Yesterday, USD bulls received solid support from the FOMC Minutes, which confirmed the intention of the Fed to act more aggressively. The regulator is now expected to raise interest rates by 50 basis points and implement the quantitative tightening plan that would see the central bank sell off about $100 billion of assets a month at the meeting in May. Above all else, the Fed is going to start reducing the size of the balance sheet by up to $2 trillion, according to some estimates.

Yesterday, the dollar strengthened after the release of the FOMC Minutes. Today, the currency is still on the rise. During the European session, DXY, a measure of the value of the greenback relative to a basket of six main foreign currencies, hit its swing high of 99.84, unseen in almost 2 years. Likewise, US government bond yields increased yesterday, with 10-year bonds jumping to 2.658% for the first time since March 2019.

Should DXY break above the important psychological barrier of 100, bullish activity will increase, experts assumed.

Speeches by several Fed members scheduled for today are likely to confirm the regulator's intention to act more aggressively.

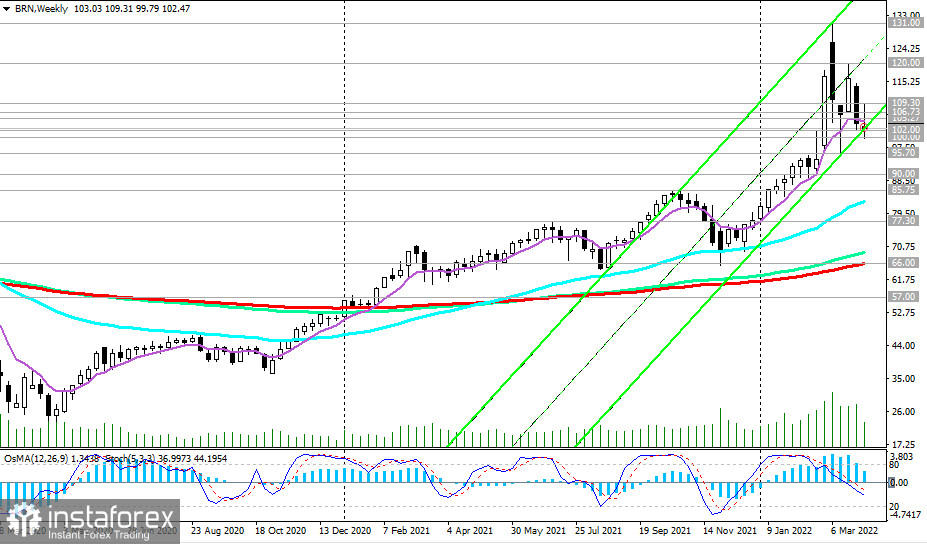

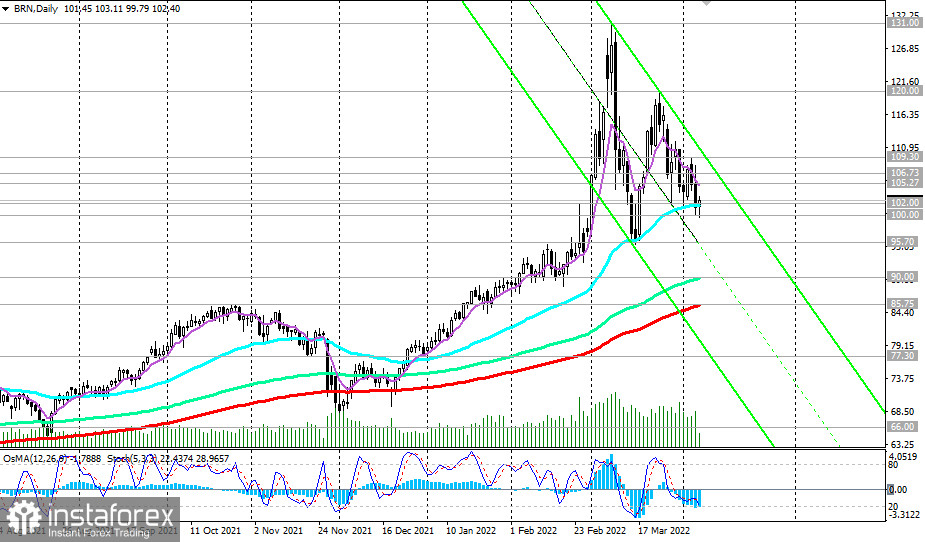

At the same time, the oil market has been in a bearish correction since March when prices hit an all-time high in the wake of geopolitical developments in Ukraine.

