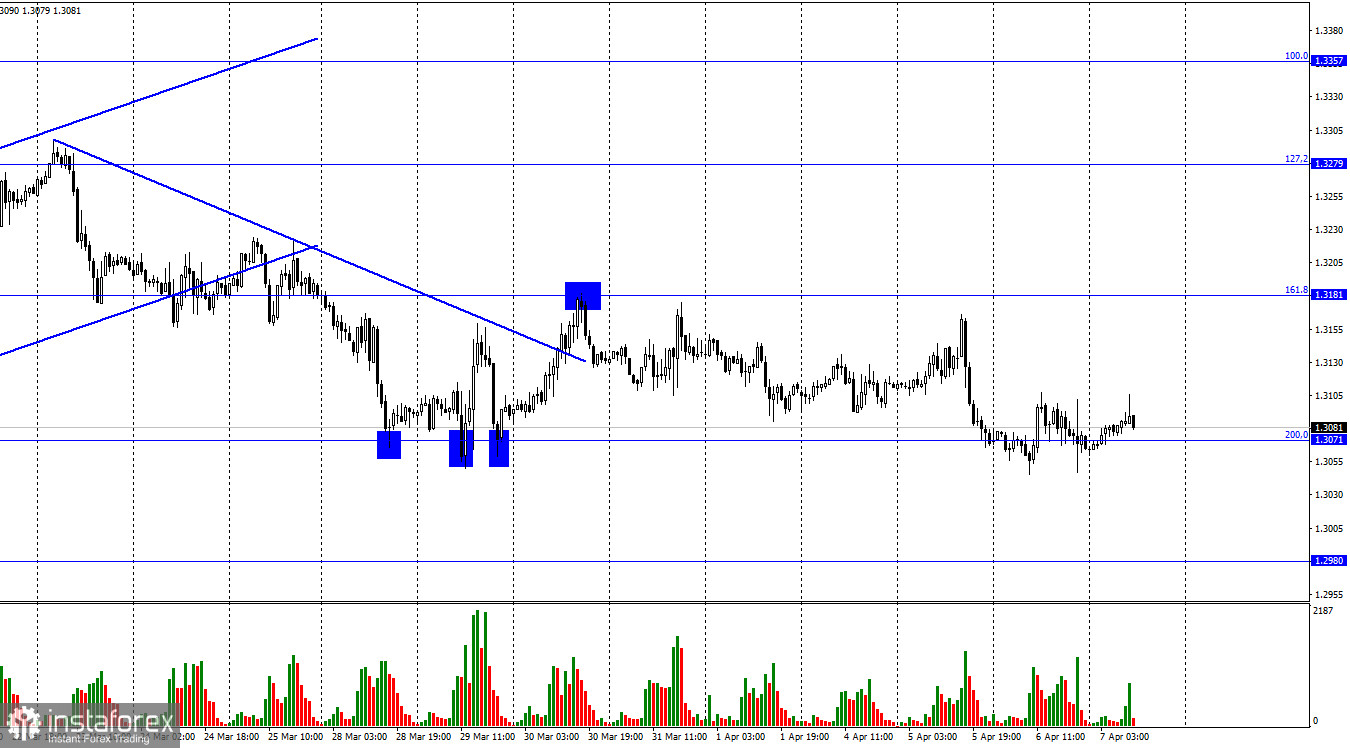

Hi everyone! On the hourly chart, the GBP/USD pair made an attempt to resume an upward movement on Wednesday. Yet, it was even unable to rebound from 1.307, the Fibonacci correction level of 200.0%. If the pound sterling drops below this level, the pair may reach the next target level of 1.2980. The pair may reverse upwards from this level as well. However, its recent rebounds have brought only approximately 100 pips. In my opinion, the pound sterling is likely to start again its downward movement. Last night, the British currency was supported by the publication of the Fed meeting minutes. This morning, it was also trading steadily. Notably, it seems that the main goal of the pound sterling is to stay afloat, trading more or less at the same levels against the US dollar. At the same time, it lacks drivers to rise. Yesterday, the UK released its construction industry report. Although the March figure remained almost unchanged versus the February reading, the pound sterling advanced slightly.

Yesterday, US Treasury Secretary Janet Yellen made a speech at a US House Financial Services Committee hearing. She said that Russia should be expelled from the Group of 20 major economies forum. The United States will boycott some G20 meetings if Russian officials show up. Yellen noted that Russia's aggression in Ukraine could result in negative economic consequences not only in Ukraine but also worldwide. "President Biden's made it clear, and I certainly agree with him, that it cannot be business as usual for Russia in any of the financial institutions. He's asked that Russia be removed from the G20, and I've made clear to my colleagues in Indonesia that we will not be participating in a number of meetings if the Russians are there," she added. Indonesia holds the G20 presidency this year. So, her speech was mostly about Ukraine and Russia but not about finance, economics, and monetary policy.

