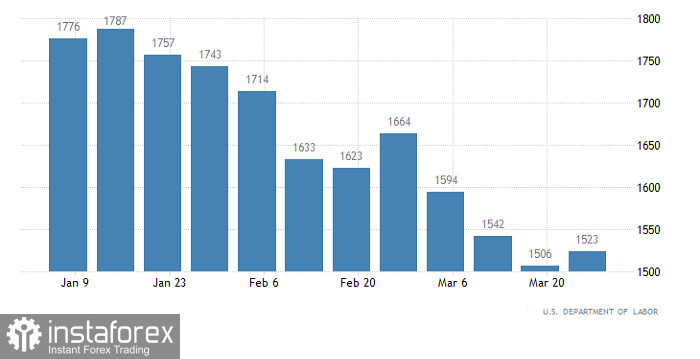

The data on jobless claims in the United States surprised market participants so much that they basically did not understand what to do with them. In general, this was the reason for the banal stagnation in the pound. It was expected that the number of initial applications for unemployment benefits would increase by 3,000, and repeated applications by 8,000. But in fact, it turned out that the number of initial applications decreased by 5,000, but repeated ones increased by 17,000. At the same time, the previous value of the number of initial appeals was reduced by 31,000, while the number of repeated ones was raised by as much as 199,000. The data turned out to be so unexpected and multidirectional that investors decided to simply ignore them.

Number of retries for unemployment benefits (United States):

Today, the pound's fate is in the hands of the Council of the European Union, which must approve a new package of sanctions against the Russian Federation. First of all, we are talking about sanctions against the supply of Russian coal. Whether this will be a complete ban on coal imports from Russia, or partial, is not yet clear. Details will only become known after the final decision has been made. In any case, this does not bode well for the single European currency. And although the heating season is over, by autumn Europe needs not only to find an alternative, but also to arrange supplies. No significant progress has yet been made on this issue. Besides, what if the summer turns out to be incredibly hot, and the Europeans have to save themselves with the help of air conditioners? A few years ago, this already happened, and then it almost led to the collapse of the entire energy system. So the single European currency in any case will be under pressure, and through the dollar index will pull the pound. The only question is the scale of the weakening. But this will depend on the nature of the sanctions against Russian coal.

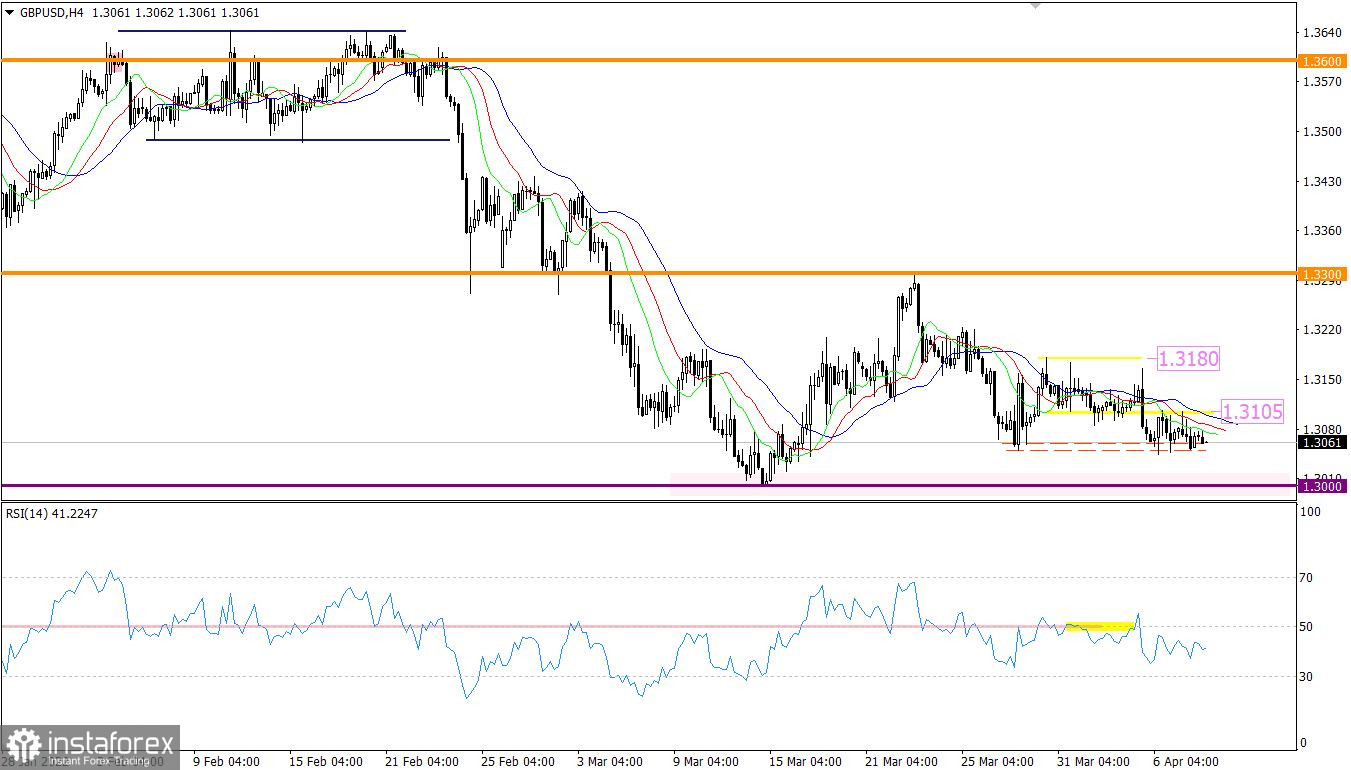

The GBPUSD currency pair, unlike EURUSD, has a restrained interest in short positions. This is indicated by a series of stagnations during the construction of a downward move. The 1.3050/1.3060 price area serves as an alternative point in the bears' way, which only temporarily postponed the restoration of dollar positions.

The RSI technical instrument is moving in the lower area of the 30/50 indicator in a four-hour period, which indicates a high interest of traders in short positions.

The MA sliding lines on the Alligator H4 and D1 indicator are directed downwards, which confirms the signal to sell the pound.

Expectations and prospects:

Price stagnation, with a high degree of probability, will be won back by the market in the form of accumulation of trading forces. This will lead to an acceleration in the market and, as a result, speculative transactions. A sell signal will be active the moment the price stays below 1.3050, which will lead to the weakening of the British currency, at least to the support level of 1.3000.

Complex indicator analysis has a variable signal in the short-term and intraday periods due to stagnation. Indicators in the medium term give a sell signal due to a downward trend.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română