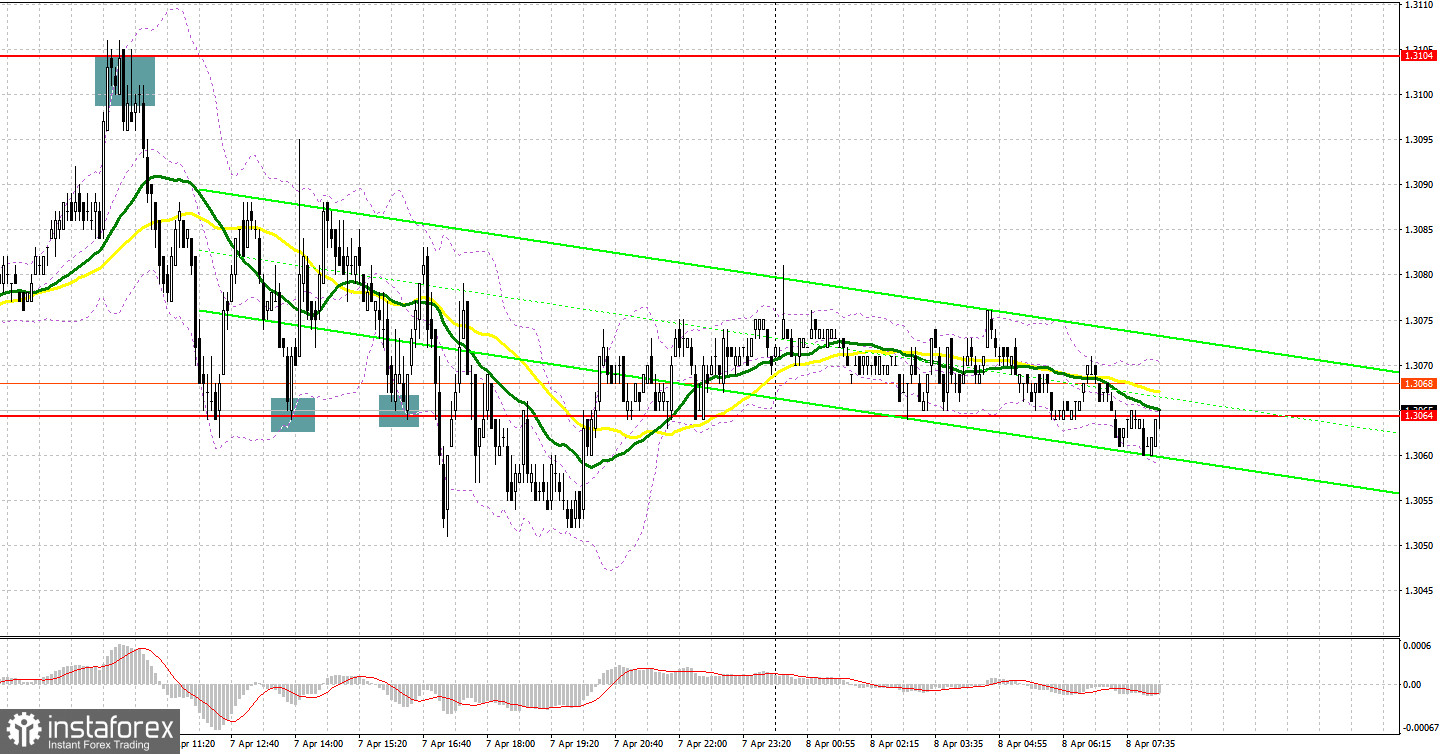

Several profitable entry signals were made yesterday. Let's turn to the 5-minute chart and analyze them. As you can see, active selling does not allow the pound to return to the upper limit of the sideways channel. In my previous overview, I paid attention to the 1.3099 level and said you could consider entering the market from it. A sharp rise to 1.3099 and failed consolidation above the range made an excellent sell entry point with a view to resuming the bearish trend. However, after a 35 pips fall, pressure on the pound decreased, and the situation somewhat stabilized. In a while, the pair dropped to support at 1.3064, and a false breakout produced a buy signal. Eventually, GBP rose by precisely 30 pips. Likewise, another buy signal was made at 1.3064 in the middle of the North American session. However, the quote grew by just about 15 pips.

When to go long on GBP/USD:

