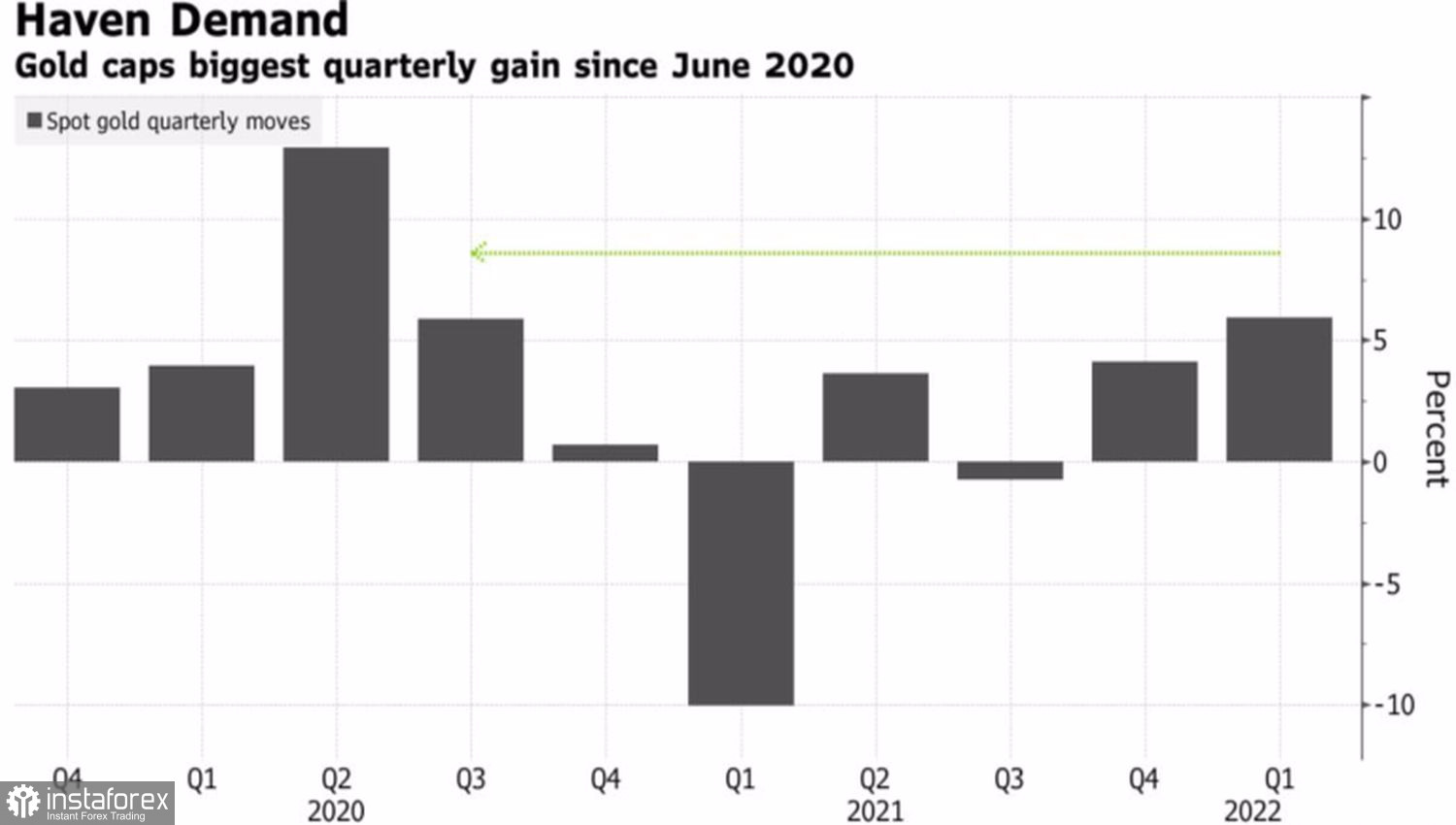

The first quarter was the best for gold since 2020. In January-March, its value increased by 5.9% due to the high demand for safe-haven assets amid the armed conflict in Ukraine and due to the use of precious metal as a tool to hedge inflationary risks. And while the Fed is now poised to tighten monetary policy with the most aggression in decades, the XAUUSD bulls are not about to throw a white flag.

