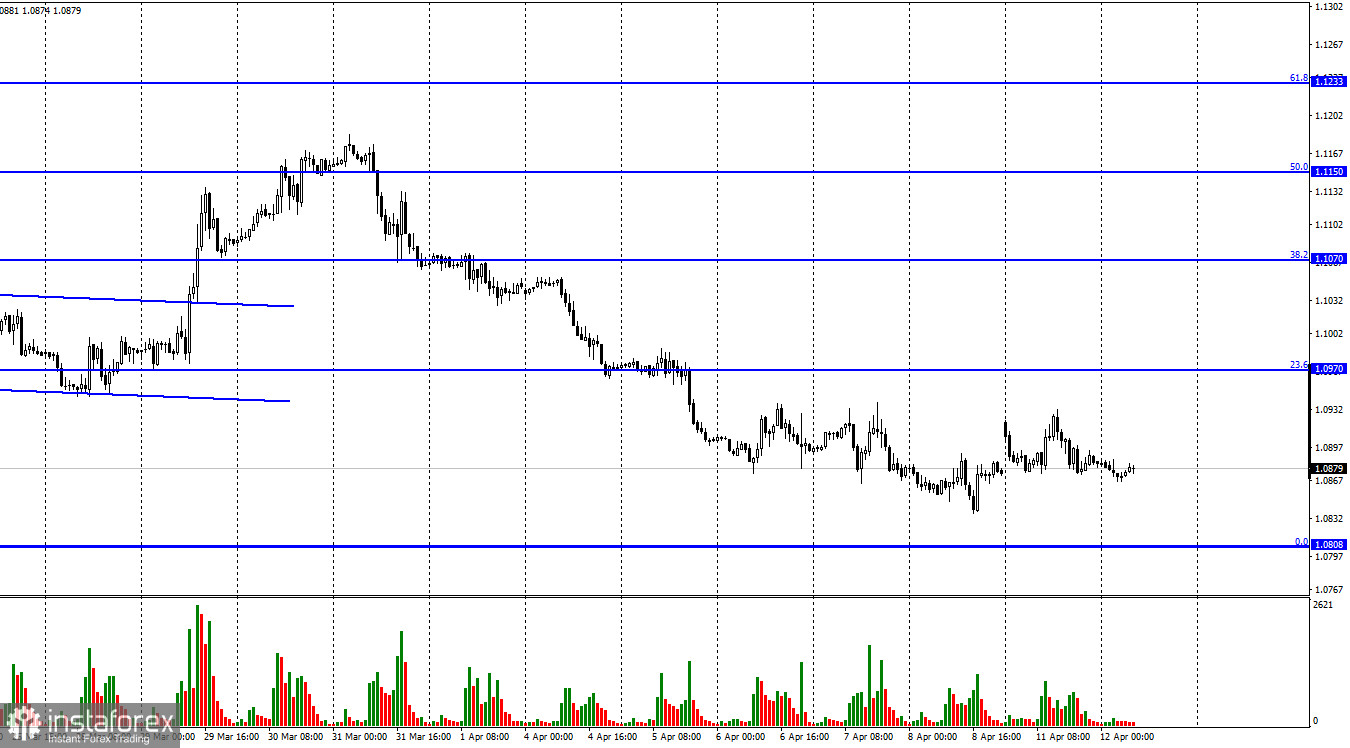

Hello, dear traders! The EUR/USD pair held steady on Monday. After the pair consolidated below the correction level of 23.6% at 1.0970, a further fall towards the next correction level of 0.0% at 1.0808 is likely. However, the downward movement ended during the last few days. Yesterday, the news background was weak. It was a possible reason why traders lacked activity trading the pair. Chicago Federal Reserve Bank President Charles Evans noted in his speech that high prices in the US (obviously, he meant high inflation) would remain for a longer period than he had expected. However, according to Evans, the current rate of inflation will not be permanent. Evans blames rising prices on supply chain disruptions initially caused by the COVID pandemic and later by the Russia-Ukraine military conflict.

Evans said that the Fed could more accurately assess inflation and realize its sustainability by the end of 2022. Therefore, FOMC members agree that inflation will remain high for a long time. Moreover, the outcome of affecting it by raising rates and reducing the Fed's balance sheet will be assessed at the end of the year. I believe it means that inflation will definitely remain high till the end of 2022. It may slow down slightly. However it will exceed the target level. Moreover, the Russia-Ukraine conflict further escalated yesterday. According to some media reports, the Russian troops used chemical weapons in Mariupol. If this data is confirmed, new sanctions will be most likely imposed against Russia. Notably, there are about 130,000 civilians in Mariupol. Negotiations between Ukraine and Russia have halted so far. There is no news on this issue.

