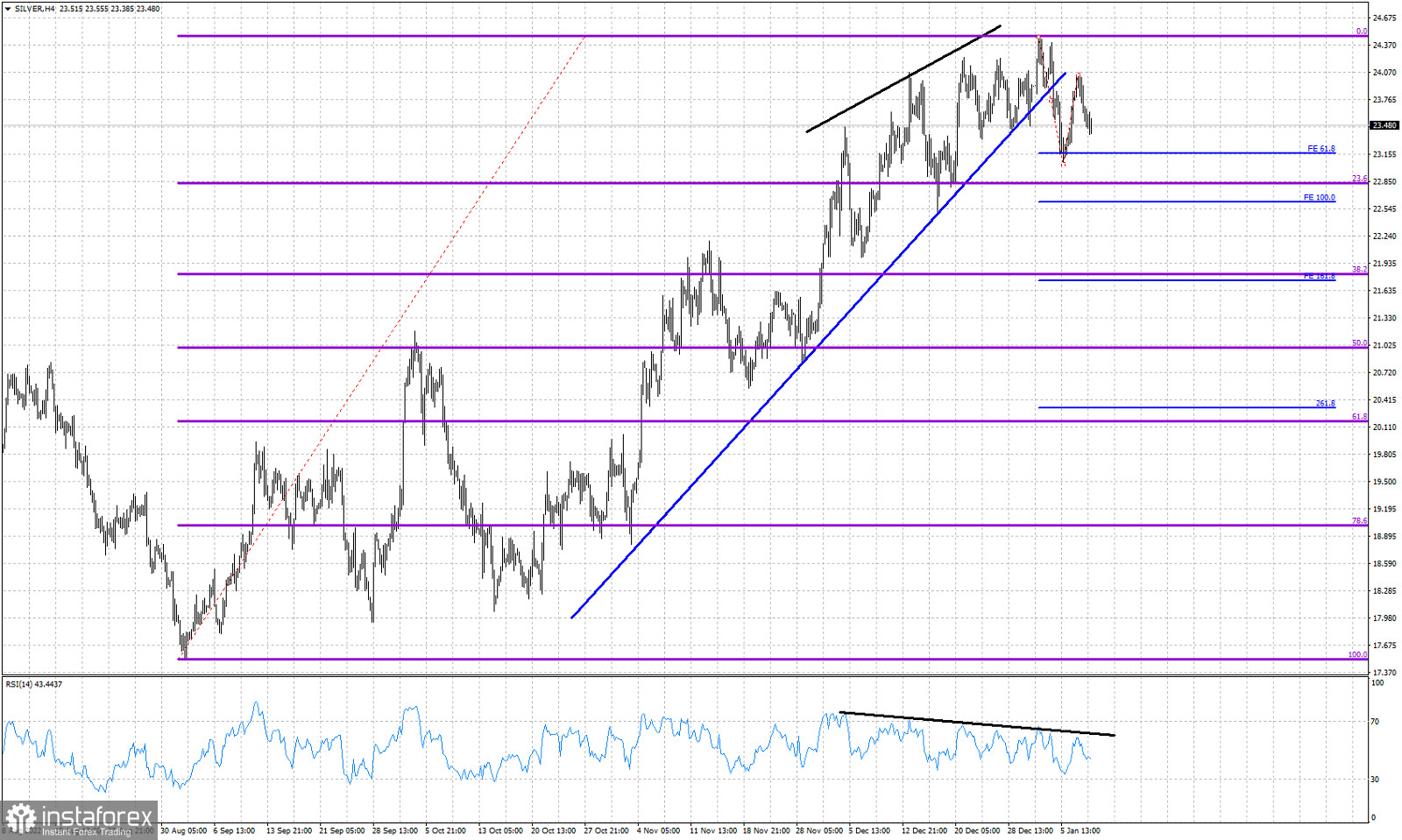

Blue upward sloping line- support trend line

Black lines- bearish RSI divergence

Purple lines- Fibonacci retracement levels

Blue lines- Fibonacci extension targets

Silver price is trading around $23.50-$23.40 before US market open. Technically trend remains bullish in the medium-term as price is making higher highs and higher lows since September. Recently we talked about some warning bearish signs in Silver as price broke down below the upward sloping trend line and the RSI provided us with bearish divergence signals. The lower high in Silver's chart is a sign of weakness. If it is followed by a new lower low below $23.06 then we will get a bearish confirmation and our first target will be the 100% extension target at $22.63. Around this level we also find the 23.6% Fibonacci retracement of the entire rise. If this support area is broken, then we should expect Silver to move even lower towards $21.80-$21.70 where we find the 38% Fibonacci retracement and the 161.8% Fibonacci extension target. This scenario is valid as long as price is below $24.06.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română