted above, last month Lagarde made it clear that the Governing Council intends to stick to the course of monetary normalization, despite what is happening in Ukraine. Most likely, such statements will be made today, which will be a signal in the direction of purchases of risky assets. Officials may also announce that the bond-buying program will be completed by the third quarter of that year - at the same time many economists expect the first interest rate hikes from the ECB. Completing the asset purchase is key to determining when the deposit rate can be raised from -0.5%, where it has been since 2019. But, as policymakers continue to emphasize the importance of flexibility of approach, it is unlikely that a more specific timetable for policy changes will be officially established.

The situation is about the same in the US, but there the policy of the central bank is more understood. Most recently, data on inflation in the United States were published, which also reached a recent record level, which forces the Federal Reserve to act more aggressively. According to the US Department of Labor, the consumer price index rose to 8.5% compared to last year in March, after jumping to 7.9% in February. The widely used inflation indicator increased by 1.2% compared to the previous month, which was the largest increase since 2005. Half of the monthly growth was provided by gasoline costs, but it is expected that food prices also made a serious contribution to the indicator. Economists had forecast CPI growth to 8.4% per annum and 1.2% compared to February. And although many economists consider March to be the peak of the current inflationary period, however, the geopolitical situation forces us to adhere to a different opinion.

As for the technical picture of the EURUSD pair

The euro rose slightly before today's ECB meeting, but geopolitical tensions around Russia and Ukraine will continue to exert quite serious pressure on the pair. Given the appeal of the Fed's policy, it is best to bet on the further strengthening of the dollar, but a lot can change today after Lagarde's statements. To regain control of the market, euro bulls need a breakthrough above 1.0930, which will allow them to build a correction to the highs: 1.0970 and 1.1010. In case the trading instrument falls, bulls will be able to count on support around 1.0840, as it was at the end of last week. Its breakdown will quickly push the trading instrument to the lows: 1.0810 and 1.0770.

As for the technical picture of the GBPUSD pair

The pound's sharp growth returned the trading instrument to April highs. Now buyers of risky assets need to focus properly on the breakthrough and consolidation above the resistance of 1.3165. Going beyond this range will lead to the continuation of the bullish scenario and will provide an opportunity to update new local highs in the area of the 32nd figure and in the area of 1.3250. When the pressure on the trading instrument returns, bulls will most likely prefer to be more active around 1.3090, but their appearance is already possible in the 1.3115 area. A larger support is seen around 1.3060.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română