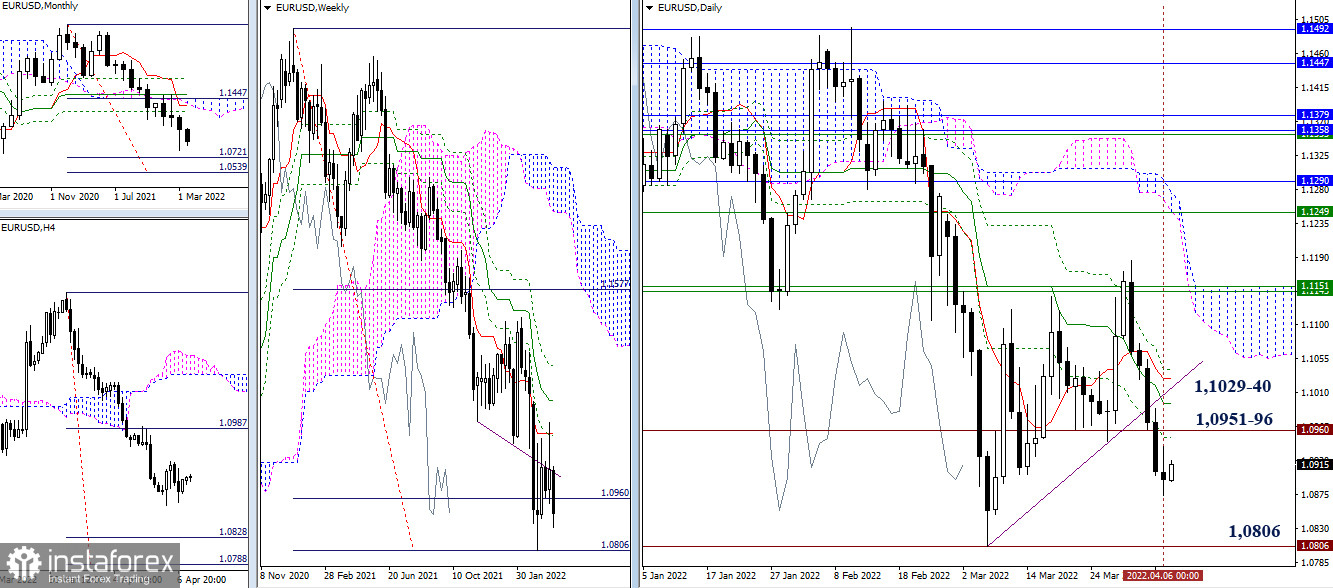

EUR/USD

The past day was not productive. Sellers reduced their activity and stopped, despite updating the previous low. The main conclusions and expectations of development options have not changed. For bears, the nearest target is the minimum extremum (1.0806), enhanced by the level of 100% completion of the weekly target (1.0806). With the recovery of the downward trend, the next reference point will be the downward monthly target (1.0721 – 1.0539).

The most significant weakening factor in this direction is the previously mentioned circumstance – the long lower shadow of the month of March. It is the mood of the end of March that will now prevent the implementation of the decline. The nearest resistance zone is formed in the current situation by a daily cross (1.0951 – 1.0996 – 1.1029 – 1.1040), which is still golden, which means it also acts to weaken the current bearish positions.

