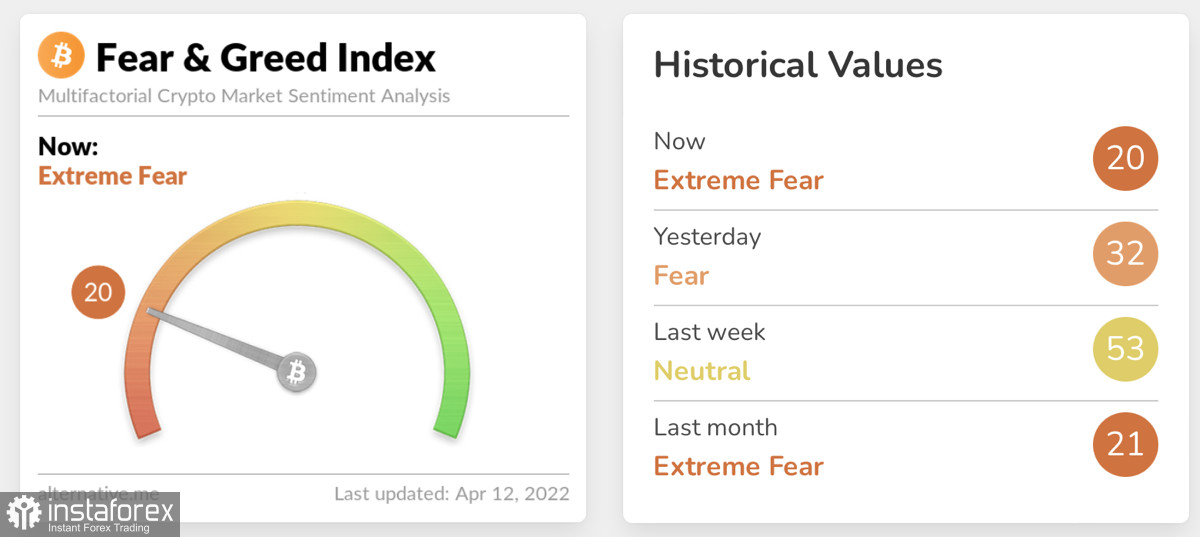

The main cryptocurrency has dropped significantly for the last two weeks. Over the past 24 hours, Bitcoin lost 5% of its value, while its weekly drop totaled 14%. The asset is trying to hold the round level of $40,000. However, BTC is gradually declining amid increasing pressure from sellers. At the same time, buyers continue to accumulate the main cryptocurrency.

