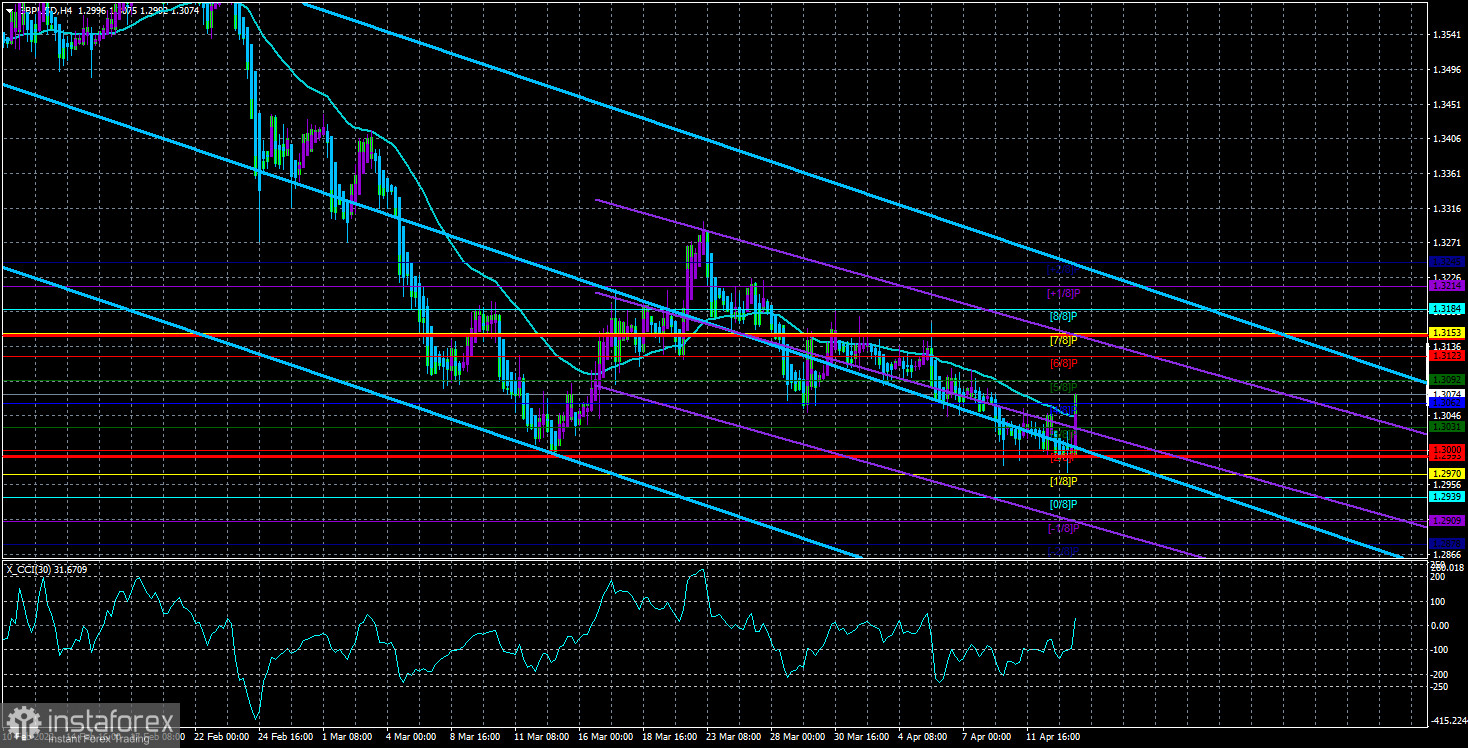

The GBP/USD currency pair continued a not too strong downward movement for most of the day on Wednesday. During the day, only one important report was published - inflation in the UK for March. This report showed that inflation continues to accelerate not only in the United States or the European Union but also in the UK. It has already grown to 7.0%. In this regard, it was possible to expect a certain reaction from traders to this report. However, the surge of emotions was minimal and in any timeframe, it is not immediately possible to even understand at what time this report was released. Moreover, the pound/dollar pair was again in the side channel for most of the day, as can be seen on the lower TF. On the 4-hour TF, a pronounced downward trend remains. Both linear regression channels are directed downwards, and an attempt to gain a foothold above the moving average in the afternoon looks like an accident in the current circumstances. The fall of the British currency persists and is very slow. At this point, it is very important not to fall into a trap. Due to the fact that the pair loses no more than 10-20 points per day, it may seem that the movement is very weak. But in fact, if the pair declines by 10-20 points every day, it will lose more than 3 cents in a month.

In the situation with the pound sterling, the set of factors that push the pair down is about the same as for the euro. Geopolitics, the strength of the Fed's monetary policy, the status of the dollar's "reserve" currency. At the same time, everyone, just the British pound can afford to continue falling for some time, since so far it has adjusted by only 45% against the upward trend of 2020 (which is clearly visible on the older TF). While the euro currency has already adjusted by 100% and is currently heading for the level of 1.0606, which is a multi-year low. However, in the case of the pound sterling, not everything is so bad. After all, the Bank of England has already raised the key rate three times and, perhaps, due to rising inflation, it will decide to raise it two or three more times this year. In this case, the pound will not have enough reasons to continue falling against the dollar. Unless, of course, the geopolitical factor changes. Unfortunately, geopolitics is now a source of risks and global uncertainty.