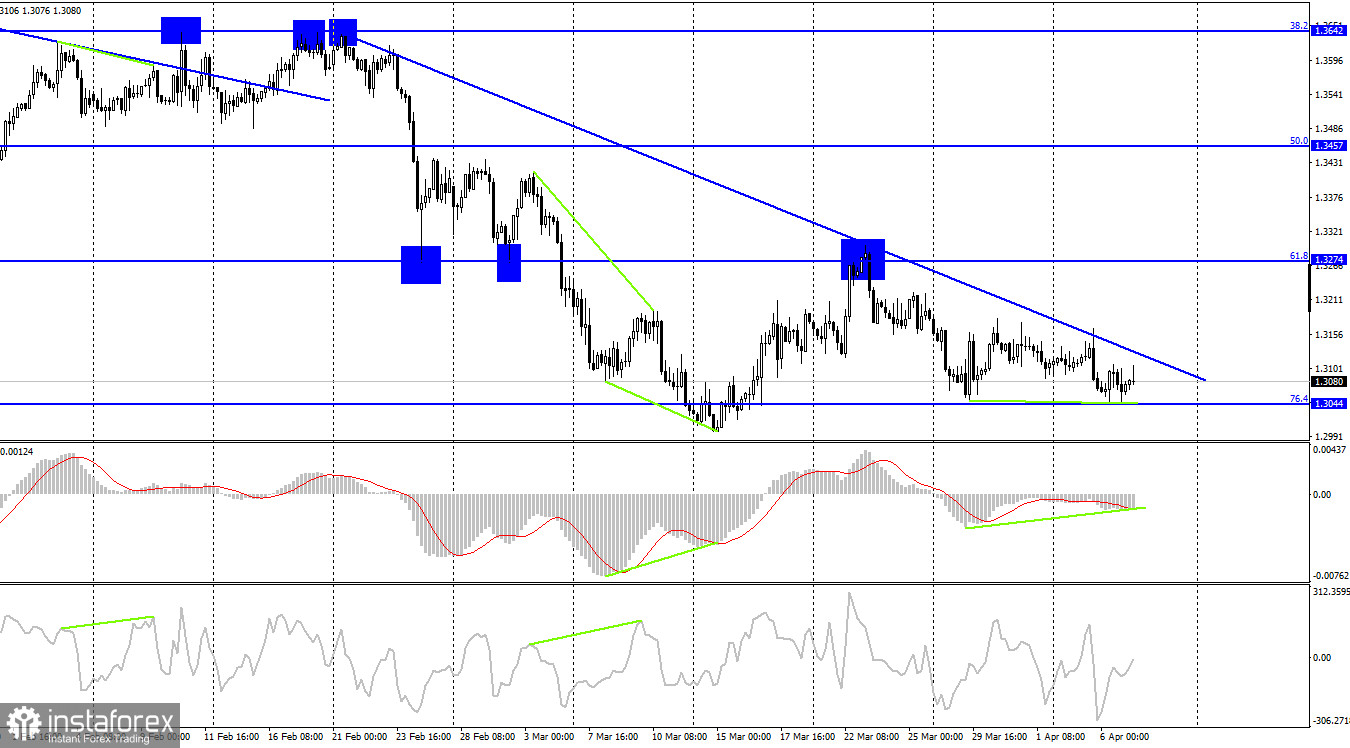

On the 4H chart, the pound/dollar pair declined to 1.3044, the Fibo correction level of 76.4%. The rebound from this level may trigger an upward reversal to 1.3274, the Fibo correction level of 61.8%. However, there is also a descending trend line on the chart. The pair needs to break through this line before rising higher. If it holds below the 76.4% level, it will increase the probability of a further fall to 1.2674, the next Fibo level of 100.0%. The bullish divergence of the MACD indicator keeps the pair from declining. However, it is unlikely to last long.

