GBP/USD

Analysis:

GBP/USD continues to trade within the downtrend. The unfinished wave section was formed on March 23. Since early April, the middle part (B) of this wave has been forming in the sideways channel. At the time of writing, the wave structure does not seem complete.

Outlook:

In the next 24 hours, the price is expected to move in the narrow channel between the opposite zones. The price is likely to rise in the first half of the day up to resistance levels. Then a reversal may follow so that bears regain control of the market.

Potential reversal zones

Resistance:

- 1.3120/1.3150

Support:

- 1.3040/1.3010

Recommendations:

Today, it is advisable to trade in the GBP/USD market only within short sessions with a fractional lot. In a conservative scenario, it is better to sell the pair from the resistance zone.

AUD/USD

Analysis:

The current ascending wave in the Australian dollar that was formed on January 28 has brought the quotes to a strong resistance zone on a higher time frame. A decline that began yesterday could mark the start of a reversal and the beginning of a counter wave.

Outlook:

In the upcoming trading sessions, the price is expected to move from the resistance zone to the estimated support level. A further downside breakout is very unlikely today.

Potential reversal zones

Resistance:

- 0.7610/0.7640

Support:

- 0.7530/0.7500

Recommendations:

Currently, there are no buying opportunities in the AUD/USD market today. In case a reversal signal appears near the current resistance, it is recommended to open short positions.

USD/CHF

Analysis:

Since the middle of last year, USD/SHF has been forming a downward sliding channel. The unfinished wave section dates back to March 16th. A correction has been developing within the wave structure since the beginning of April.

Outlook:

In the next 24 hours, the pair is expected to continue the uptrend. At the same time, a short-term decline to the support area is possible in the coming session, with the highest activity predicted in the afternoon. Then a reversal and a resumption of the downtrend are possible.

Potential reversal zones:

Resistance:

- 0.9400/0.9430

Support:

- 0.9330/0.9300

Recommendations:

Today, it is possible to open long positions on the pair for the short term and with a fractional lot. It is better to refrain from entering the market until a reversal sell signal appears near the resistance zone.

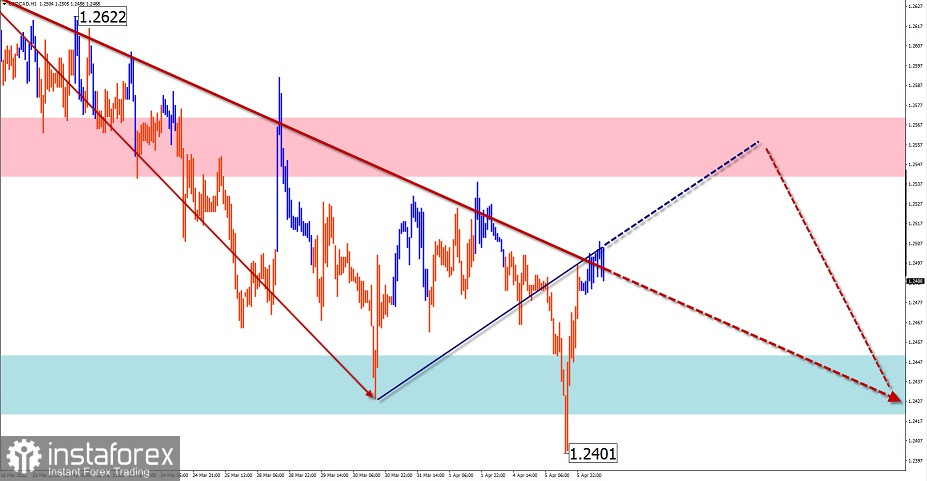

USD/CAD

Analysis:

The ongoing decline of the USD/CAD pair that has been there for the whole month has changed the current wave layout. All price fluctuations in recent months take place within the descending wave algorithm from August 20, 2021. The price has reached the upper boundary of a strong weekly support zone. The wave algorithm does not look complete at the time of writing.

Outlook:

Today, the price is expected to trade in the channel between the opposite zones. An upside movement is possible in the first half of the day. At the end of the day or tomorrow, we can expect a reversal and the resumption of the downtrend.

Potential reversal zones

Resistance:

- 1.2540/1.2570

Support:

- 1.2450/1.2420

Recommendations:

In the current session, trading in the CAD market can be done only through short-term trades with a small lot. It is safer to refrain from entering the market until sell signals appear in the resistance zone.

Explanation: In simplified wave analysis (SWA), waves consist of 3 parts (A-B-C). We analyze the last unfinished wave. The solid arrow background shows the structure that has been formed. The dashed lines show the expected movements.

Note: The wave algorithm does not take into account the duration of the instrument's movements over time!

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română