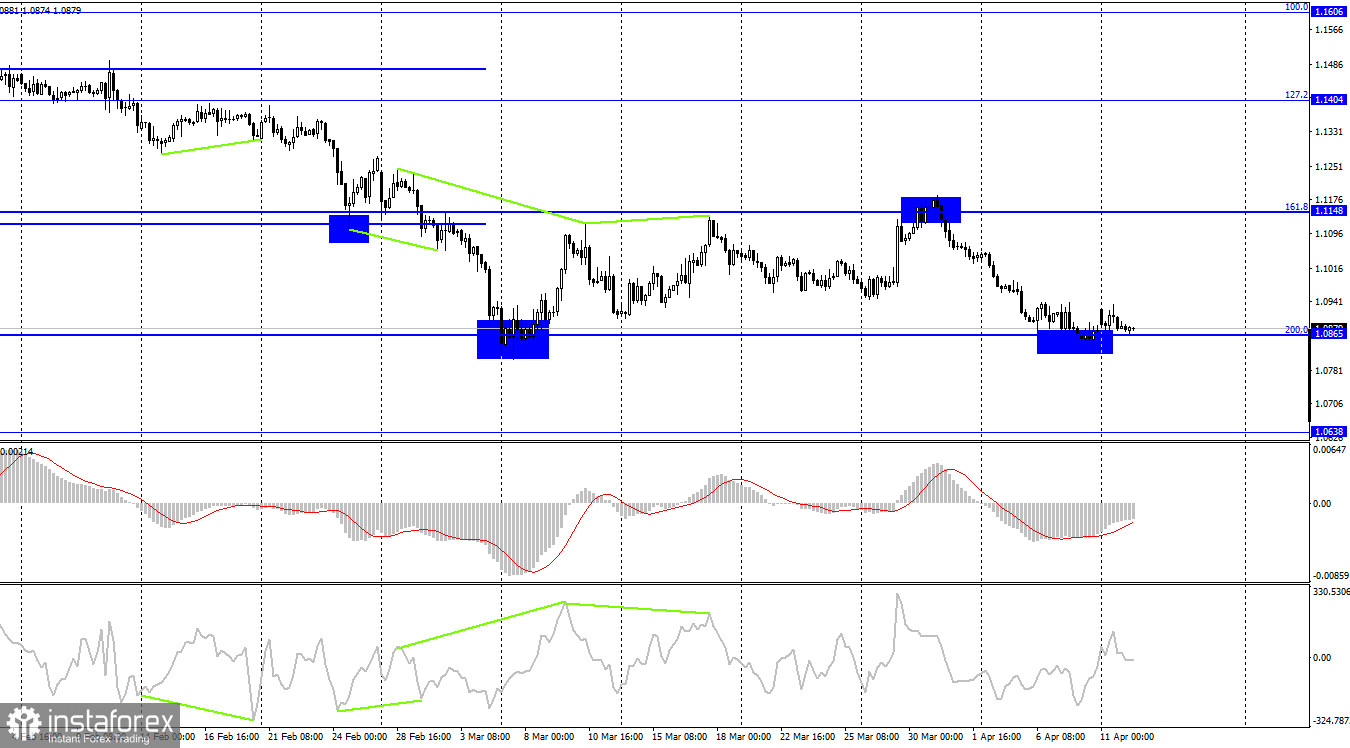

On the 4-hour chart, the pair fell to the correction level of 200,0% at 1,0865 and rebounded from it. The EUR/USD pair reversed in favor of the EU currency and began to rise slightly towards the correction level of 161.8% at 1.1148. If the pair consolidates below the 200.0% Fibo level, it will favor the dollar and will resume the fall towards 1.0638. There are no emerging divergences in any of the indicators today.