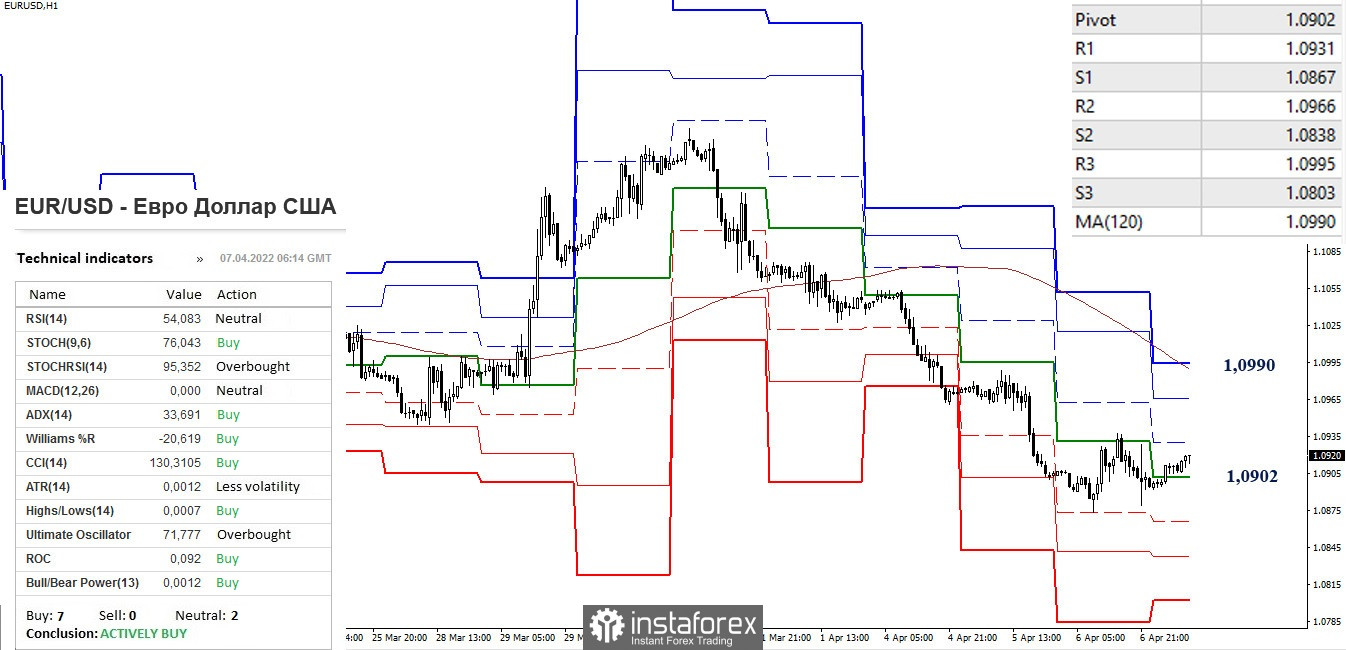

On the lower timeframes, the pair is currently in the correction zone. Bulls are now working above the first key reference point of the lower timeframes – the central pivot point (1.0902). If the upward movement continues, the interests of the bulls will be aimed at working out upward reference points, the main of which is the resistance of the weekly long-term trend (1.0990), intermediate resistances along this path are 1.0931 (R1) and 1.0966 (R2). The completion of the correction and the restoration of the downward trend (1.0874) will return the relevance to the support of the classic pivot points (1.0867 – 1.0838 – 1.0803).