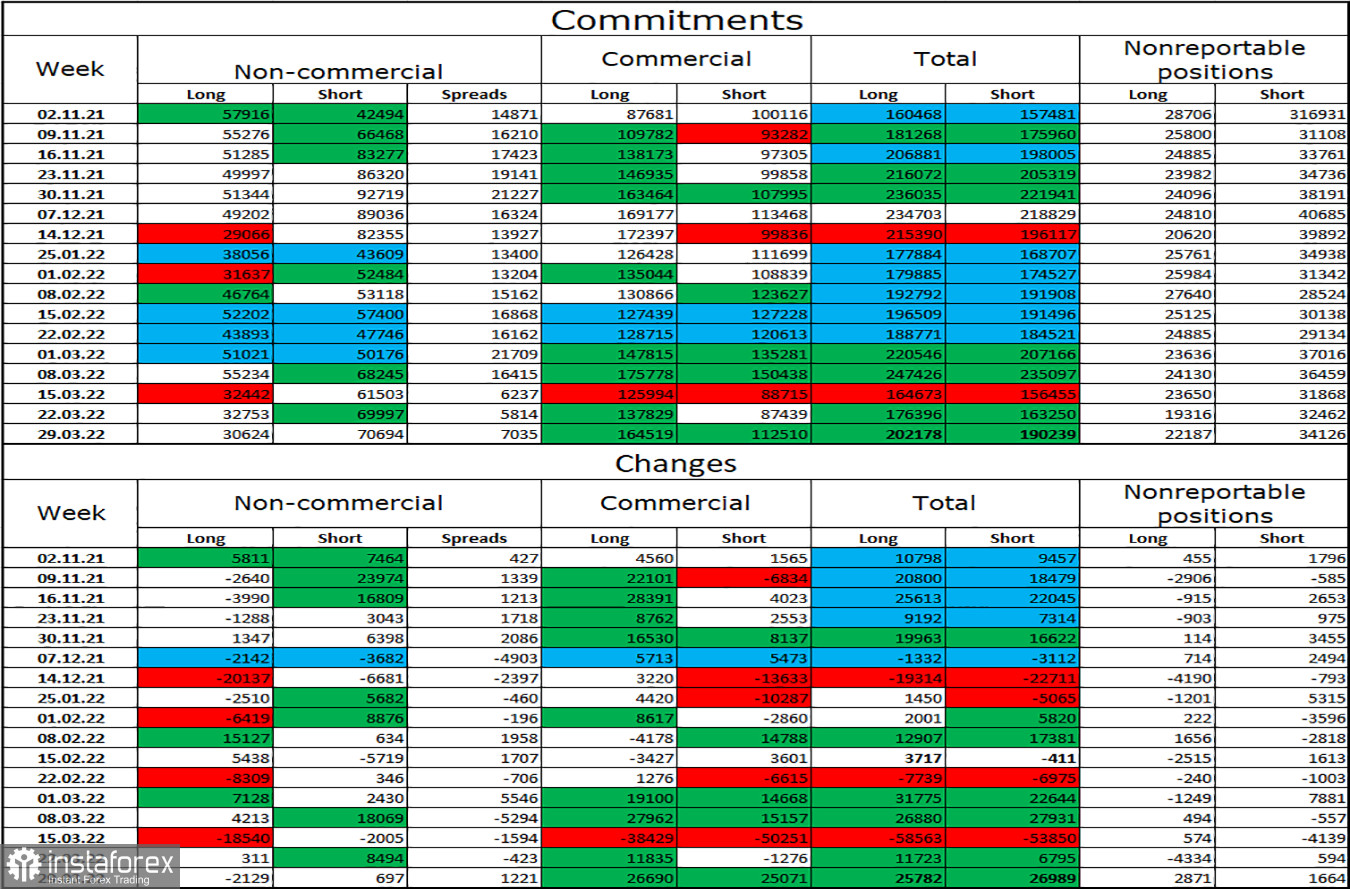

Commitments of Traders (COT):

The mood of the "Non-commercial" category of traders has not changed significantly over the week. The number of Long contracts in the hands of speculators decreased by 2,129, while the number of Short contracts rose by 697. Thus, the general mood of the major market players has become even more bearish. The ratio between the number of Long and Short contracts already corresponds to the real market situation. Long trades exceeded short ones by 2.5 times. The pound sterling is falling. Market players are selling the pound sterling more than buying it. Thus, I expect a further drop in the British currency. My forecast is mainly based on the geopolitical situation and COT reports.

Macroeconomic calendar for the US and the UK:

US- Initial jobless claims (12:30 UTC).

US – US Treasury Secretary Janet Yellen will deliver a speech (14:30 UTC).

On Thursday, the economic calendar for the UK is completely empty. In the US, Janet Yellen will speak in Congress again. However, she will probably talk again about sanctions against Russia and the military conflict in Ukraine. So, market sentiment is unlikely to be affected by this event.

Outlook for GBP/USD and trading recommendations:

It is recommended to open short positions on the pound sterling today with downward targets of 1.2980 and 1.2895 if it declines below 1.3044 on the 4H chart. It is better to open long positions if it consolidates above the trend line on the 4H chart with upward targets of 1.3181 and 1.3274.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română