Quarterly dynamics of gold

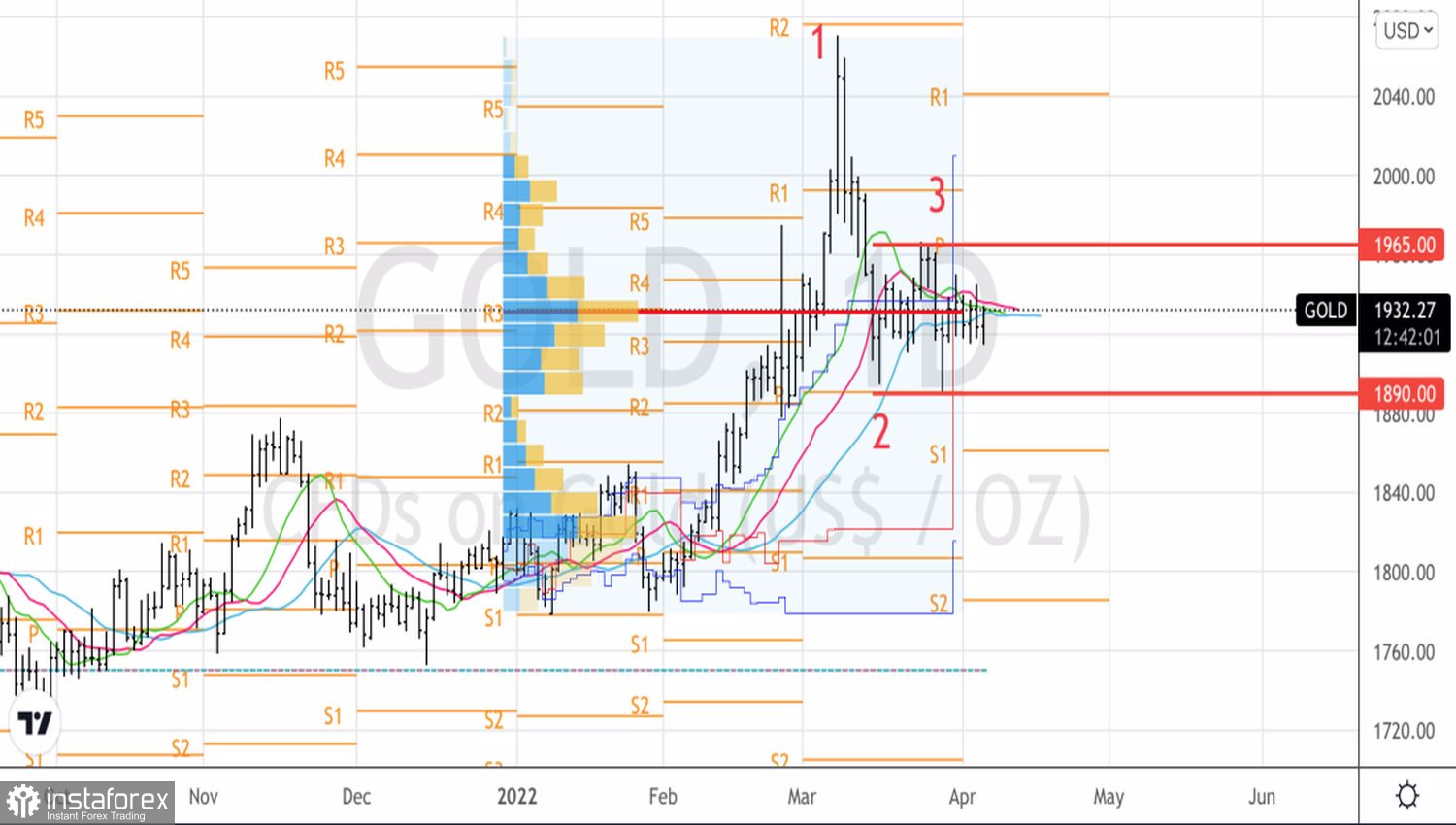

Despite the hawkish rhetoric of FOMC officials, their willingness to raise the federal funds rate by 50 basis points in May and bring borrowing costs to a neutral level of 2.4-2.5% as quickly as possible, gold is in no hurry to exit outside the trading range of $1,890-1,965 per ounce. Even the speech of Federal Reserve Governor Lael Brainard, which stirred up the financial markets, caused a very modest drop in XAUUSD quotes.

Brainard announced her readiness to throw all her strength into the fight against inflation. This will require methodical rate hikes and a faster balance sheet contraction of $8.9 trillion than during the previous monetary tightening cycle. Treasury yields and the U.S. dollar rose, but the precious metal managed to hold its balance.