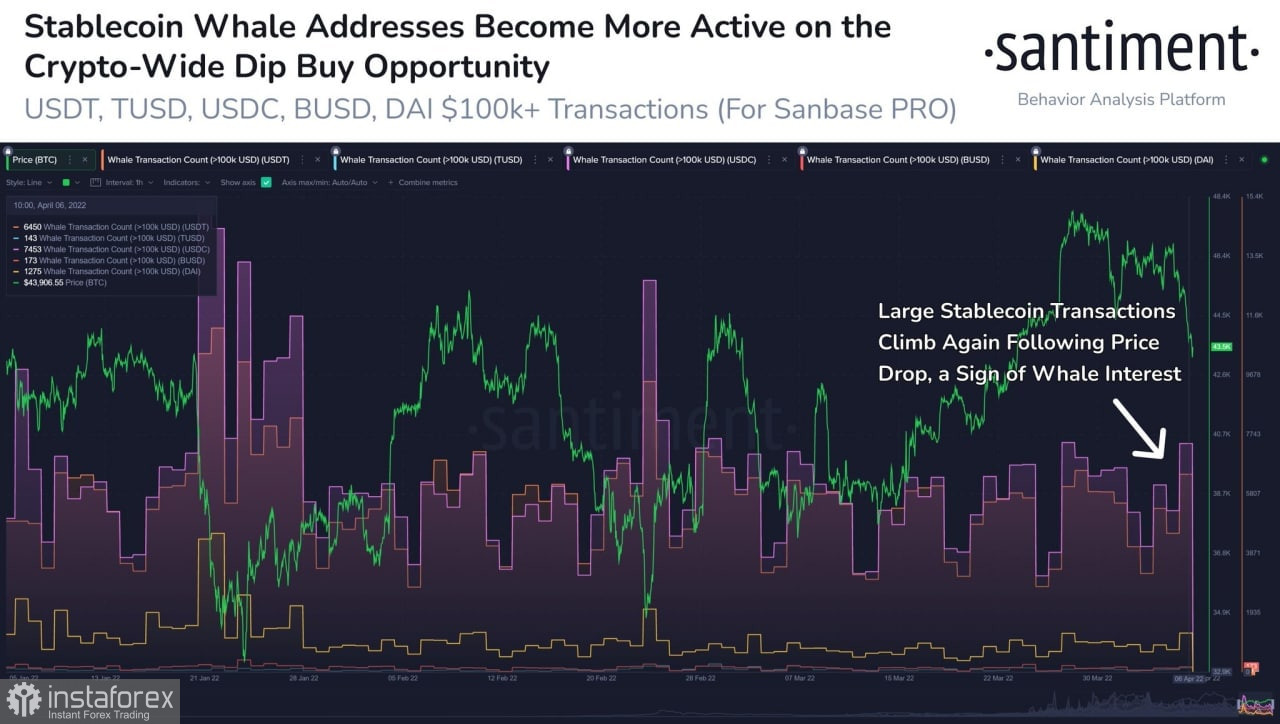

BTC current drop was caused by a false breakout of the $48,000 mark with further pressure from sellers. Last week, some investors sold the asset to lock in profits and redistribute capital. However, the situation has changed this week. Currently, the majority of investors selling Bitcoin are retail traders, who sell at a loss. Moreover, major players are converting BTC into stablecoins.

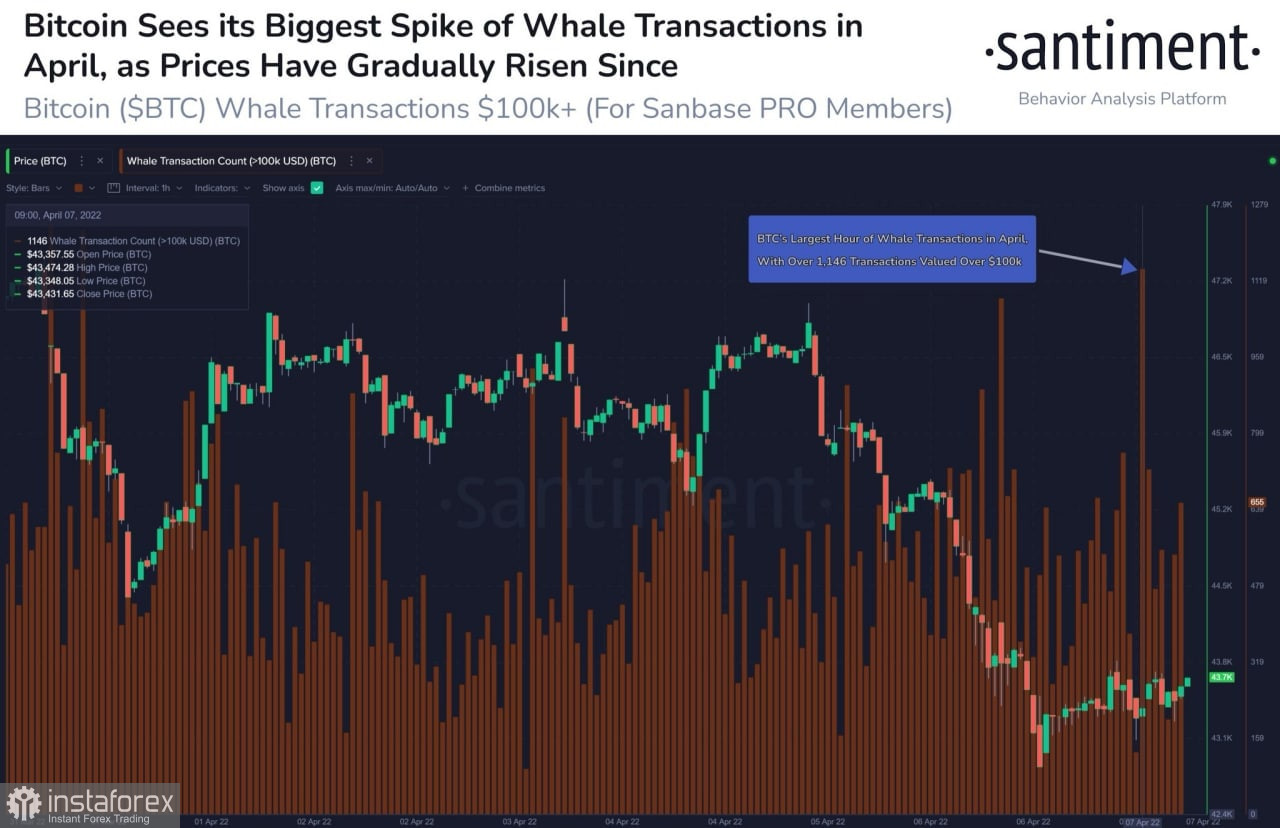

Santiment experts noted an unprecedented surge in large transactions and subsequent increase in the number of stablecoins in the overall cryptocurrency market. A similar situation arose in early and mid-March when the price of Bitcoin consolidated in a narrow range. In the medium term, the on-chain data suggests that the market is likely to rise dramatically again. As of April 12, market players continue to accumulate BTC coins. At the same time, trading volumes remain at an average level, indicating a lack of buyers activity to defend the $40,000 level. The bears continue to increase their pressure due to gradual transition of the cryptocurrency market to turmoil.