Thus, BRENT futures touched the level of $131 a barrel in March, and WTI futures exceeded $126 a barrel. Today, oil prices are hovering around the 3-week low. It was reported that 29 IEA members are contemplating releasing some 120 million barrels from their strategic reserves. Earlier, the US announced it would release 180 million barrels from its emergency reserves.

On Wednesday, the US Department of Energy reported an increase in oil inventories by 2.421 million barrels after a 3.449 million barrel drop in the previous week and compared with market expectations for a 2.056 million fall.

Nevertheless, the release of global emergency reserves will not be enough to make up for the missing supplies from Russia, analysts said. At the same time, OPEC+ is reluctant to expand production. The cartel believes that the oil market is now well-balanced and current volatility is caused by geopolitical developments.

So far, we can see a bearish correction in the oil market. It may seem wise to open new trades and increase the volume of long positions at the current levels. Last month, Russia's Deputy Prime Minister Alexander Novak warned that Europe would struggle to quickly replace Russian oil and prices would soar above $300 a barrel. What if he was right?

Tomorrow, Baker Hughes will present its weekly oil rig count.

The latest report logged an increase in oil rigs to 533 (from 531, 524, 527, 519, 522, 520, 516, 497, 495, 491, 481, 480, 475, 471, 467, 461, 450, 445, 433, 428, 421, 411, 401, 394, 410, 405, 397 in the previous reporting periods). This means the number of oil producers in the US is again on a rise. In the short term, this fact will have a negative effect on oil quotes.

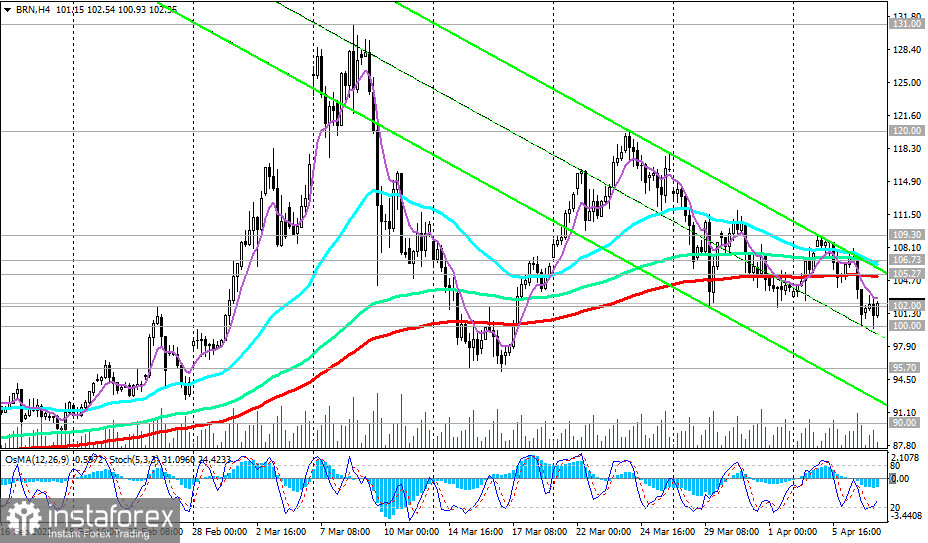

Technical analysis and outlook:

Generally speaking, the oil market is now in a bearish correction. Today, Brent has already approached the barrier of $100 a barrel. So far, the price is still above this important psychological level, trading above the support level of 102.00, in line with the EMA50 and the lower limit of the ascending channel on the daily chart.

In the case of growth, resistance levels at 105.27 (in line with the EMA200 on the 4-hour chart), and 106.73 (in line with the EM200 on the 1-hour chart) will stand as the closes targets.

A breakout of swing resistance at 109.30 will confirm the fact that the uptrend has resumed.

Alternatively, if the price breaks through support at 100.00, the bear corrective move will continue, with targets at long-term support levels of 90.00 (in line with the EMA144 on the daily chart), 85.75 (in line with the EMA200 on the daily chart), and intermediate swing support at 95.70.

As for the main scenario, price growth is likely to resume from current levels. It may well be the right moment to enter long positions and resume buying.

Support: 102.00, 100.00, 95.70, 90.00, 85.75, 77.30, 66.00

Resistance: 105.27, 106.73, 109.30, 114.00, 120.00, 130.00, 131.00

Recommendations:

Brent: Sell Stop 99.30. Stop-Loss 103.30. Take-Profit 96.00, 91.00, 87.00, 77.30, 66.00

Buy Stop 103.30. Stop-Loss 99.30. Take-Profit 105.00, 106.00, 109.00, 114.00, 120.00, 130.00, 131.00

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română