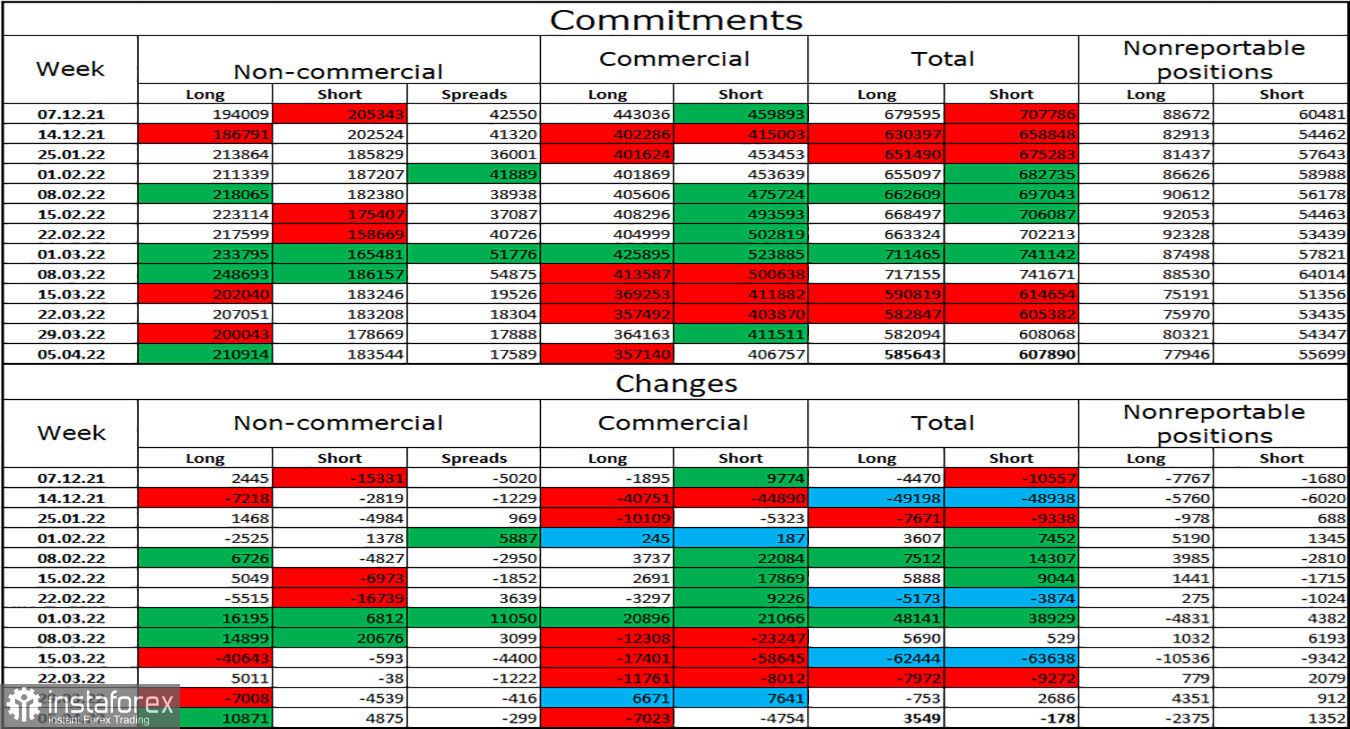

COT report:

Last week, speculators opened 10,871 long and 4,875 short contracts. This means that the bullish sentiment of major players has increased. The total number of long contracts held by major players is currently 211,000, while the total number of short contracts totals 183,000. Therefore, the general sentiment of "non-commercial" traders is considered bullish. In this case, the European currency should grow. However, despite this fact the euro continues to decline or remain at a very low level. Consequently, it is currently impossible to make logical conclusions taking into account the COT reports. Traders' sentiment is deeply affected by geopolitics and the dollar's role as the world's reserve currency.

US and EU economic news calendar:

EU - Business Sentiment Index from the ZEW Institute (09-00 UTC).

US - Consumer Price Index (12-30 UTC).

US - FOMC member Lael Brainard will deliver a speech (16-10 UTC).

On April 12, the US economic calendar contains a crucial inflation report that traders will definitely focus on. Moreover, Fed Governor Lael Brainard will deliver a speech, while a minor business sentiment index from the ZEW Institute will be released in the EU. The news background may significantly affect the traders' sentiment today.

EUR/USD outlook and recommendations for traders:

I recommend new sales of the pair if it closes below 1.0865 on the 4-hour chart with a target of 1.0638. I recommend buying the pair if it rebounds from 1.0865 on the 4-hour chart with the targets of 1.0970 and 1.1070.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română