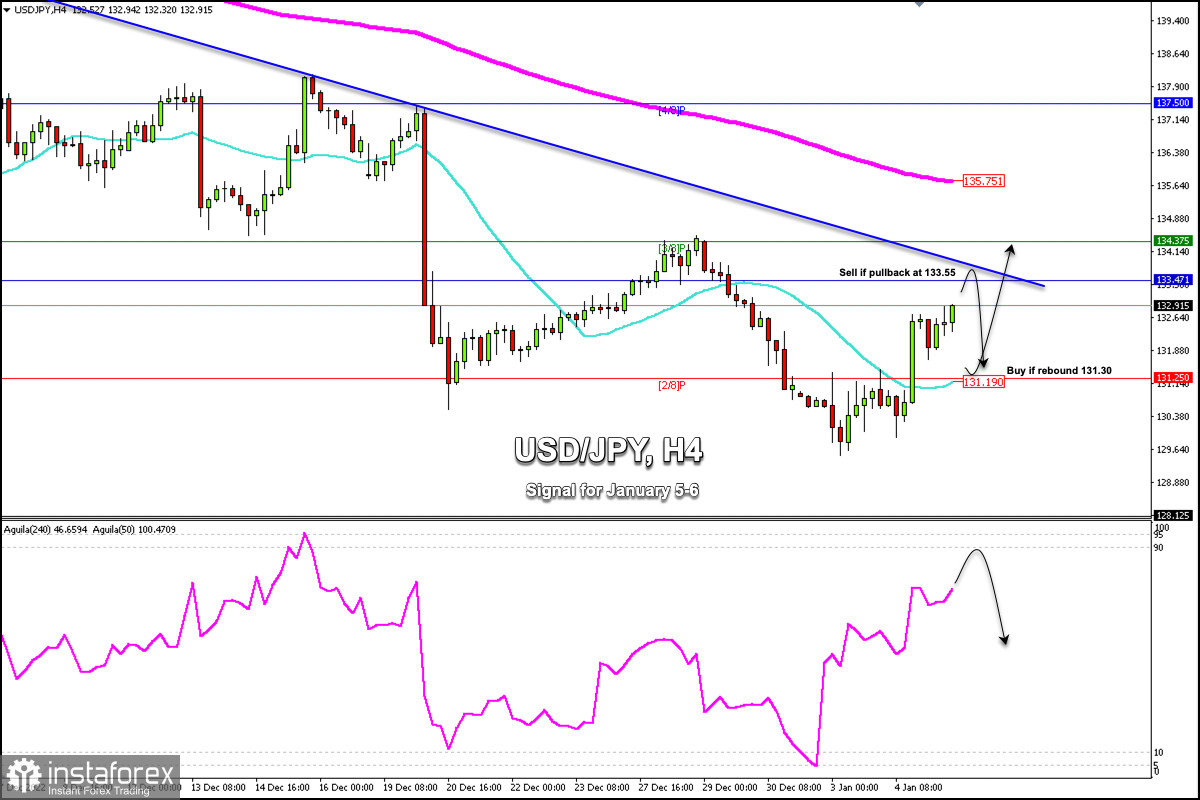

Early in the American session, the Japanese yen is trading around 132.91 with a bullish bias and is likely to continue rising in the coming hours to reach the strong resistance zone of 133.50 and 134.37.

Since USD/JPY reached the psychological level of 130, the yen started a strong technical rebound. So, in the next few days, it is likely to continue its rise until it reaches the 200 EMA located at 135.75.

USD/JPY has strong resistance at around 133.60. In case there is a pullback towards this zone, it could be seen as a signal to sell with targets at the SMA 21 located at 131.30.

The data from the ADP pollster will be published in the next few hours. The report could give an idea regarding what will be rough data in the nonfarm payrolls on Friday. In case the report logs strong employment which is bullish for the USD, we could see an upward acceleration in USD/JPY and the pair could reach the 133.50 area and even 3/8 Murray at 134.37.

Our trading plan for the next few hours is to sell the USD/JPY pair only in case there is a pullback towards 133.55 with targets at 132.60 and 131.30 (21 SMA). The eagle indicator is approaching the overbought zone, so it is likely that there will be a technical correction in the next few hours.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română