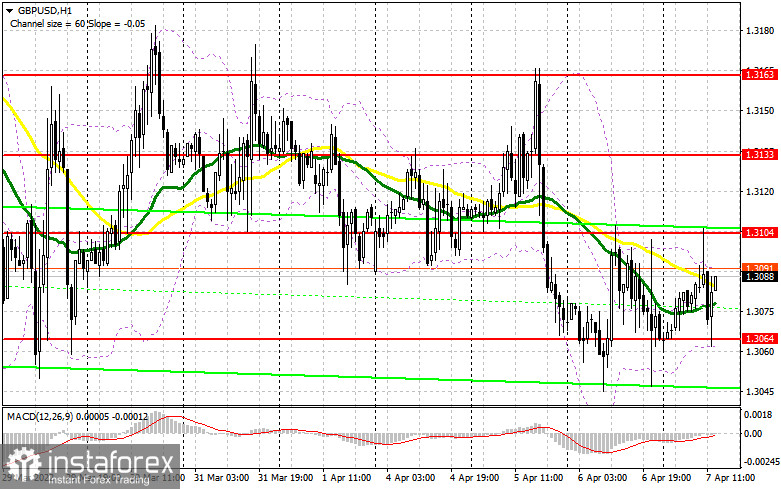

Strong sell-offs do not allow the pound to rally and return to the upper boundary of the sideways channel. Judging by how the price was held below 1.3099 in the morning, today the pound's rally has been postponed. In my forecast this morning I drew your attention to the level of 1.3099 and recommended entering the market from it. Let's have a look at the 5-minute chart and analyze what happened. The pound showed a sharp hike to 1.3099 and an unsuccessful attempt to fix above this level. This formed a good entry point to sell the pound, counting on the renewal of the bear market. However, after the 35 pips decline of the pair, the pressure on the pound has decreased, and the situation has stabilized a bit. We never reached the lower boundary of the channel. In the afternoon, there were some changes in the technical picture, which are worth paying attention to.

Long positions on GBP/USD:

Bulls are gradually accumulating their limit orders, trying to break through resistance at 1.3104. However, it is very important to prevent the pair from falling again and reaching below 1.3064. Here is why. Despite the pound's intraday increase, bulls need to hold the price above the new support at 1.3064 during the US session. If data on the US economy - Unemployment Claims and Consumer Credit - appears to be strong, the pound may drop below this level again. Only a false breakout of 1.3064 may form the first buy signal, which can send the GBP/USD back to 1.3104. The moving averages are located below this level. Notably, the MAs support the sellers now. A breakthrough and a retest of 1.3104 amid weak US data will form an additional entry point into long positions, which may strengthen the uptrend and open the way to 1.3133. The next target is located at 1.3163, where traders may lock in profits. However, the pair is likely to struggle while reaching this level in the current conditions. The good news on the geopolitical situation may bring the pound back to the upper boundary of the sideways channel. If the decline towards 1.3065 continues and bulls fail to hold the price above this level, the pair is likely to fall to the new lows and break out of the sideways channel. In this case, it is better to postpone buying the pound until the pair reaches a new low at 1.3033. It would be better to enter the market at that level only if a false breakout occurs. Buying the GBP/USD pair against the trend is possible from 1.3001, or lower from 1.2960, allowing an intraday correction of 30-35 pips.

Short positions on GBP/USD:

Judging by the current situation, bears are not going to miss a chance to resume the downtrend. They need to hold the price below resistance at the level of 1.3104, just below which the moving averages are located. A false breakout at this level will create an entry point into short positions with an aim to strengthen the downtrend and drop to 1.3064. However, it is hard to say what bears should do to make a breakthrough at this level and strong US data is unlikely to help much. Probably, the sell-off in the stock market and a sharp jump in the yields of the Treasuries will make the US dollar attractive again today. Bulls have a different viewpoint on what is going on in the market and they will try not to let the pair go lower. Only a breakthrough and a retest of 1.3064 is likely to trigger buyers' stop-loss orders and form a sell signal that may send the GBP/USD pair to the lows of 1.3033 and 1.3001. The next target is located in the area of 1.2960, where traders are advised to take a profit. If the pair grows during the US session and sellers show weak activity at 1.3104, it will not be a problem for the sellers, but it is better to postpone the sales until the pair reaches 1.3133. Opening short positions at this level is possible only if a false breakout is formed. It is possible to sell the pair on a rebound from the high of 1.3163, or higher from 1.3192, allowing an intraday rebound to the downside by 30-35 pips.

