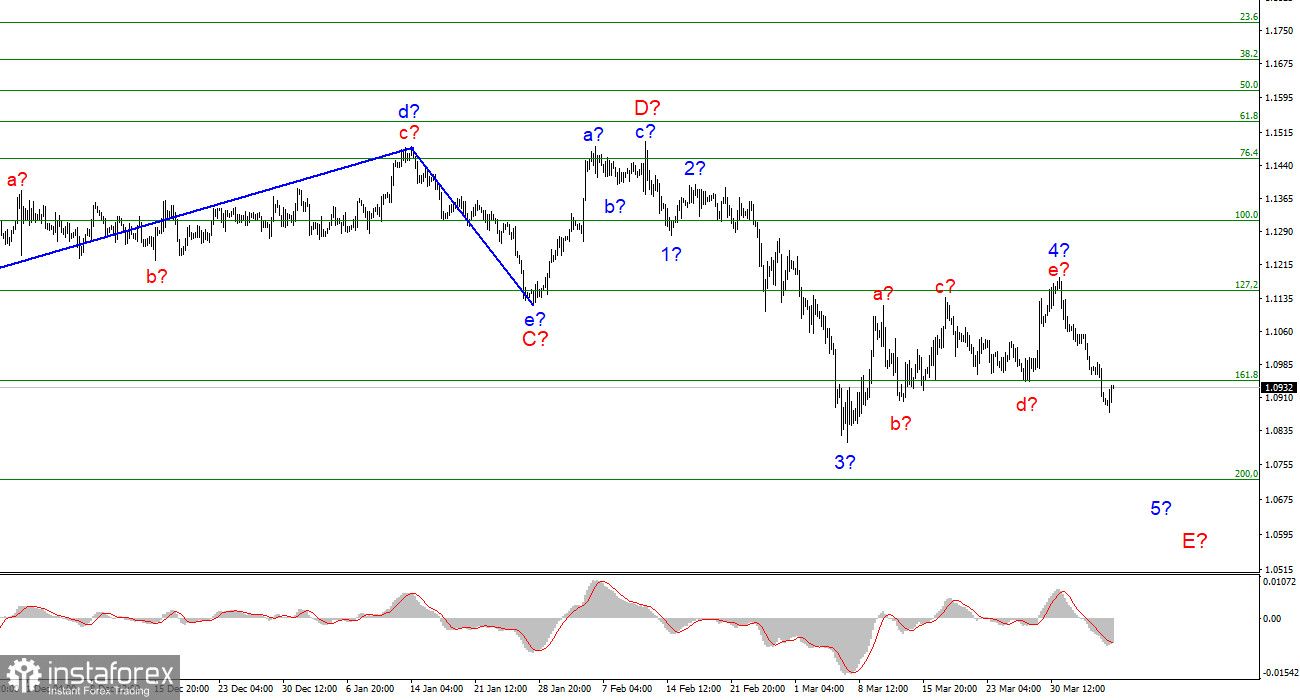

The wave marking of the 4-hour chart for the euro/dollar instrument continues to look convincing. The proposed wave 4 took a five-wave form and turned out to be completely different from wave 2. Nevertheless, now this wave is recognized as complete, and the wave pattern does not require any changes. Accordingly, the instrument began constructing the proposed wave 5-E. If this assumption is correct, then the decline in the quotes of the euro currency may continue for another one or two months. At the moment, the entire wave structure of the downward trend section looks almost fully equipped, but wave 5-E is likely to also take a five-wave form. If this is the case, then at the moment, the construction of only the first wave consisting of 5-E has been completed. Thus, the instrument still has a fairly strong potential for decline. The first target is around 1.0721, which equates to 200.0% Fibonacci. At the same time, much of the instrument will now depend not only on geopolitics but also on gas and oil prices and the further rupture of relations between Russia and the European Union.

The situation for the euro currency is getting worse every day

The euro/dollar instrument fell by 65 basis points on Tuesday and increased by 30 on Wednesday. Price changes are not so strong, but it does not matter for the European currency, the demand for which, though slowly, continues to decline. Yesterday, it became known that the European Commission approved a new package of sanctions against the Russian Federation in response to what was seen in the Ukrainian cities of Bucha, Gostomel, and Irpen. Photos of the destruction and killing of civilians shocked the whole world and pushed the European Union to take action. The euro currency immediately began a new decline. A little later, it became known that a fairly large number of FOMC members already support a 50 basis point rate hike in May. And already at the next FOMC meeting, the start of the Fed's balance sheet reduction program may be announced, which provides for the sale of securities purchased in recent years. On this news, the demand for the dollar increased. And what happened in the end? Demand for the euro fell due to new EU sanctions, and demand for the dollar increased due to the tightening of the Fed's rhetoric.

I would like to mention the gas issue separately. Europe is very dependent on gas and imports most of it from Russia. Gas prices are rising, and they are growing for a reason. They are growing precisely because of the difficult geopolitical situation in Ukraine, because of the military conflict between Ukraine and Russia, because of the very likely imposition of an embargo on gas from Russia, and because of the already imposed gas embargo on both Russia by the United Kingdom and the United States. The market is very sensitive to any geopolitical changes, and the European Union is actively suffering from these changes. Oil and gas prices are rising all over the world, but America can cope with its inflation, but the European Union is unlikely. Inflation in Europe is already almost as high as in the United States, and there are no instruments to combat inflation, as in the United States. Thus, analysts predict a serious recession and high inflation for the European Union, which cannot have a positive effect on the euro exchange rate.

General conclusions

Based on the analysis, I still conclude that the construction of wave E continues. If so, now is still a good time to sell the European currency with targets located around the 1.0721 mark, which corresponds to 200.0% Fibonacci, for each MACD signal "down". The current wave marking assumes the construction of a wave 5-E, which can also turn out to be very long. A correction wave may form in the next few days, after which I expect a new decline in the instrument.

On a larger scale, it can be seen that the construction of the proposed wave D has been completed, and the instrument has updated its low. Thus, the fifth wave of a non-pulse downward trend section is being built, which may turn out to be as long as wave C. If this assumption is correct, then the European currency will still decline.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română