To open long positions on GBP/USD, you need:

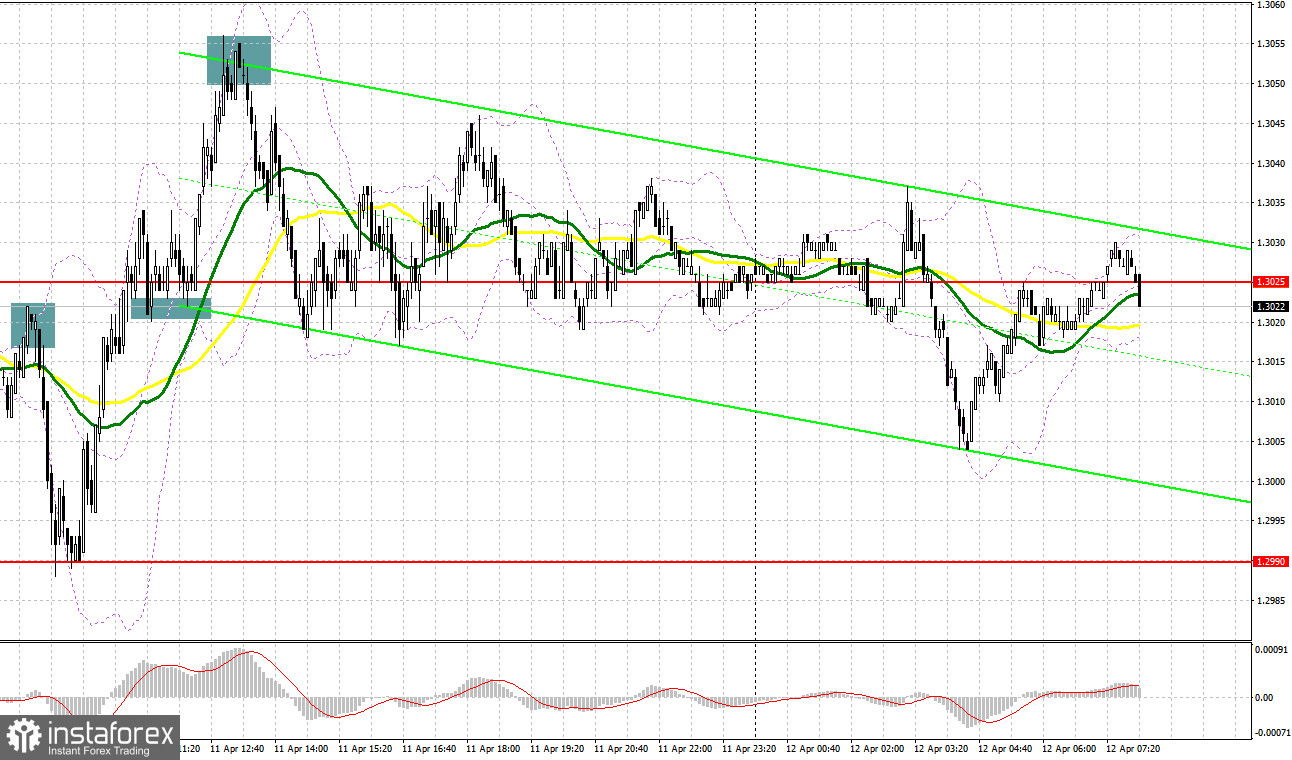

Yesterday, quite a lot of profitable signals were formed for the pound to enter the market in the first half of the day, while the US session was quite crushed. Let's look at the 5-minute chart and figure out what happened and how to act. In my morning forecast, I paid attention to the levels of 1.3019 and 1.3050 and advised you to make decisions on entering the market. A false breakout at 1.3019 at the beginning of the European session after weak statistics on GDP and industrial production in the UK led to a signal to open short positions. As a result, the pound dropped 30 points, but fell just a little short of 1.2984. A return to 1.3019 and a reverse test from top to bottom – all this was a buy signal, which returned the pound to 1.3050, making it possible to pick up about 30 more points. A false breakout at 1.3050 led to a sell signal. As a result, the pair failed by more than 30 points. In the second half of the day, it was not possible for normal entry points to form into the market, since trading was mainly conducted around the 1.3025 level.

