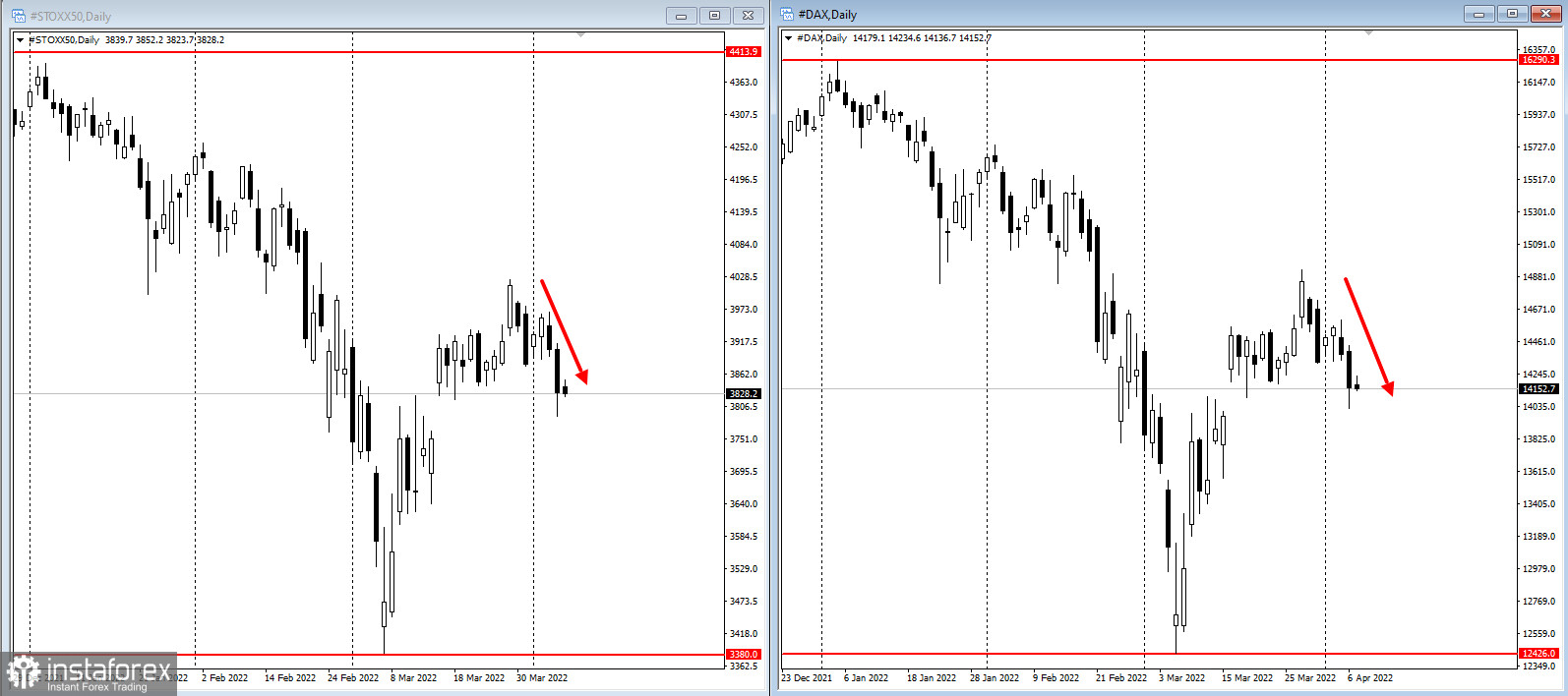

Global stock markets tumbled on Wednesday after Fed minutes showed officials were focused on curbing inflation, outlining plans to cut the balance sheet by more than $1 trillion a year. It continued up to today's Asian session, sending the benchmark MSCI down more than 1%. The European Stoxx50 also declined despite a 10% rally in shares of Atlantia SpA.

Meanwhile, S&P 500 contracts remained virtually unchanged despite recent corporate events, which include the purchase of an over $4.2 billion stake in HP.

Oil prices, on the other hand, continued to increase, with Brent trading above $102 per barrel.

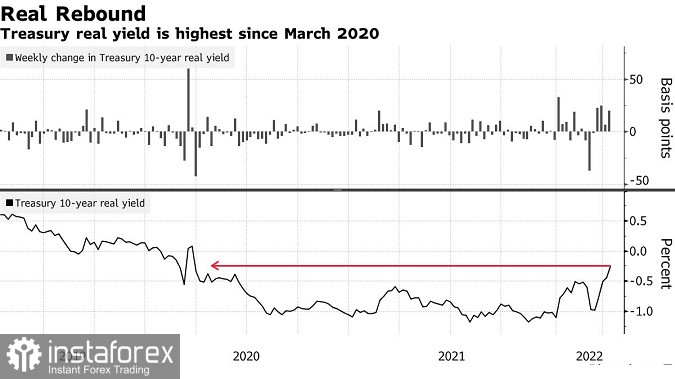

10-year Treasury yields, meanwhile, fell two basis points to 2.57%.

Clearly, commodity markets are suffering from the disruption caused by the ongoing conflict in Ukraine. Oil prices rose to a very high level, curtailing a slump caused by the International Energy Agency's decision to deploy 60 million barrels of emergency reserves.

In China, officials will reportedly use monetary policy tools at "the right time" and consider other measures to stimulate consumption.

Key events to watch this week:

- speech of Fed members James Bullard, Raphael Bostic and Charles Evans on Thursday;

- monetary policy decision of the Reserve Bank of India on Friday.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română