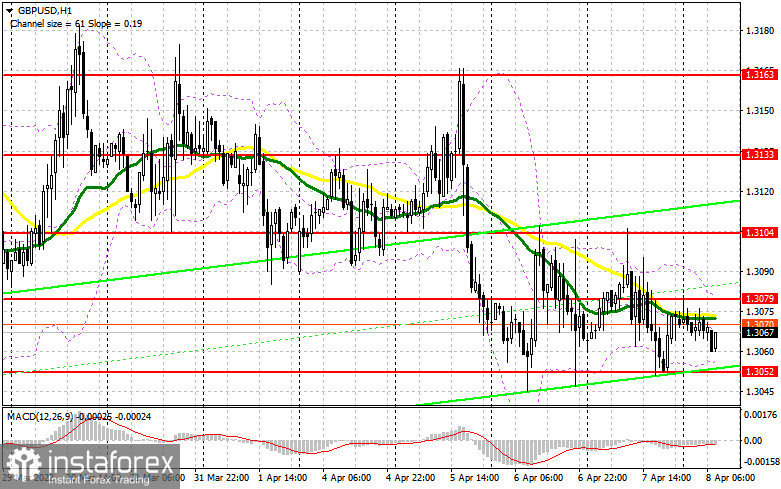

The fact that GBP has been hovering around 1.3050, the lower limit of the sideways channel, for a while now signals a possible breakout any time soon. No macro events are to unfold in the UK during the European session today. In this light, bears will try to test the 1.3050 mark once again. Meanwhile, bulls will try to protect this level as it is their last hope for keeping the pair in the sideways channel and building up a bullish correction. A false breakout there will produce the first buy signal, allowing GBP/USD to return to 1.3079, almost in line with the bearish moving averages. If so, an additional buy entry point will be created with the target at 1.3104 after a breakout and a test of the 1.3079 level from top to bottom. The level of 1.3133 stands as a more distant target where you should consider profit taking. Under the current circumstances, the pair is unlikely to go there. However, should geopolitical tensions ease, the quote may head towards 1.3163, the upper limit of the sideways channel. In case of bearish GBP/USD during the European session and a decrease in bullish activity at 1.3050, you may look for buy entry points after a breakout at 1.3027. Long positions on GBP/USD could also be entered on a bounce off 1.3001, allowing a 30-35 pips correction intraday.

When to go short on GBP/USD:

It is now unclear where the pair can go further. Today, a lot will depend on how bears behave below 1.3050. They will try to protect intermediate resistance at 1.3079, formed yesterday. The bearish MAs are just below the barrier. A false breakout there will make a sell entry point, with the target at 1.3050. However, I can hardly imagine what can make bears break through it. Bulls definitely have their own view on what is now going on in the market. Therefore, they are unlikely to let the pair go further down that easily. A breakout and a retest at 1.3050 could trigger a row of stop orders of bulls and create a sell signal. If so, GBP/USD will plunge to the lows of 1.3027 and 1.3001. The level of 1.2960 will stand as a more distant target where you should consider profit taking. In the event of bullish GBP/USD during the European session and a decrease in bearish activity at 1.3079, you may look for sell entry points after a false breakout at 1.3104. Short positions on GBP/USD could also be entered on a bounce from the 1.3133 high, or slightly higher, from 1.3163, allowing a 30-35 pips downward correction intraday.

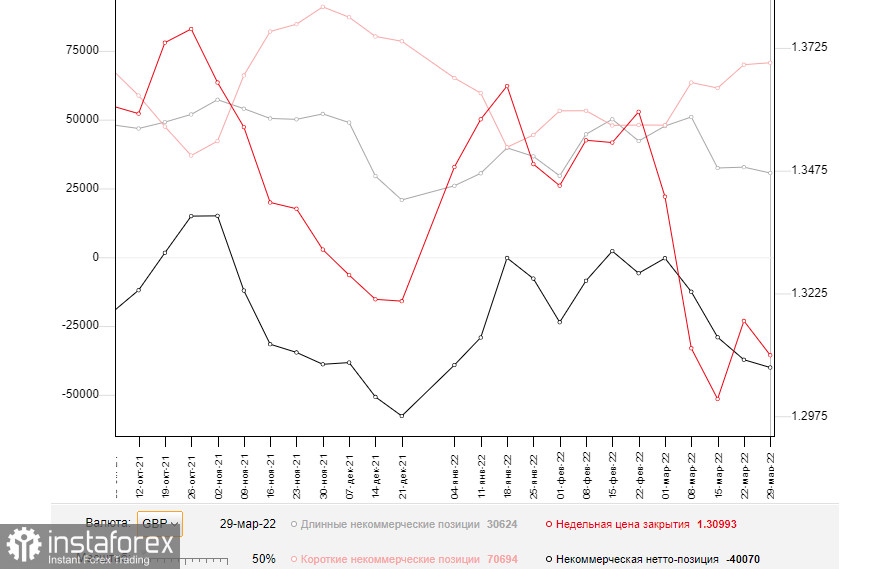

Commitments of Traders:

The Commitments of Traders report for March 29 logged a rise in short positions and a decrease in long ones. The results reflect market concerns over the current state of the British economy and persistent inflation, which will only make things worse for households in the UK. Experts say the situation will get even worse because inflationary risks weighing on the British economy are now difficult to evaluate. In this light, the dovish stance of Governor Bailey allowing bulls to increase the volume of longs in the face of further rate hikes seems to be inappropriate. The only driver GBP bulls can rely on is progress in Russia-Ukraine peace talks. In addition, aggressive measures of the US Fed ensure high demand for the dollar in the face of growing recession risks in the second half of the year. According to the COT report from March 29, long non-commercial positions fell to 30,624 from 32,753. Short non-commercial positions jumped to 70,694 from 69,997. As a result, the negative value of non-commercial net positions grew to -40,070 from -37,244. The weekly closing price dropped to 1.3099 versus 1.3169.

Indicator signals:

Moving averages

Trading is carried out below the 30-day and 50-day moving averages, indicating a bearish market.

Note: The period and prices of moving averages are viewed by the author on the hourly chart and differ from the general definition of classic daily moving averages on the daily chart.

Bollinger Bands

The lower band at 1.3050 stands as support. Resistance is seen at 1.3079 in line with the upper band.

Indicator description:

- Moving average (MA) determines the current trend by smoothing volatility and noise. Period 50. Colored yellow on the chart.

- Moving average (MA) determines the current trend by smoothing volatility and noise. Period 30. Colored green on the chart.

- Moving Average Convergence/Divergence (MACD). Fast EMA 12. Slow EMA 26. SMA 9.

- Bollinger Bands. Period 20

- Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions are the total long position of non-commercial traders.

- Non-commercial short positions are the total short position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română