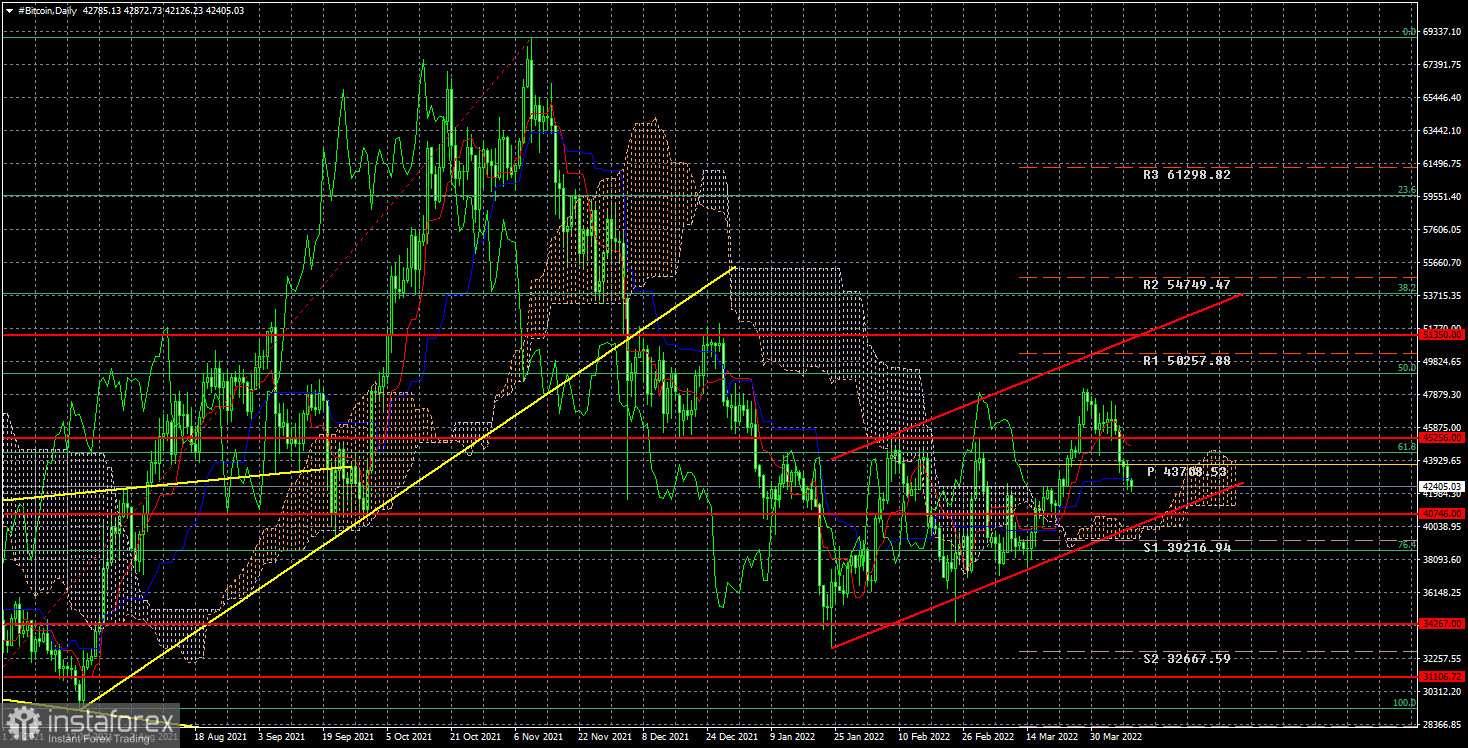

Over the past week, the bitcoin cryptocurrency has fallen in price by $ 4,000. Thus, the hopes of crypto-banks for a new upward trend are being shelved again. There is an upward trend in the 24-hour TF, which is supported by an ascending channel. However, by the end of today, the rate may go below the critical line, which is the first signal for a trend change. It should be noted right away that the entire current movement, which began on January 23, looks like a typical correction. Even with a strong desire to consider this movement as the beginning of a new trend, it does not work. Therefore, we believe that this correction will be completed in the coming weeks, and bitcoin will rush to its annual lows near the level of $ 34,267. And I must say that in the medium term, this is the minimum level to which the first cryptocurrency can fall. The level of $ 31,100 looks like a more realistic target.

Recall that the fundamental background remains extremely unfavorable for the entire cryptocurrency market, for all risky assets. In the United States, the key rate may be raised by 0.5% next month, and the first round of the "anti-QE" program will be held, under which the Fed's balance sheet may decrease by $ 95 billion. And this will not be the only rate increase this year. It's even better to say that this will be only the second of seven promotions this year. FOMC members already almost unanimously believe that the rate should be raised this year to at least 2.5%. And in the future - up to 3.5% minimum. Otherwise, inflation cannot be stopped. From our point of view, as the key rate increases and the Fed balance decreases, bitcoin will only fall. This would be logical, given that when the Fed lowered the rate or maintained it at an ultra-low level, and also poured $ 120 billion into the economy every month, bitcoin grew. It grew because safe instruments gave almost no profitability. It grew because the money supply was getting bigger. And now the money supply will decrease. Inflation will start to decline sooner or later. And the rates will rise and provoke an increase in the profitability of safe assets. Such as bonds and bank deposits. Thus, if some unpredictable factor does not interfere now, then the fall of bitcoin in 2022 is almost guaranteed.

Of course, it should always be remembered that we are dealing with a cryptocurrency that does not always trade logically and pays attention to the foundation and macroeconomics. For example, it has repeatedly happened that one tweet by Elon Musk led to an increase or fall of the "bitcoin" by 5-10 thousand dollars. If Apple announces tomorrow that it will now sell the iPhone for bitcoins, this could lead to strong growth of the cryptocurrency and it does not matter what the Fed rates will be. But we still do not consider how those events have not even happened yet. And according to the current fundamental background, it turns out that the "bitcoin" simply has no grounds for growth.

In the 24-hour timeframe, the quotes of the "bitcoin" fell below the level of $ 45,256, so further growth has been canceled for the time being. Near the lower border of the side channel, a rebound with an upward reversal may occur, after which the cryptocurrency may begin another round of growth. And this signal (a rebound from the $ 40,746 level) can be used for purchases. Sales should be considered below the ascending channel with targets of $ 34,267 and $ 31,100.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română