Analysis of transactions and tips for trading the British pound

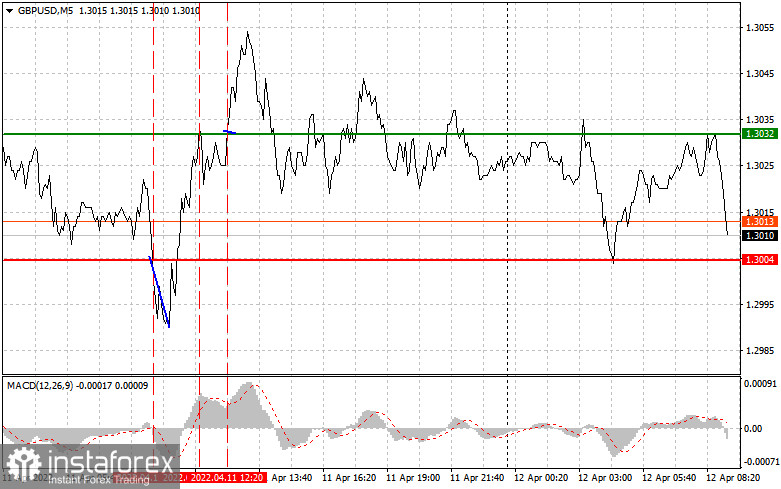

Yesterday's signals on the pound did not make it possible for us to earn. The 1.3004 test came at a time when the MACD was just starting to move down from zero, which was a confirmation of the correct entry point into short positions. However, after the pound declined by 15 points, which occurred immediately after the release of weak data on the UK economy, the pair turned around and the pressure went away. The sharp rise by the middle of the day and the test of 1.3032 came at a time when the MACD went up far enough from the zero mark. For this reason, I did not buy the pound and waited for the implementation of the second scenario for a short position. After some time, a repeated test of 1.3032 at the time of finding the MACD indicator in the overbought area seemed to lead to an ideal sell scenario, but alas, the deal turned out to be unprofitable. No other entry points were formed.

As I noted above, the GDP growth rate in February of this year turned out to be worse than economists' forecasts, which confirmed the complexity of the situation in the economy. The decline in industrial production was offset by an increase in the index of activity in the UK services sector. In the afternoon, the speeches of FOMC members Michelle Bowman, Rafael Bostic and Charles Evans did not greatly affect the pair's direction. Today's report on the UK labor market will be important. Reports are expected on the change in the number of applications for unemployment benefits and the unemployment rate in the UK. The indicator on the change in the level of average earnings of the population will be quite interesting. If the data turn out to be worse than economists' forecasts, and inflation blocks all wage growth, the pressure on the British pound will not go away, and the bulls' observed attempts to turn the market in their direction will end very quickly. In the afternoon, we need to closely follow the report on the consumer price index in the United States in March of this year. It is expected that annual inflation may reach the level of 8.5% and even exceed it – a very strong bullish signal for the US dollar, since for sure the Federal Reserve will definitely not delay changing its monetary policy any longer. The speech of FOMC member Lael Brainard will once again remind market participants of the central bank's plans – everything points towards the fall of the GBPUSD pair.

For long positions:

You can buy the pound today when you reach the entry point around 1.3033 (green line on the chart) with the goal of rising to the level of 1.3071 (thicker green line on the chart). I advise you to leave long positions in the area of 1.3071 and open short positions in the opposite direction (counting on a movement of 20-25 points in the opposite direction from the level). We shouldn't count on the pound's growth in the first half of the day, especially if we receive disappointing data on the economy and the labor market. Before buying, make sure that the MACD indicator is above the zero mark and is just beginning its growth from it.

It is also possible to buy the pound if the price reaches 1.3004 today , but at this moment the MACD indicator should be in the oversold area, which will limit the pair's downward potential and lead to an upward reversal of the market. We can expect growth to the opposite levels of 1.3033 and 1.3071.

For short positions:

You can sell the pound today only after updating the 1.3004 level (the red line on the chart), which will lead to a rapid decline of the pair. The key goal will be the 1.2975 level, where I recommend leaving short positions, as well as immediately opening long positions in the opposite direction (counting on a movement of 20-25 points in the opposite direction from the level). A return to weekly lows may strengthen the bear market, which will lead to a new fall of the pair, and weak labor market data will only increase investors' pessimism. Before selling, make sure that the MACD indicator is below the zero mark and is just beginning its decline from it.

It is also possible to sell the pound today if the price reaches 1.3032, but at this moment the MACD indicator should be in the overbought area, which will limit the pair's upward potential and lead to a reverse reversal of the market to the downside. We can expect a decline to the opposite levels of 1.3004 and 1.2960.

What's on the chart:

The thin green line is the key level at which you can place long positions in the EUR/USD pair.

The thick green line is the target price, since the quote is unlikely to move above this level.

The thin red line is the level at which you can place short positions in the EUR/USD pair.

The thick red line is the target price, since the quote is unlikely to move below this level.

MACD line - when entering the market, it is important to be guided by the overbought and oversold zones.

Important: Novice traders need to be very careful when making decisions about entering the market. Before the release of important reports, it is best to stay out of the market to avoid being caught in sharp fluctuations in the rate. If you decide to trade during the release of news, then always place stop orders to minimize losses. Without placing stop orders, you can very quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

And remember that for successful trading, you need to have a clear trading plan. Spontaneous trading decisions based on the current market situation is an inherently losing strategy for an intraday trader.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română