Before analyzing the technical picture of the pound, let's look at what happened in the futures market. The Commitment of Traders (COT) report for April 5 logged an increase in both short and long positions. However, there were more of the first ones, which once again led to an increase in the negative delta. Fears related to the state of the UK economy and the risks of high inflation, which is sure to further exacerbate the ongoing crisis of British households, have been confirmed. Recent GDP data indicated a very sharp slowdown in economic growth. Experts note that the situation will only worsen, as inflation risks are now quite difficult to assess, but it is clear for sure that the consumer price index will continue to grow in the coming months. At the same time, the soft position of the governor of the Bank of England will only push prices up. The only thing the bulls can count on now is the positive results of the negotiations between the representatives of Russia and Ukraine and progress towards a settlement of the conflict. Do not forget about the aggressive policy of the Federal Reserve, which is becoming more hawkish every day. In the US, there are no such problems with the economy as in the UK, so there the Fed can raise rates more actively, which it is going to do during the May meeting – another signal towards selling the pound against the US dollar. The COT report for April 5 indicated that long non-commercial positions rose from the level of 30,624 to the level of 35,873, while short non-commercial positions jumped from the level of 70,694 to the level of 77,631. This led to an increase in the negative value of the non-commercial net position from -40,070 to -41,758. The weekly closing price rose to 1.3112 against 1.3099.

Yesterday's data on the British economy did not make traders very happy, so it will be quite difficult to count on the pound's real growth in the current conditions, even despite the good protection of yesterday's monthly lows. The data on the UK labor market, which are expected to be at a fairly good level, may allow the bulls to break above 1.3034, but if the reports turn out to be disappointing, they will have to fight an active battle for the 1.2990 area again – it is impossible to let the pound go lower, the abyss is lower. Only strong reports on changes in the number of applications for unemployment benefits, the unemployment rate and, in particular, changes in the level of average earnings in the UK will lead to an increase in the pound. If the pair falls after the data, only a false breakout at 1.2990 will provide a buy signal that can return GBP/USD to the resistance area of 1.3034. However, we all understand the conditions in which the pound is currently located and that the bears will become more active with each significant increase. The reason for the build-up of short positions is the governor of the Bank of England, Andrew Bailey, with his soft policy, and the chairman of the Federal Reserve, Jerome Powell, with his hawkish approach to interest rates. A breakthrough and a test of 1.3034 from top to bottom will create an additional entry point into long positions, which will strengthen the demand for the pound and lead to an increase in the area of a high of 1.3071. A more distant target will be the 1.3104 area, where I recommend taking profits. However, we can only reach this level if we receive very positive news about the reduction of the conflict between Russia and Ukraine. In case the pound falls during the European session and the lack of activity at 1.2990, it is best to postpone long positions until the next low of 1.2950. Forming a false breakout at this level can stop the bearish trend and provide an entry point in the expectation of a short-term rebound of the pair. You can buy GBP/USD immediately for a rebound from 1.2911, or even lower – around 1.2856 with the goal of correcting 30-35 points within the day.

To open short positions on GBP/USD, you need:

Bears are still feeling quite calm today, and most likely this calmness will remain. The deterioration of the geopolitical situation will also play into the bears' hands, but if it improves, the bears will quickly leave the market, which will lead to a rapid growth of the pound – pay special attention to this. Trading is conducted slightly below the moving averages, which indicates a likely decline in the pound in the short term. The primary task is to protect the 1.3034 range. Forming a false breakout at this level, together with weak data on the UK labor market, will provide an entry point into short positions with the goal of continuing the bear market and the subsequent decline to the support area of 1.2990 formed by yesterday's results. You will have to fight for this level, as there are a number of stop orders of speculative buyers. A breakthrough and a reverse test from the bottom up of 1.2990 will push GBP/USD to the lows: 1.2950 and 1.2911. A more distant target will be the 1.2856 area, where I recommend taking profits. If the pair grows during the European session and bears are weak at 1.3034, it is best to postpone short positions to 1.3071. I also advise you to open short positions there only in case of a false breakout. It is possible to sell GBP/USD immediately for a rebound from the high of 1.3104, counting on the pair's rebound down by 30-35 points within the day.

Indicator signals:

Trading is conducted below the 30 and 50 moving averages, which indicates a further fall of the pair.

Moving averages

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

A breakthrough of the lower limit of the indicator in the area of 1.3005 will increase the pressure on the pair. Surpassing the upper limit in the area of 1.3050 will lead to a new wave of growth of the pound.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română