***

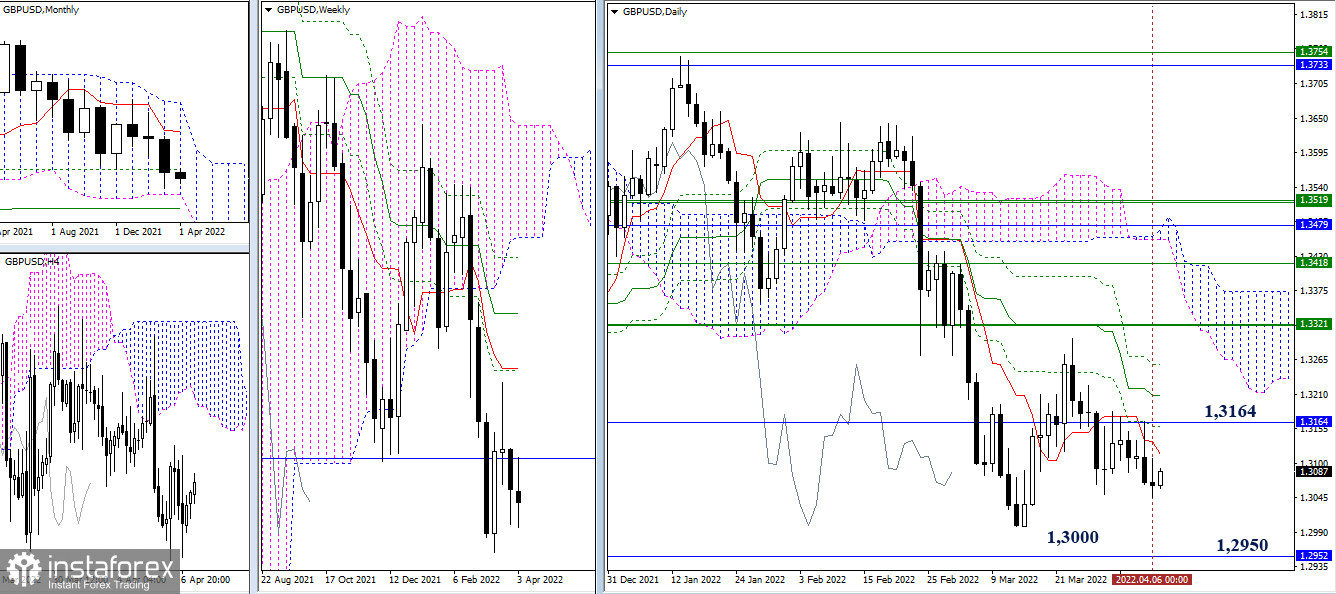

GBP/USD

After an attempt to leave the correction zone, bears have not yet managed to achieve a decent result. The main reference points remain in place in the current conditions. For bears, the minimum extremum (1.3000) and monthly supports 1.2950 and 1.2830 are still important. And for bulls, resistance can be noted at the locations of the daily Ichimoku cross (1.3114 – 1.3159 – 1.3209 – 1.3258), and the monthly Fibo Kijun (1.3164) serves as support.

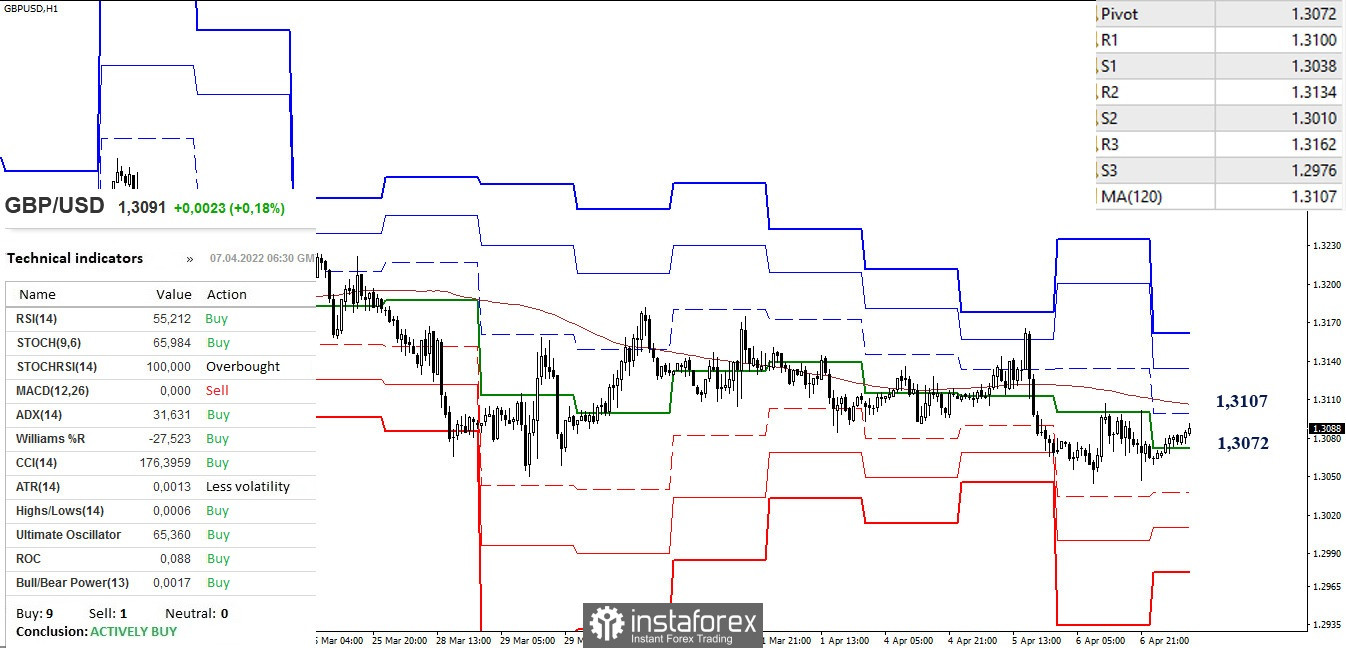

On the lower timeframes, some advantage is on the side of the bears. Nevertheless, the pair continues to remain in the zone of influence and attraction of key levels, which today are consolidating their efforts in the region of 1.3072 – 1.3107 (central pivot point + weekly long-term trend). The resistance of the classic pivot points (1.3134 – 1.3162) can be considered as additional upward targets within the day. Supports of the classic pivot points for today are at 1.3038 – 1.3010 – 1.2976.

***

In the technical analysis of the situation, the following are used:

higher timeframes – Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română