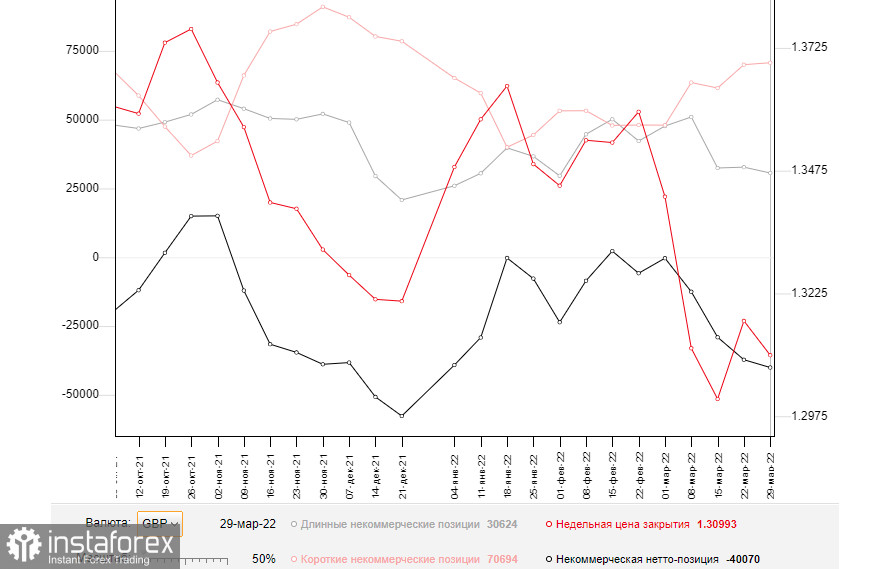

The COT (Commitment of Traders) reports for March 29 showed an increase in short positions and a reduction in the long ones. It indicates that market players are concerned about the state of the UK economy and the risks of high inflation, which is sure to add pressure on households in the UK. Experts note that the situation is likely to worsen, as inflation risks, which are mostly negative for the economy, are now quite difficult to assess. Against this background, the dovish stance of the Governor of the Bank of England seems inappropriate, which does not allow buyers of risky assets to open long positions on the pound in the expectation of a further increase in interest rates. Bulls can count only on the positive results of negotiations between Russia and Ukraine and progress towards a settlement of the conflict. Meanwhile, the aggressive policy of the Fed continues to maintain demand for the US dollar in view of the increased significant risks of economic recession already in the second half of the year. The March 29 COT report indicated that long non-commercial positions fell to 30,624, from 32,753, while short non-commercials jumped to 70,694 from 69,997. This led to an increase in the negative nonprofit net position from -37,244 to -40,070. The weekly closing price was down to 1.3099 against 1.3169.

Indicators' signals:

Moving averages

Trading is carried out near the 30- and 50- day moving averages, indicating some market uncertainty with further direction.

Note: Period and prices of moving averages are considered by the author on hourly chart H1 and differ from the common definition of classic daily moving averages on daily chart D1.

Bollinger Bands

If the pair declines, the level of 1.3050 at the lower boundary of the indicator will act as support.

Indicators description

- Moving average defines the current trend by smoothing out volatility and noise. Period 50. Marked in yellow on the chart.

- Moving average defines the current trend by smoothing volatility and noise. Period 30. Marked in green on the chart.

- MACD (Moving Average Convergence/Divergence) indicator Fast EMA 12. Slow EMA 26. SMA 9

- Bollinger Bands. Period 20

- Non-commercial traders are speculators, such as individual traders, hedge funds, and large institutions, which use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open positions of non-commercial traders.

- Short non-commercial positions represent the total short open positions of noncommercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română