Against the backdrop of the crypto market situation in the last two months, bitcoin has changed significantly. It has become a hedge like gold. However, following the results of the FOMC meeting, the asset grew along with the SPX and NASDAQ. It means that bitcoin is still correlated with the main stock indices. The main reason for this is the Fed's hawkish stance on monetary policy.

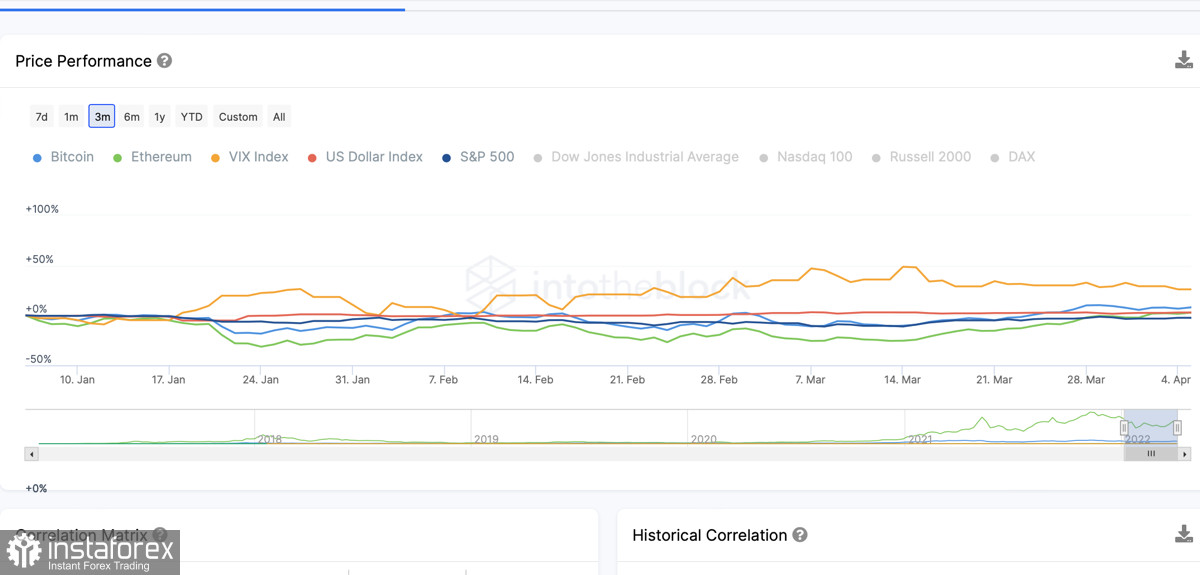

As seen on the charts of BTC and the S&P 500 index, they have the same price movement. It indicates that investors still consider bitcoin a risky asset. It was confirmed by the fact that the stock market began to recover after an unexpectedly small increase in the key rate. In the long term, the correlation with stock indices may advert affect BTC. There are several important factors showing that an increase in correlation is a temporary phenomenon. It is unlikely to have a negative impact on BTC.

It is mainly due to the Fed's monetary policy. At first, speculators were positive about the news about the rate hike by only 0.25%. However, keep in mind that this is not a one-time measure. The gradual rate hike gave traders an opportunity to invest in risky assets to receive profit in the medium term. In the next two years, the FOMC will hold 9 more meetings where the key rate will be increased. Market reaction is sure to be negative. Risky assets are likely to incur losses amid risk aversion. Bitcoin is also a risky asset but there is a crucial difference.

Its distinctive feature is its growing demand and the opportunities it gives amid macroeconomic and geopolitical headwinds. Over the past two weeks, bitcoin has become a full-fledged hedge and a safe-haven asset for large companies. This is why the capitalization of an asset may soar. Currently, investments are limited by a weak regulatory framework. However, there is no doubt that in the near future cryptocurrencies will be used as the main safe-haven assets.

The main difference between cryptocurrencies and stock indexes is the long-term holders. According to the Intotheblack report, by the end of the first quarter of 2022, investors have accumulated 12 million BTC coins worth more than $551 billion. The lion's share of purchases occurred during the massive sell-off of the asset. The cryptocurrency managed to consolidate in the range of $34k-$36k thanks to the activity of long-term holders. They also boosted its further growth. The investments of long-term traders had a positive impact on bitcoin. They helped the asset break the correlation with high-risk stock indices. Bitcoin recovered most of its quarterly losses, while SPX and NASDAQ ended the first quarter with a yield of 3.4% and 7.65%, respectively. BTC managed to hold at high levels and return to $48k thanks to the activity of the holders.

There are no changes on the daily chart of BTC/USD. Bears managed to push the price to $44.2k, where the bulls again gained momentum. It signals the high probability of a medium-term uptrend as the price may rise higher. As of April 5, BTC is trading around $46.6k, having remained in the consolidation phase for the eighth day in a row. Gradually, the price is climbing higher and the triangle pattern figure is visible on the chart. Taking into account investment activity and market sentiment, the price may break through the pattern to resume an upward movement. It may occur in the second half of the week as investors will be careful ahead of the Fed's upcoming meeting minutes on March 16, as well as US economic reports for March.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română