Production in the EU countries slowed down significantly in March, which negatively affected business optimism in this sector. This happened not only due to the disruption of supply chains, but also due to a significant weakening of demand in the face of a rapid increase in energy prices.

The cost of living of Europeans is currently in a state of increasing crisis. No one knows how much this crisis will intensify and grow. Uncertainty risks plunging the entire manufacturing industry into a deep recession in the current quarter.

Thus, the final S&P Global Purchasing Managers' Index (PMI) in the manufacturing industry collapsed to a 14-month low in March, reaching 56.5 (in February, this indicator was at 58.2). By the way, economists initially expected an estimate of 57.0.

The index, which measures production volumes and is included in the composite PMI, fell to 53.1 from 55.5 (the lowest level since June 2020, when the first wave of the pandemic began). Recall that this index is a reflection of the healthy state of the EU economy.

All these indicators stubbornly indicate that the imposition of sanctions by Western European elites on Russia hit the economies of their countries in the same way as the beginning of the coronavirus pandemic. After the mass blockages were lifted, the Europeans finally took a deep breath. In light of the fading of the last wave of COVID-19, the pace of production began to grow again, economies perked up, and even to some extent the main supply chains were adjusted. It would seem to live and live. But judging by the strong-willed decisions of European politicians to punish the Kremlin, this Russian military operation on the territory of Ukraine is a sufficient reason to plunge the EU economy into another long-running crisis.

Demand growth has also slowed. This is due to the fact that factories have greatly raised prices due to a sharp increase in cost. This growth rate was the fastest since 2002. Export orders, in turn, decreased for the first time since June 2020, including between EU member states.

In addition, the eurozone's inflation data does not please economists. Over the past month, price growth in the EU has accelerated significantly, totaling 7.5% at an annual level. Analysts note that this growth rate is the highest ever recorded by the EU statistical service. For comparison: in January, the inflation rate in the eurozone was 5.1%, in February this indicator increased by 0.8%, in March – by 1.6%.

In March, Europeans were primarily faced with a strong rise in the price of energy (by 44.7% year-on-year). Food and alcohol have also significantly soared in value, each of these categories by an average of 5%.

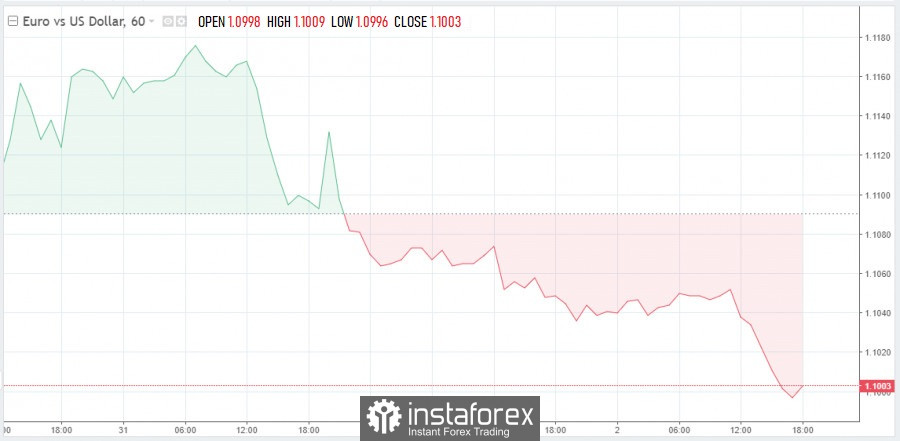

Against the background of all these negative factors, the euro is under strong pressure. The exchange rate of the single European currency, being held hostage by the package of sanctions of European leaders against Russia, fell by 0.15% against the US dollar on Monday. At one point, the EUR/USD pair was at 1.1003, which is not far from last month's nearly 2-year low at 1.0806. Against the pound, the euro fell by 0.24% to 84.05.

After photos and videos of the Russian army's war crimes on the territory of Ukraine appeared in the information space, the German and French governments announced the need for a new package of sanctions against Russia. With these new sanctions, the moment when the energy supply in Europe will reach a state of collapse is getting closer. Against the background of all these political confrontations between the West and the East, the risk of a strong weakening of the euro is only increasing.

It is noteworthy that with the deployment of military operations in Eastern Europe, the mass discontent of citizens of Western Europe is also growing. If we recall the large-scale protests of the yellow vests that began in France four years ago, it is worth saying that they were caused by a less significant increase in the price of fuel. In the current situation, citizens of a number of countries in the euro bloc have significantly more reasons to protest, which is already reflected in the growing unrest, which is unlikely to subside in the near future.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română