Sentiment in the gold market remains highly bullish amid rising bond yields as the Federal Reserve intends to aggressively tighten its monetary policy through the end of 2022.

The latest results from the weekly gold survey show that no Wall Street analyst is bearish. At the same time, a significant majority expects to see higher prices this week. Also, retail investors remain firmly optimistic about the precious metal.

Many analysts point to gold's resilience as 10-year bond yields rose to their highest level in 3 years without gold falling in value. The US central bank also expects to start cutting its balance sheet after the May monetary policy meeting.

Despite all this bearish news, gold managed to rise to $1950 an ounce.

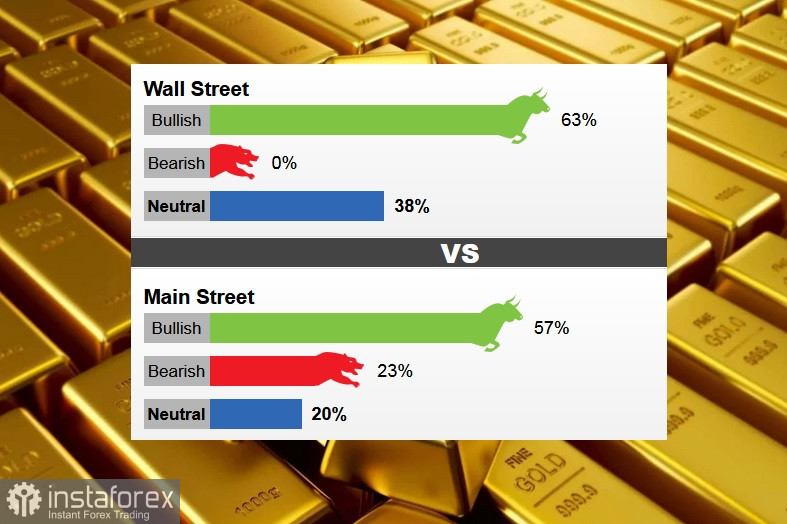

16 Wall Street analysts took part in the gold survey. Among the participants, ten analysts, or 63%, voted for the increase in gold prices this week. At the same time, six analysts, or 38%, were neutral about prices.

In online polls on Main Street, 842 votes were cast. Of these, 478 respondents, or 57%, expect gold to rise. Another 198 voters, or 23%, announced a reduction, while 166 voters, or 20%, were neutral.

David Madden, market analyst at Equiti Capital, believes that given what gold faced last week, prices could rise above 1960 an ounce this week.

However, Madden does not expect a breakout soon, adding that in order for gold to rise again to $2,000 an ounce, there must be a serious escalation of geopolitical actions on the territory of Ukraine. Noting that if there is a big problem with the supply of Russian gas and oil to Europe, this could lead to a fall in stocks and an increase in energy prices.

Phillip Streible, chief market strategist at Blue Line Futures, said as long as volatility dominates in financial markets, gold remains an attractive asset for investors. However, investors should exercise caution.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română