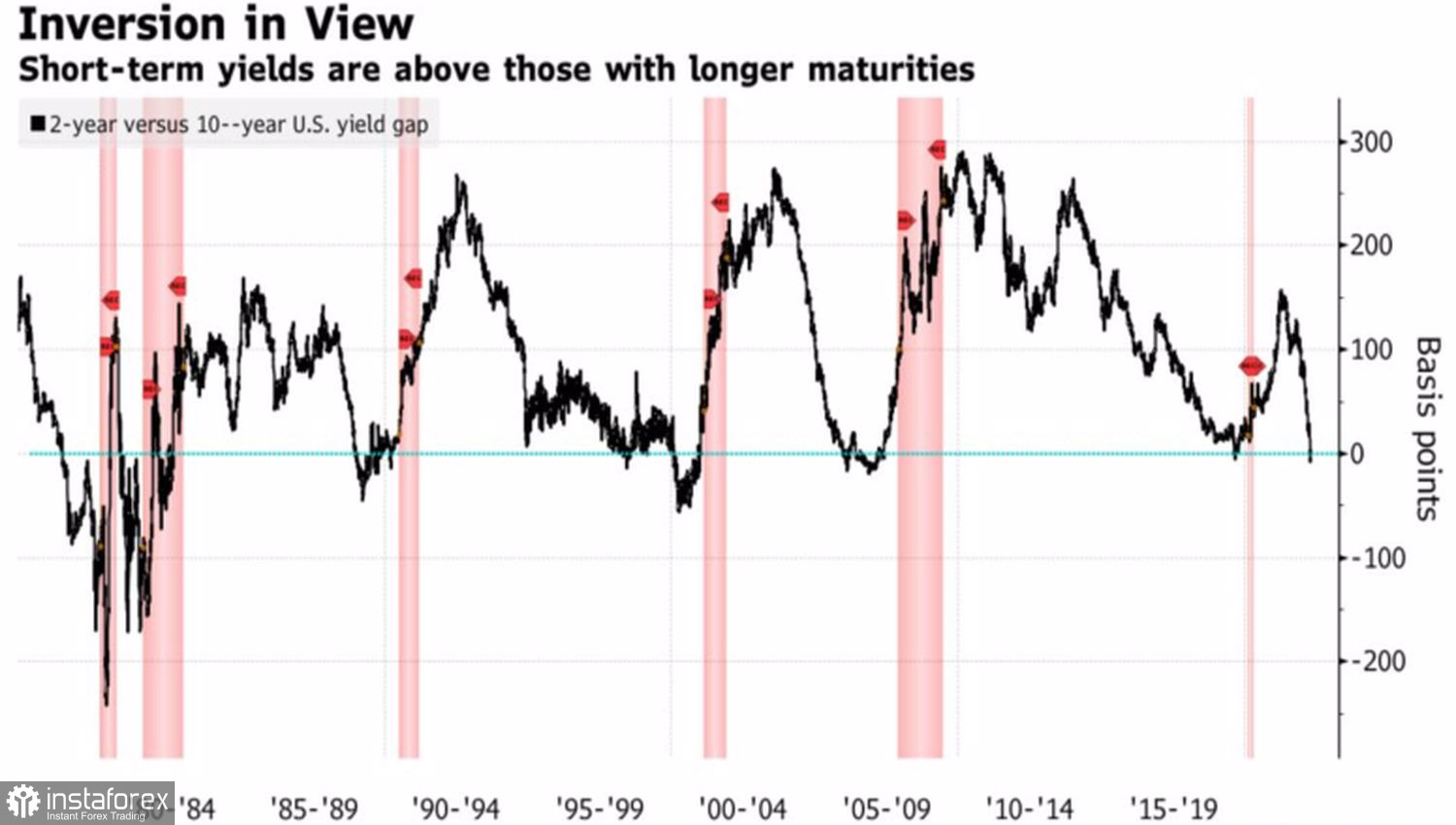

There are serious doubts in the market that a rapid monetary restriction will not lead to a recession. The yield curve inversion signals that a recession will become a reality within the next 12 months. Deutsche Bank also speaks about the increased risks of such a scenario. In their opinion, the Fed will decide to raise the federal funds rate by 50 basis points at once at three consecutive FOMC meetings in a row. Borrowing costs will rise to 3.5% by the middle of next year, and a balance sheet reduction of $2 trillion will add another 1.5-2% to this figure.

U.S. yield curve dynamics

It is known that during periods of turmoil, investors run to gold, as was the case, for example, at the beginning of the armed conflict in Ukraine. The same thing will happen during a recession, so the expectation of its arrival extends a helping hand to the "bulls" on XAUUSD.

The precious metal is also supported by information about the escalation of geopolitical risks in Eastern Europe, including the expectation of new Western sanctions against Russia, as well as the worsening epidemiological and economic situation in China. China is battling its worst COVID-19 outbreak, and lockdowns are pushing purchasing managers' indices into their worst crashes since February 2020. These events are pushing up oil prices and exacerbating supply chain problems, further spinning the inflationary spiral.

Against this background, it is difficult to expect a deep drawdown of XAUUSD. At the same time, if the minutes of the March FOMC meeting turn out to be less "hawkish" than the last speeches of officials, the weakening of the U.S. dollar and the growth of the precious metal are likely.

Technically, consolidation within the "Splash and shelf" pattern in the range of $1890-1965 continues. We adhere to the previous strategy of buying gold on the decline in quotes towards the lower limit and selling it on the rise towards the upper one.

Gold, Daily chart

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română