Boris Johnson, new sanctions against Russia, the British call to leave Russia.

There really isn't much important news of a geopolitical nature right now. There is a feeling that the whole world is now waiting for the escalation of the military conflict in Ukraine. Recall that Russian troops left four regions of Ukraine, but began to redeploy their forces to the East and Southeast. Thus, it is there that large-scale battles are expected in the coming weeks, as openly stated in Kyiv and hinted at in Moscow. Meanwhile, it became known that Boris Johnson will receive a fine from the London police for his "coronavirus parties". Fines will also be issued to Rishi Sunak, Johnson's wife Carrie, and some members of the government. On this, in the matter of violation of the "lockdown", you can put a bold dot. We can say that Boris Johnson managed to get away with it. Very timely for him personally, the "military operation" in Ukraine began, which allowed shifting all public attention from Johnson's personality to Ukraine and Russia.

At the same time, the UK continues to impose all kinds of sanctions against the Russian Federation. The new package will include a ban on the import of steel and iron from Russia, as well as on the export of quantum technologies. This was stated by British Foreign Minister Liz Truss. Thus, Britain continues to bend the most "anti-Russian" line. Recall that just a few days ago Boris Johnson arrived in Kyiv on an unannounced visit, he walked around Khreschatyk, met with Vladimir Zelensky, discussed new sanctions against the Russian Federation and military assistance for Ukraine, the volume and scale of which will be expanded and increased in the near future.

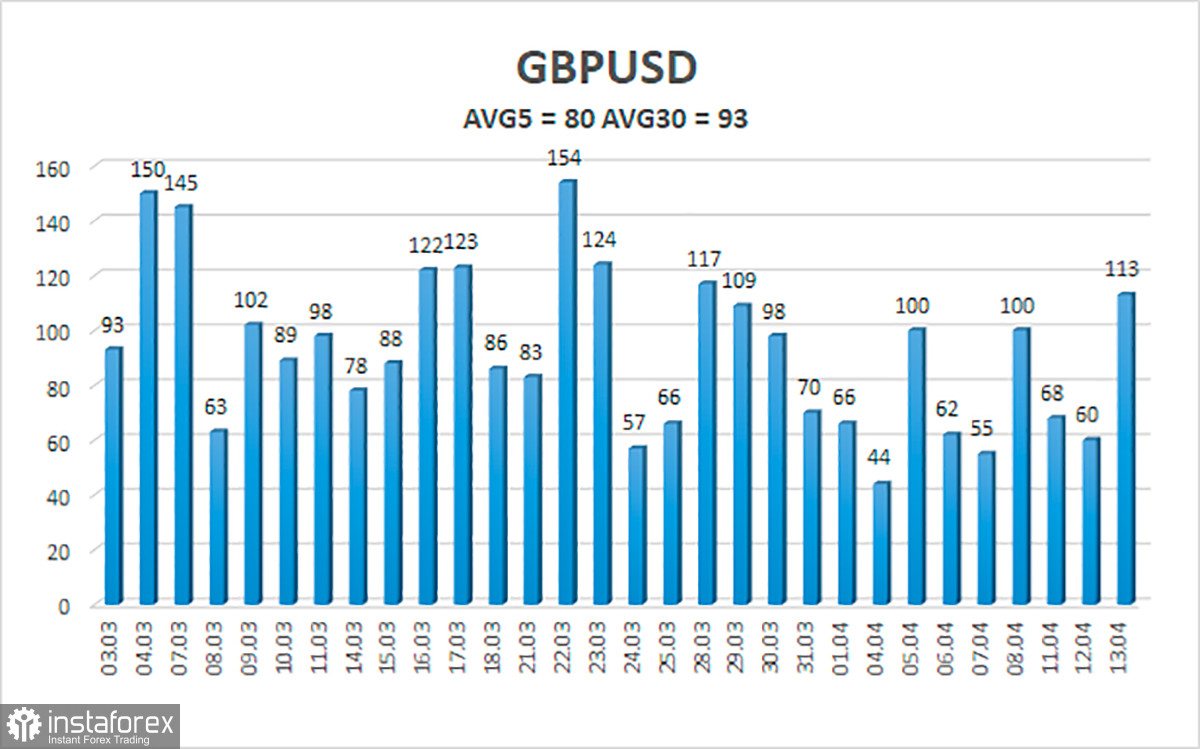

The average volatility of the GBP/USD pair is currently 80 points per day. For the pound/dollar pair, this value is "average". On Thursday, April 14, thus, we expect movement inside the channel, limited by the levels of 1.2993 and 1.3153. A reversal of the Heiken Ashi indicator downwards will signal a possible resumption of the downward movement, even if the moving before that will be overcome.

Nearest support levels:

S1 – 1.3062

S2 – 1.3031

S3 – 1.3000

Nearest resistance levels:

R1 – 1.3092

R2 – 1.3123

R3 – 1.3153

Trading recommendations:

The GBP/USD pair is trying to start an upward correction in a 4-hour timeframe. Thus, at this time, sell orders with targets of 1.2970 and 1.2939 should be considered if the price remains below the moving average. It will be possible to consider long positions if the price is fixed above the moving average line with targets of 1.3123 and 1.3153 (or higher). It should be recognized that traders have problems with overcoming the 30th level.

Explanations of the illustrations:

Linear regression channels - help to determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română