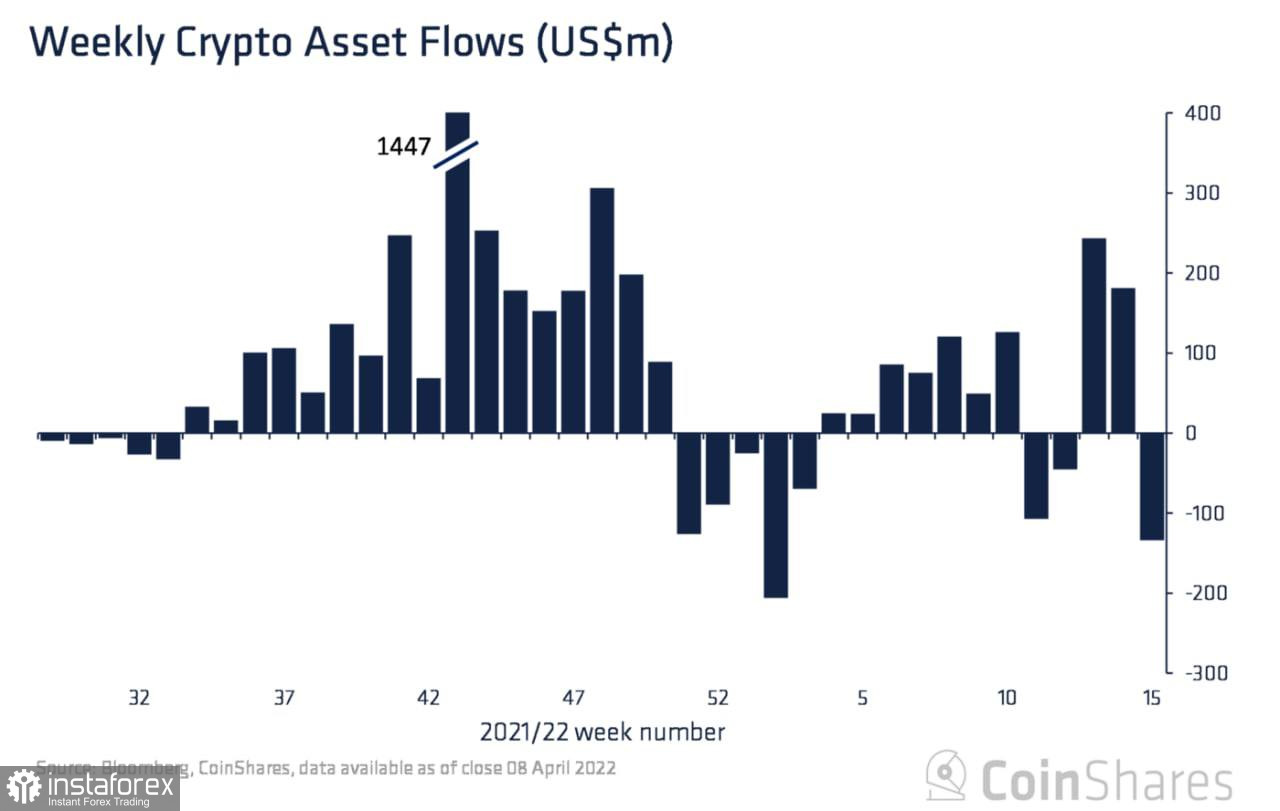

This fact indicates that Bitcoin will continue to fall and break through the level of $40,000 in the short term. Another significant reason for the price decline of the main cryptocurrency is the outcome of the publication of the latest Fed protocol. Investors realized that the quantitative tightening program came into effect in May and began to redistribute capital en masse. The release of the Fed protocol produced a negative effect on the crypto market due to the second largest outflow of capital from cryptocurrency funds in 2022. At the same time, gold resumed an upward movement near its previous high. Therefore, major market players do not consider BTC a hedge against inflation.

At the same time, there has also been a drop in stock indices, including the SPX. The correlation between the cryptocurrency and stock indices suggests that the future launch of the quantitative tightening program was the key reason for the market to view BTC as a high-risk asset. Taking this fact into account, the cryptocurrency will likely continue to decline to the area of $36,000-$37,400. The Fibonacci level of 0.5 is located at this point. Moreover, technical indicators signal that the situation has improved. The RSI and the stochastic oscillator have turned sideways. However, the MACD has entered the red zone.

With a strong downtrend over the past week, a local consolidation is possible. The cryptocurrency will likely reach the range of $40,000-$42,000 after the price stabilizes locally. Overall, there is no reason to believe that investors will fundamentally change their decision-making paradigm and resume active investments in Bitcoin. Therefore, the formation of the third local bottom around $35,000-$37,000 is expected in the near future.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română