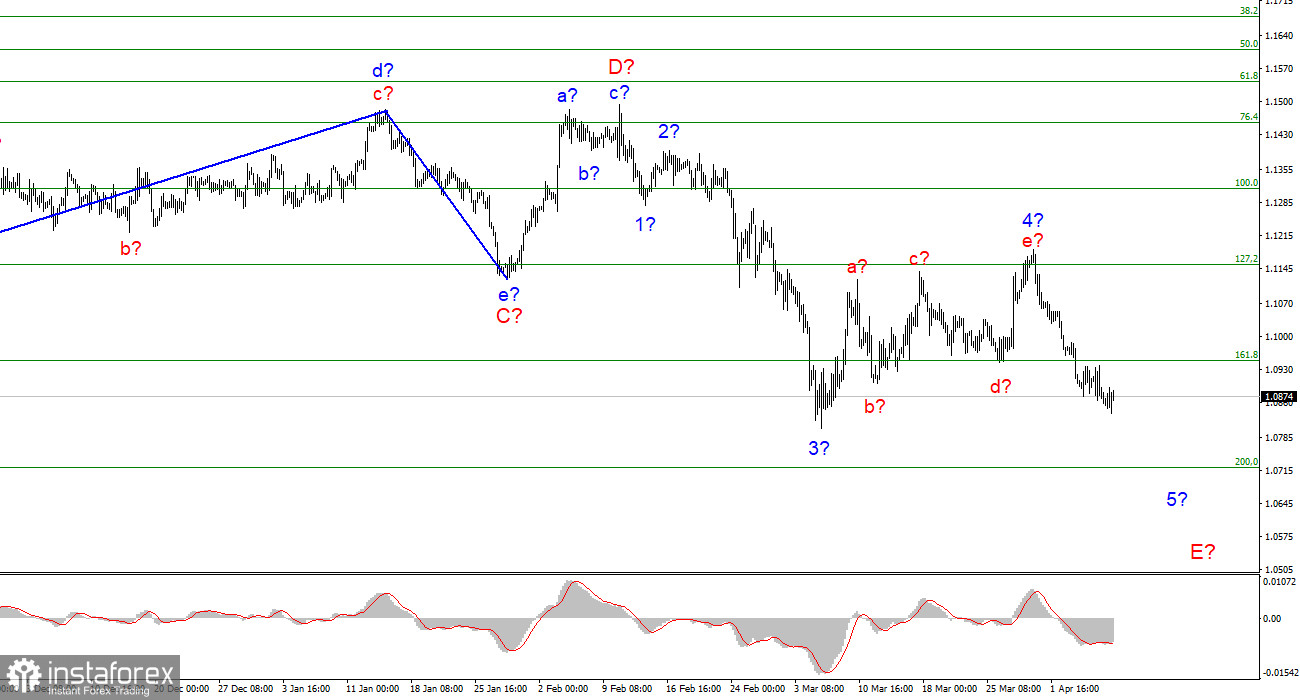

The wave marking of the 4-hour chart for the euro/dollar instrument continues to look convincing. The proposed wave 4 took a five-wave form and turned out to be completely different from wave 2. However, now this wave is recognized as complete, and the wave pattern does not require any changes. Accordingly, the instrument began constructing the proposed wave 5-E. If this assumption is correct, then the decline in the quotes of the euro currency may continue for another one or two months. At the moment, the entire wave structure of the descending trend section looks almost fully equipped, but wave 5-E is likely to also take a five-wave form. If this is the case, then at the moment, the construction of only the first wave consisting of 5-E has been completed. Thus, the instrument still has a fairly strong potential for decline. The first target is around 1.0721, which equates to 200.0% Fibonacci. At the same time, much of the instrument will now depend not only on geopolitics but also on gas and oil prices and the further rupture of relations between Russia and the European Union.

Tomorrow, the first round of presidential elections will be held in the homeland of the Musketeers for Napoleon.

The euro/dollar instrument dropped by just a few points on Friday, which did not affect the current wave marking in any way. The news background on Friday was not weak, it was absent. At least, if we are talking about the economy. The entire information space was packed with news on the topics "Ukraine", and "Russia". Ursula von der Leyen went to Kyiv to personally see the destruction of the suburbs after the de-occupation by Russian troops. Immediately after this meeting, the European Union started talking about a new, sixth package of sanctions against Moscow. At the same time, "anti-Russian" sentiments are beginning to intensify within the European Union itself. It is no secret that the head of Hungary Viktor Orban supports Russia and most recently his party won the elections in this country, which means that the entire Hungarian people support the Russian Federation. In this regard, Poland decided to stop any cooperation with Hungary until "Orban visits an ophthalmologist," as stated by Jaroslaw Kaczynski, head of the Law and Justice party. By the way, Hungary's position does not affect the overall position of the European Union in any way.

However, a very remarkable event may happen tomorrow in France, where the first round of presidential elections will be held. The current President Macron supports Ukraine but has not given up trying recently to personally negotiate with Russian President Vladimir Putin. Against this background, his ratings dropped very much right before the election. The second candidate for the French presidency, Marine Le Pen, has repeatedly openly stated that she sees favorable cooperation with Russia and generally supports Putin, although she publicly condemned the "massacre in Bucha." The third presidential candidate, Eric Zemmour, is also linked to Russia, and he questioned the veracity of the videos presented from the Kyiv suburbs. According to opinion polls, Macron is currently beating Le Pen by 6% and, as expected, they will go to the second round of elections. If Macron wins, France's position will remain unchanged. If Le Pen wins, France may begin to change its course in the direction of the Kremlin.

General conclusions.

Based on the analysis, I still conclude that the construction of wave E continues. If so, now is still a good time to sell the European currency with targets located around the 1.0721 mark, which corresponds to 200.0% Fibonacci, for each MACD signal "down". The current wave marking assumes the construction of a wave 5 in E, which can also turn out to be very long. In the next few days, a correction wave may begin to build, after which I expect a new decline in the instrument.

On a larger scale, it can be seen that the construction of the proposed wave D has been completed, and the instrument has updated its low. Thus, the fifth wave of a non-pulse downward trend section is being built, which may turn out to be as long as wave C. If this assumption is correct, then the European currency will still decline.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română