The war in Ukraine and Fed's aggressive interest rate hike amid rising inflation in the U.S. continue to be the main topic in the global markets.

Investors are under a lot of pressure from negative news and the risk of a sharper rise in the cost of borrowing due to the Fed's aggressive interest rate hike and the rise in inflation. Moreover, this process of inflationary pressure is typical not only in the economically developed countries of the West. Thus, although the data on inflation in China released today showed its downward correction in annual terms to 8.3% in March from the February value of 8.8%, the monthly stronger growth of the indicator by 1.5% against the forecast of 1.2% caused a wave of sales in the Asia-Pacific region. Chinese major stock indices before closing showed a drop from more than 2 percent to a little over 3.

In the wake of the general negative sentiment in the markets, which is primarily generated by strong inflation, rising energy prices, and the conflict in Ukraine, there is a persistent strengthening of the dollar in the Forex market.

The root cause of the growth in demand for the dollar was the almost vertical rise in the yield of the U.S. Treasury in recent years. The yield on the benchmark 10-year U.S. Treasury soared to the values of the beginning of March 2019. At the time of writing, the yield of 10-year T-Bonds is growing by 1.83% to 2.765%. At the same time, the increase in the yield of government securities is stimulated by high expectations in the investor environment that the Fed will vigorously raise interest rates by 0.50% at once. In addition, it is assumed that the regulator will also actively reduce its bond portfolio by selling government securities.

Of course, in this case, we should not expect a downward reversal of the dollar. Most likely, its upward dynamics will only intensify this week if the data on the consumer price index in America presented on Tuesday show no less growth than the consensus forecast demonstrates. We believe that the figures indicating an increase in inflation will only push up the exchange rate of the U.S. currency against all major currencies without exception.

Assessing the general outlook on the financial markets this week, it is highly likely that the dollar will continue to strengthen in the Forex market, global stock indices will remain under pressure, and crude oil prices will consolidate around the current levels.

Forecast of the day:

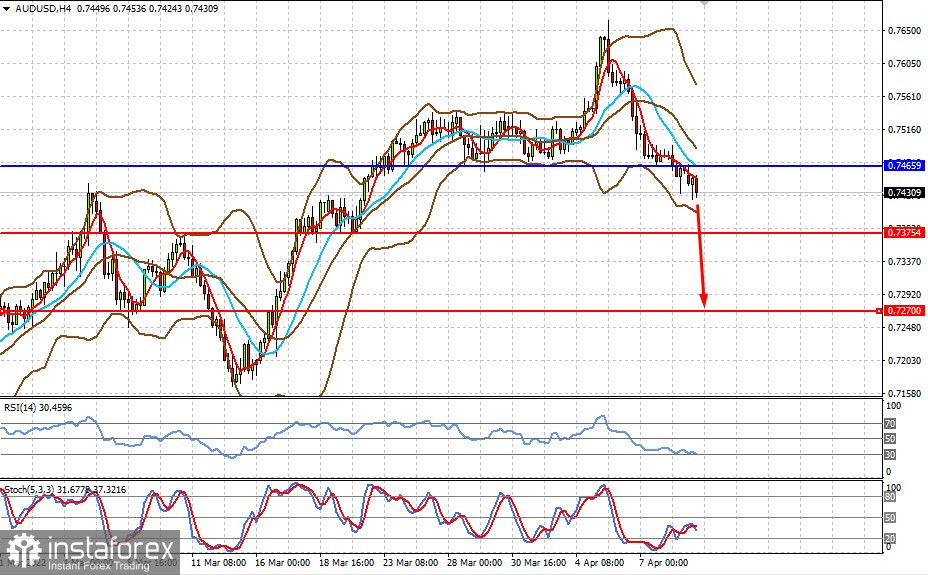

AUDUSD fell below 0.7465 and continues to decline towards our previous target of 0.7375. The data on the growth of inflation in America may lead to an even more noticeable fall of the pair to the level of 0.7270.

The USDCAD pair may continue rising towards 1.2710 after breaking through 1.2620.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română