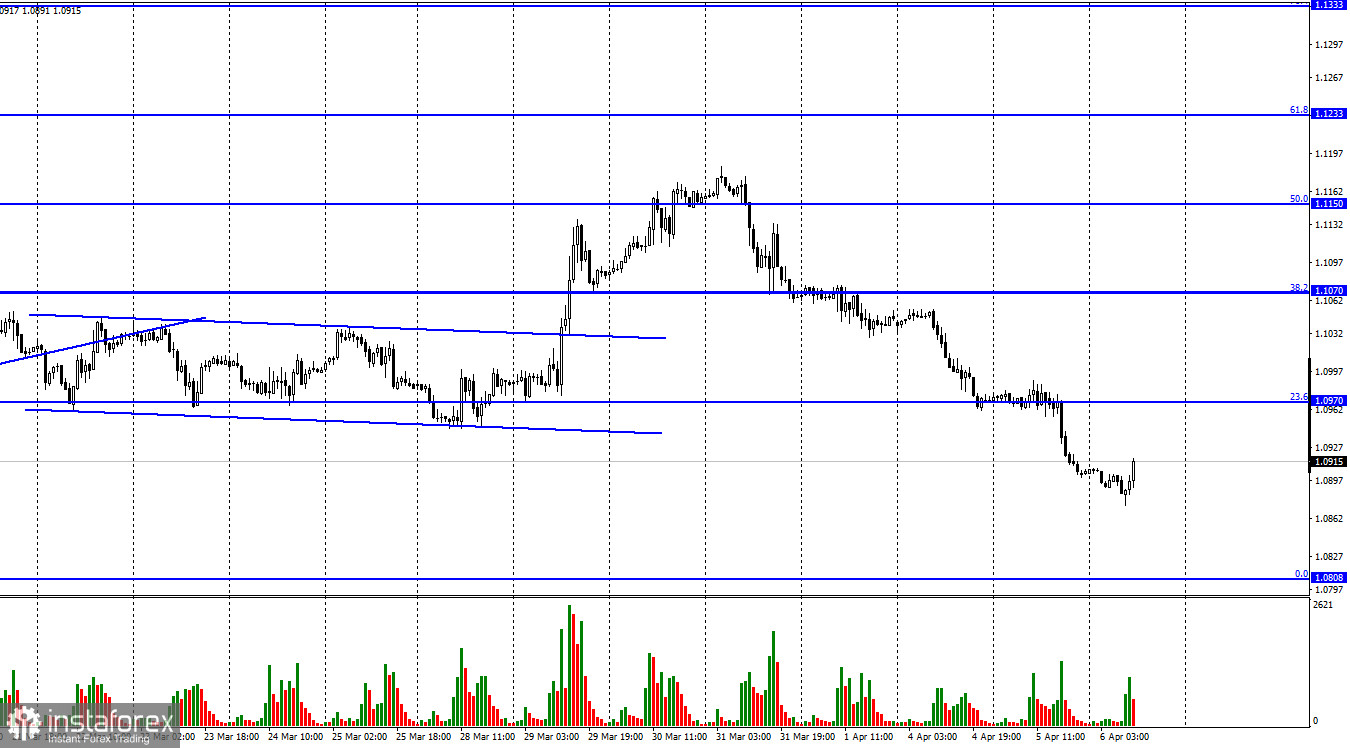

Hello, dear traders! On Tuesday, EUR/USD incurred losses, settled below the 23.6% retracement level (1.0970), and then fell to the 0.0% Fibonacci level (1.0808). Generally speaking, Tuesday was a calm day in the market. The key events were the release of business activity data in the eurozone and the United States as well as speeches by several FOMC members. Since traders commonly react to just one out of ten or even twenty speeches by FOMC members, I usually don't pay attention to them. Their rhetoric rarely contradicts the general stance of the regulator. This is exactly what happened yesterday when Lael Brainard said the Fed is prepared for aggressive measures to tame inflation by raising rates further and starting to reduce the balance sheet in May. However, the regulator's intention to continue rate hikes is no longer breaking news.

Thus, Chairman Powell earlier said that the interest rate could be raised by 50 basis points at the May meeting. Meanwhile, the central bank's readiness to reduce the balance sheet made the news. Initially, the Fed planned to resort to this measure as early as the end of the year or the summer. Yesterday, it became known about the regulator's intention to reduce the balance sheet already in May. We may expect the Fed to announce the decision at the next FOMC meeting. This is exactly what caused a plunge in the euro and provided support for the dollar. Brainard's speech and the ISM non-manufacturing PMI came out practically at the same time. Therefore, the market's reaction to Brainard's speech could be easily mistaken for the one to the ISM non-manufacturing PMI. In my view, the market showed no reaction to an increase in figures to 58.3 from 56.5. Geopolitical developments had little effect on the market yesterday.

