The EUR/USD pair is trading somehow sideways in the short term. It seems undecided as the Dollar Index moves in a range as well. As you already know from my analyses, the DXY remains under pressure, it's still in a corrective phase, and that's why the EUR/USD pair maintains a bullish bias despite temporary drops.

Today, the Eurozone PPI reported a 0.9% drop versus the 0.8% drop expected while German Trade Balance came in at 10.8B versus the 7.5B expected and compared to the 6.9B in the previous reporting period.

The United States ADP Non-Farm Employment Change could come in higher at 152K last month versus the 127K in the previous reporting period. This represents a high-impact event and could bring sharp movements. Furthermore, the Final Services PMI, Trade Balance, and Unemployment Claims indicators will be released as well.

EUR/USD Outlook!

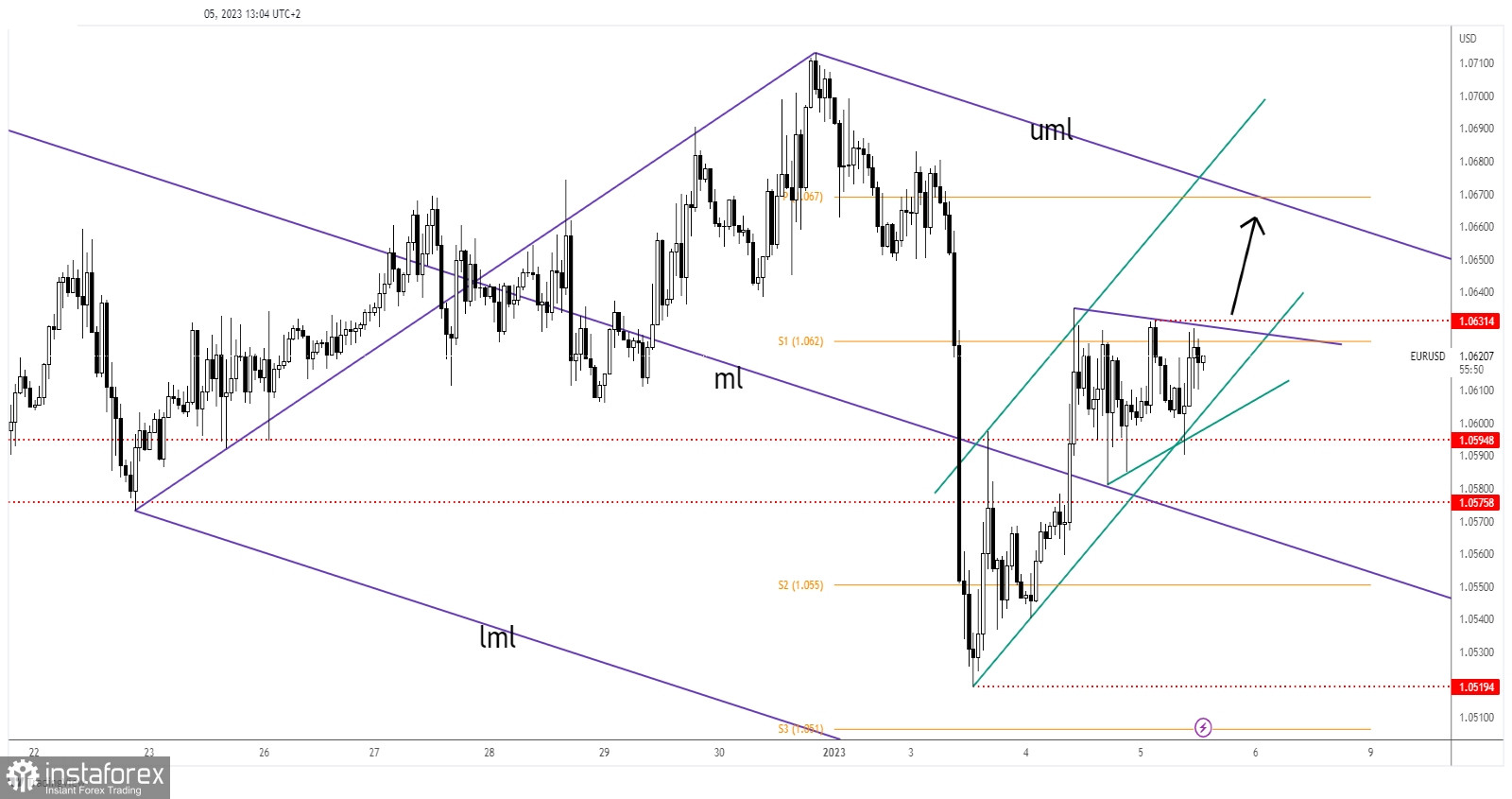

Technically, the price action developed a potential triangle pattern inside of the up channel. Today's false breakdown through the uptrend line and below 1.0594 signaled upside pressure.

So, as long as it stays above the uptrend line, the currency pair could resume its rebound. Still, the S1 (1.0620) and 1.0631 represent upside obstacles.

EUR/USD Forecast!

A new higher high, a valid breakout above 1.0631 activates further growth towards the upper median line (uml) and represents a bullish signal.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română