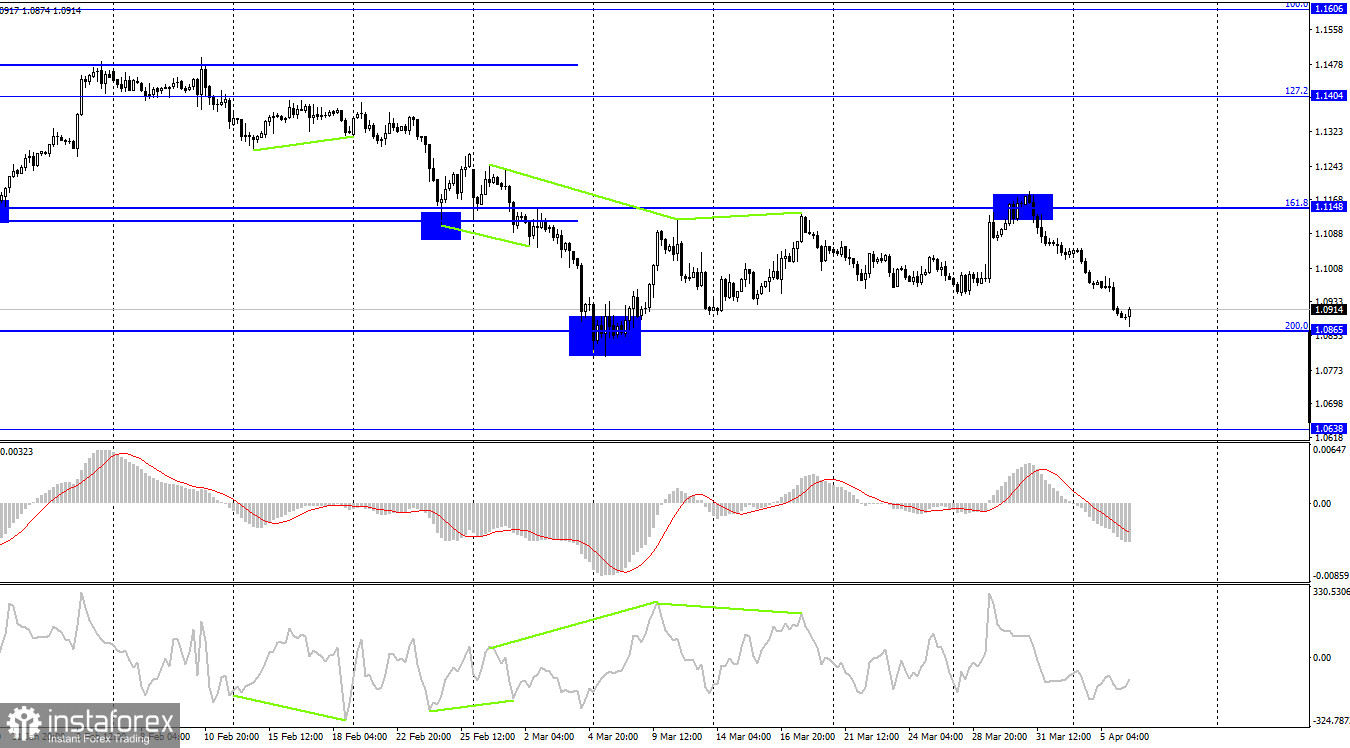

The pair approached the 200.0% retracement level (1.0865) on the 4-hour chart. A rebound from this mark may lead to a bullish reversal with an increase to the 161.8% Fibonacci level (1.1148). Consolidation below 1.0865 will increase the likelihood of a fall to 1.0638. Neither of the indicators signals an impending divergence.

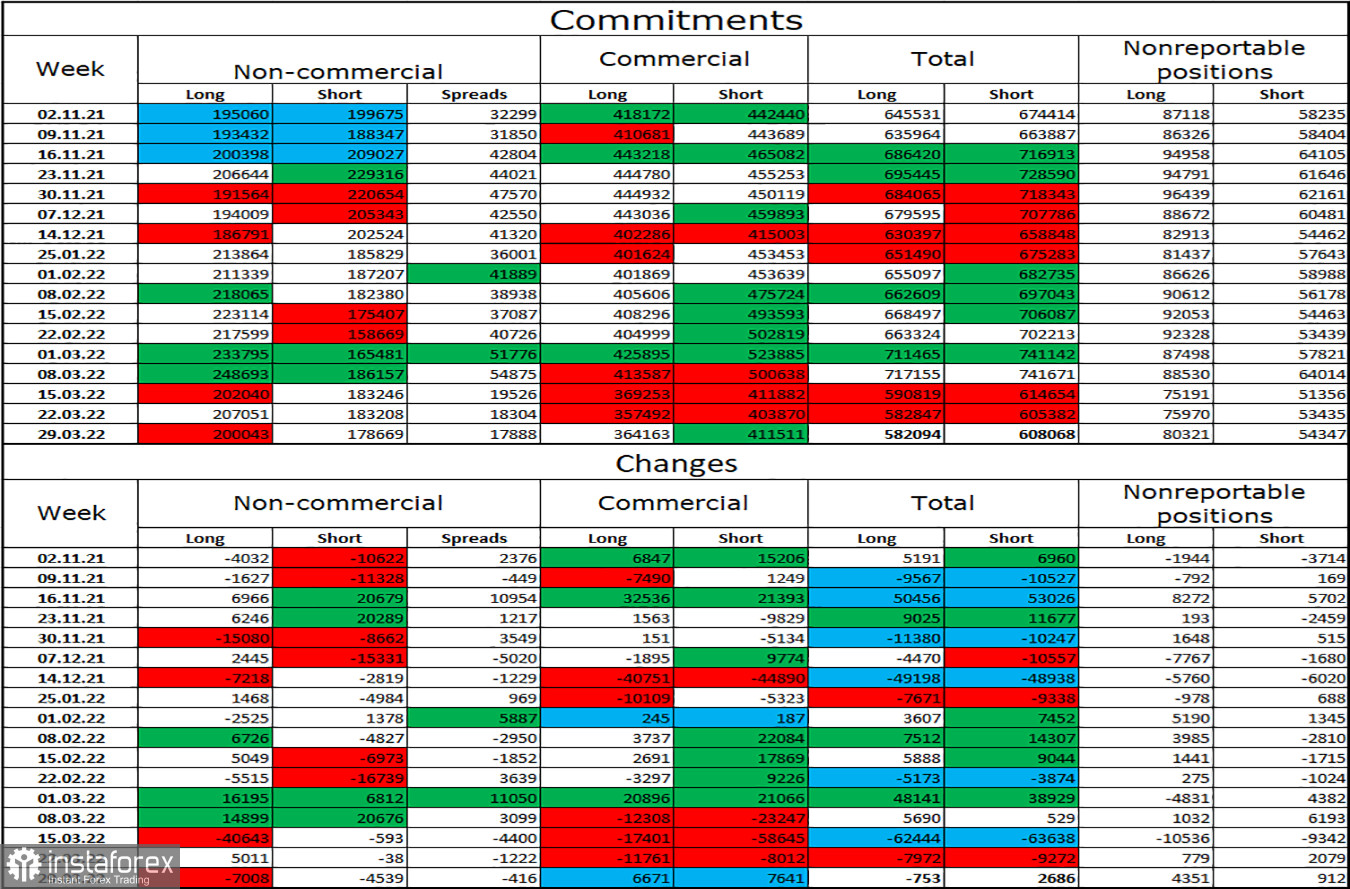

Commitments of Traders:

In the previous week, speculators closed 7,008 long positions and 4,539 short ones, which means bullish sentiment somewhat decreased. The number of long and short positions now totals 200,000 and 1878,000 respectively. Generally speaking, the bullish sentiment of non-commercial traders has barely changed for two weeks. In this light, EUR should be bullish as well. However, the fundamental background provides support for the greenback. So, we may now see how the currency is depreciating despite the bullish sentiment of major players. In addition, the geopolitical factor will continue weighing on the euro.

Today's macro events:

United States - Treasury Secretary Yellen's speech (14-00 UTC); FOMC Minutes (18-00 UTC)

There are two crucial events in today's macroeconomic calendar. However, the reaction of traders to them will depend on their content.

Outlook for EUR/USD:

Short positions could be opened with the target at 1.0808 after consolidation below 1.0970 on the 1-hour chart. Meanwhile, it would be wise to go long after a rebound from 1.0865 on the 4-hour chart, with targets at 1.0970 and 1.1070.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română